1099 Vendor Business Central

1099s are issued to any vendor who received a check dated during the year reported. 1099s are contingent upon check date not invoice date.

1099 Processing In Microsoft 365 Business Central And Dynamics Nav

1099 Processing In Microsoft 365 Business Central And Dynamics Nav

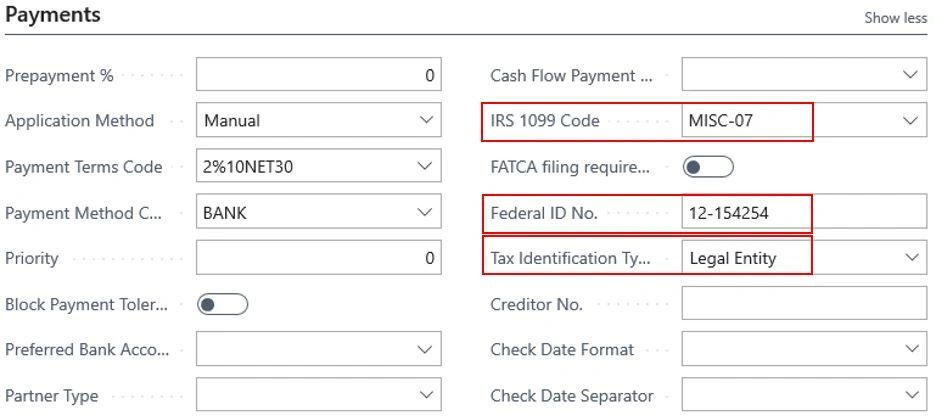

Within the Payments Fast tab select the IRS 1099 Code for the vendor and enter their Federal ID No.

1099 vendor business central. Open the vendors list and select the vendor that you will be setting up as a 1099 vendor. IRS 1099 Code. Office of Business and Finance.

Delete the following line. To do this follow these steps. For each tax liable vendor you can then specify the relevant 1099 code on the Payments FastTab on the Vendor card.

An updated 1099 form must be sent to vendors each year on or before the last day of January. The 1099 Toolkit a Business Central add-in is the only tool available that allows you to prepare and print the 1099 forms right from Business Central and without the time-consuming manual preparation. According to BWC the forms will be mailed to employers in March 2021 at the latest and BWC will make every effort to issue them as soon as it is possible to do so they are still in the process of collecting W-9s from employers.

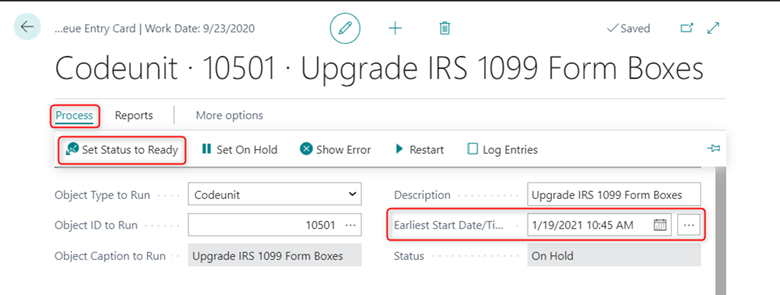

In the Vendor Maintenance Options window make sure a Tax Type and 1099 Box are selected. Business Central has added new 1099 Form Box codes NEC-01 MISC-14 and a new Vendor 1099 NEC form all of which are relevant for the reporting year 2020. The paper form to the vendor should be mailed by January 31 st of the following year.

In the vendor card there is a section called - Payments -- In that section there is a line for IRS 1099 code -- from the drop down window we select the type of 1099 Misc form for the client We also enter the Federal ID number and the tax identification type -- either legal entity or individual. With the Vendor 1099 Information report you can review 1099 transactions paid during a specified period. The amount reported on the 1099-G will be for the aggregate amount of all three BWC payments received in the calendar year 2020.

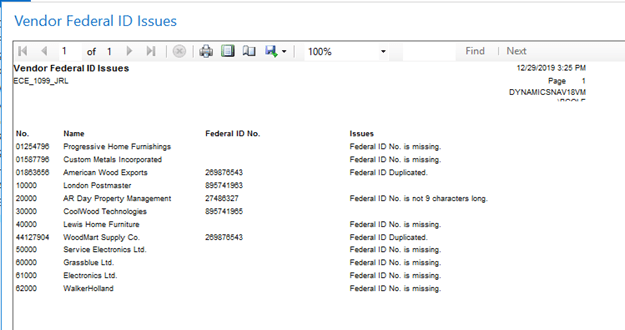

Is there additional information we need to enter. Generally 1099s are ready to process when all payables are paid through check date 1231 of the year to be reported. To update the magnetic media format change the code in the Vendor 1099 Magnetic Media report 10115.

I usually suggest that for a vendor that is usually 1099able the 1099 Code field on the vendor card should be filled in. 1099s are issued to any vendor who received a check dated during the year reported. If you have paid them 600 or.

1099s are contingent upon check date not invoice date. Businesses are required to register with the Ohio Secretary of State to legally conduct business in the State of Ohio this is commonly called a business license. In Dynamics 365 Business Central the new 1099 Forms includes Box codes NEC-01 and MISC-14.

To check this click on the Cards menu point to Purchasing and click Vendor. Click the back arrow in the top left of the vendor. The codes are defined on the IRS 1099 Form Box page where you can also add new 1099 codes.

Office of Business and Finance. We usually select MISC from the dropdown. Dynamics 365 Business Central will record 1099 transactions so you can report them at the end of the year.

Within the Payments Fast tab select the IRS 1099 Code for the vendor and enter their Federal ID no. Who can I contact regarding my Tax form 1099. Simply navigate to the vendor and open the Vendor Card.

BEGIN MISC InvoiceEntrySETRANGE1099 CodeMISC-MISC-99. In Business Central the most common 1099 codes are already set up for you so you are ready to generate the required reports. Its new capabilities also make transitioning to the new 1099 NEC form quick and simple.

In this video learn how to set up and enter basic information about a vendor in Microsoft Dynamics 365 Business Central. The vendors are typically individuals who arent employees and who provide services to your organization. Change the code in the Data Item Number 2 - A Record as follows.

If you do business with vendors that are subject to United States US 1099 tax you must track the amount that you pay to each vendor and report that information to the US tax authorities at the end of the calendar year. For a vendor that is only 1099able on occasion leave the vendor cards 1099 Code field blank then manually fill in the purchase invoiceorder headers 1099 Code field manually as needed. Before users submit their reporting for 2020 users must first upgrade their Business Central to handle the new requirements by running the action Update Form Boxes on the 1099.

The 2017 1099-MISC threshold is 600 per year with the exception of payments for royalties. At the end of the year you can print 1099. Generally 1099s are ready to process when all payables are paid through check date 1231 of the year to be reported.

The paper form to the vendor should be mailed by January 31 st of the following year. This means that if any of your vendors fall into the categories above you dont need to issue them a 1099 if you havent paid them 600 or more. Selecting their Tax Identification Type is optional.

If a vendor is a 1099 vendor you need to setup the 1099 code. We usually select MISC from the dropdown. 1099 Vendor Setup Setting up a 1099 vendor in BC is easy.

On users purchase documents you can specify that the document is 1099 liable and users can specify the 1099 code for the vendor. 1099 Setup To set up a 1099 vendor. The vendor is not set up to be a 1099 vendor.

The 1099 has been broken into two separate forms one for reporting nonemployee compensation NEC and one for miscellaneous income. Enter a Vendor ID and click the Options button. Ohio Business Central 100 of all filings needed to start or maintain a business in Ohio may now be submitted online.

Microsoft Dynamics 365 Business Central 1099 Processing 2020 Changes Youtube

Microsoft Dynamics 365 Business Central 1099 Processing 2020 Changes Youtube

Vendor 1099 S In Dynamics 365 Business Central Western Computer Youtube

Vendor 1099 S In Dynamics 365 Business Central Western Computer Youtube

Microsoft Dynamics 365 Business Central 1099 2020 Form Update Bond Consulting Services

Microsoft Dynamics 365 Business Central 1099 2020 Form Update Bond Consulting Services

Important Year End Information For Dynamics 365 Business Central Dynamics Nav Users Stoneridge Software

Important Year End Information For Dynamics 365 Business Central Dynamics Nav Users Stoneridge Software

1099 Processing In Microsoft 365 Business Central And Dynamics Nav

1099 Processing In Microsoft 365 Business Central And Dynamics Nav

Get The Best Jobs Through The Best Manpower Hiring Consultant In United States Send Your Updated Resume On Staffing Agency Recruitment Consultancy Job Seeker

Get The Best Jobs Through The Best Manpower Hiring Consultant In United States Send Your Updated Resume On Staffing Agency Recruitment Consultancy Job Seeker

Import Data Into Dynamics 365 Business Central With A Configuration Package Youtube

Import Data Into Dynamics 365 Business Central With A Configuration Package Youtube

Screenshot Http Www Freightdepotaccounting Com A Grouped Images Picture One Page Website Accounting Web Design

Screenshot Http Www Freightdepotaccounting Com A Grouped Images Picture One Page Website Accounting Web Design

Form I 4 Instructions 4 Form I 4 Instructions That Had Gone Way Too Far Doctors Note Template Employee Tax Forms Funeral Program Template

Form I 4 Instructions 4 Form I 4 Instructions That Had Gone Way Too Far Doctors Note Template Employee Tax Forms Funeral Program Template

Microsoft Dynamics 365 Business Central 1099 2020 Form Update Bond Consulting Services

Microsoft Dynamics 365 Business Central 1099 2020 Form Update Bond Consulting Services

Processing 1099s 2020 Tax Changes In Dynamics Business Central

Processing 1099s 2020 Tax Changes In Dynamics Business Central

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

The 1 Thing To Do If You Want To Grow Your Startup Quickly Hire A Cfo Schedule Template Excel Excel Templates

The 1 Thing To Do If You Want To Grow Your Startup Quickly Hire A Cfo Schedule Template Excel Excel Templates

1099 Reporting Submitting Forms Dynamics 365 Business Central Forum Community Forum

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

1099 Processing In Microsoft 365 Business Central And Dynamics Nav

1099 Processing In Microsoft 365 Business Central And Dynamics Nav

1099 Toolkit For Microsoft Dynamics 365 Business Central And Dynamics Nav Youtube

1099 Toolkit For Microsoft Dynamics 365 Business Central And Dynamics Nav Youtube