How To Record Business Expenses In Xero

Pin Manage expenses on Pinterest. Keep tabs on your expenses as soon as you start incurring them.

No more lost receipts or piles of receipts waiting to be entered and employees can submit an expense claim there and then.

How to record business expenses in xero. And payment or reimbursement typically happens weeks after the original expense was incurred. That is what expense claims are for. Paid Business expenses from Personal bank accounts In true disorganised style my accounts are a mess.

In this video of my Xero accounting series I show you how to record invoices as paid and also how to record bank payments and receiptsCreate a bookkeeping. Approve the Bill 4. View and edit expense claims.

Write a description of this journal including percentages and the period in a narration. Enter terms to search videos. Create a new expense or mileage claim.

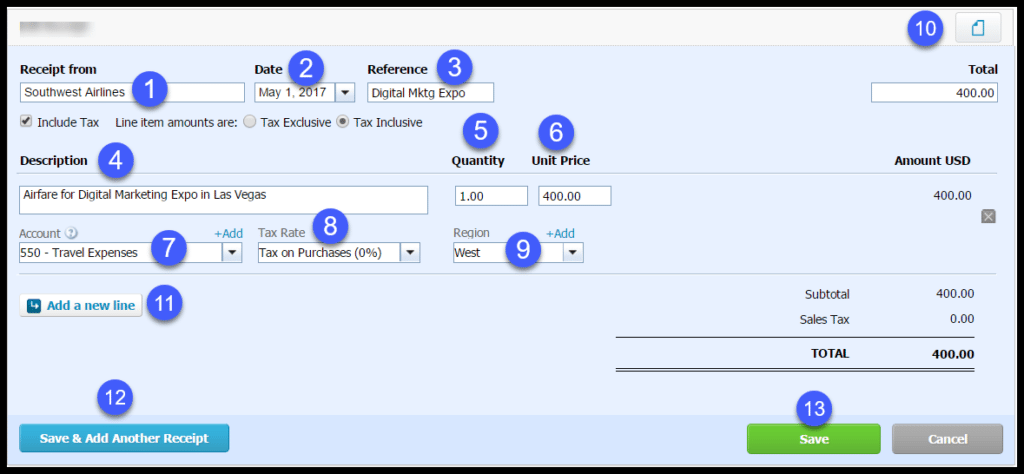

Expense claims should be used when you have paid business expenses out of personal cash. The date is the date the purchase happened and the due date is when you will pay yourself back by. Feb 19 2013 A short video tutorial on entering expense claims into Xero.

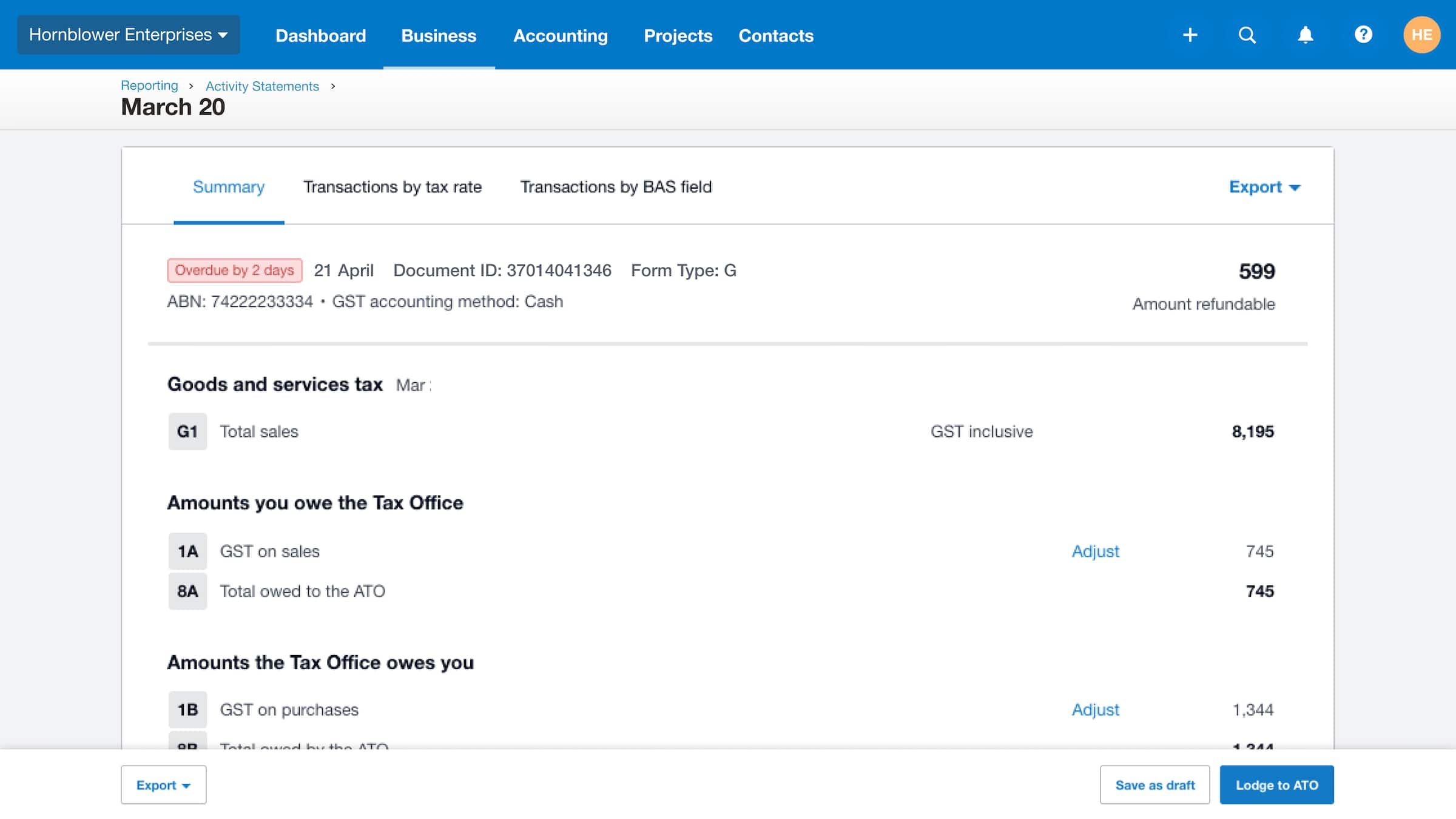

Simply log into Xero then head to Business. The expense claim feature confuses many because as a business owner they just want to record the fact that they have purchased some business items but dont necessarily want to be repaid those amounts. View plans and pricing.

Create a Bill for the purchase as usual entering the Vendor or Store Name where the expense was bought the date of purchase and the item details. Just snap a picture and details from the receipt are automatically scanned into Xero. Speed up the process for employees and business owners from claim to reimbursement with the Expenses app.

Submit and approve claims from your phone for fast turnaround. Try Xero Expenses for free Tap into the tools and insights you need to efficiently track assign and manage expense claims. Set up expense and mileage claims.

Create a separate business bank account as soon as you can. Go to business then bills to pay. Hold onto receipts and write down what each one was for.

Its a more intuitive way to connect and chat all things business with one another. Consider the expenses paid as capital. Xero HQ - the platform for your practice 152.

Often a bookkeeper or accountant is involved. Set up expense and mileage claims. Getting Started with Xero.

And you can restart conversations you feel have been of huge value to you on Xero Central. Share Manage expenses on LinkedIn. Select the expense account for the actual item bought.

The to section is yourself. I have created the business expenses in Xero eg. Xero accounting software can easily handle all of your expense claims for those times youve bought company items with your own money and need to be reimbursed.

Expense Claims to get started. Email Manage expenses to a friend. Expenses paid with company money.

Jul 11 2019 In Xero. Create a new bill. All items being paid out of personal funds should be submitted by the owner accompanied with the receipt and posted as an expense claim and coded to the appropriate business expense cost centre.

Small business accounting software 159. Employees list their expenses allocate receipts and codes to each expense and submit the list for approval. The app for Xero 127.

Forget paper receipts use a photo instead. You can still view topics in the Xero Business Community to see all the useful knowledge thats been shared there. Approve or decline expense claims.

Telstra Bill as purchases and they are sitting as accounts Payable. Share Manage expenses on Twitter. - Create a bill - to yourself Jonny Lastname - Record the expense in the line item to the appropriate account - fuel materials etc - Attach the image - Authorise Once authorised you have the option.

I would not use a bank account to record business expenses going through a personal account. Create a manual journal and post it. Then your bank statement will double as a record of all your expenses.

Nov 18 2013 Xero has a very handy system to handling expenses claims for those expenses you pay in cash or from your personal account or credit card. In the description put the expenses and where it was made eg Ikea purchase of new office bookcase. Set the date usually the last day of a GST period or the financial year and the reference to the amounts to be tax inclusive.

At the bottom of the bill record payment and select Owners Investment instead of selecting a bank account or credit card. 1 Reimburse yourself in which case simply wait for the payment to appear in your reconciliation page and find and match your bill2. You need to add a new journal to record home office expenses.

Ask questions dish out answers and get involved. Capture expense receipts with Xeros receipt scanning app. Track and submit mileage using the map in the mobile app.

I have incurred expenses for my business that I have used my personal bank accounts to pay. Traditionally business expenses are done manually at the end of the month.

Ghaffar Abdul I Will Do Bookkeeping In Quickbooks Online Xero And Excel For 10 On Fiverr Com Bookkeeping Services Quickbooks Online Quickbooks

Ghaffar Abdul I Will Do Bookkeeping In Quickbooks Online Xero And Excel For 10 On Fiverr Com Bookkeeping Services Quickbooks Online Quickbooks

Bank Statement Xero 2 Features Of Bank Statement Xero That Make Everyone Love It Bank Statement Small Business Accounting Software Small Business Accounting

Bank Statement Xero 2 Features Of Bank Statement Xero That Make Everyone Love It Bank Statement Small Business Accounting Software Small Business Accounting

Accountantteams I Will Do Bookkeeping In Quickbooks Online And Xero Accounting For 10 On Fiverr Com Quickbooks Online Bookkeeping Quickbooks

Accountantteams I Will Do Bookkeeping In Quickbooks Online And Xero Accounting For 10 On Fiverr Com Quickbooks Online Bookkeeping Quickbooks

How To Create And Manage Expense Claims In Xero

How To Create And Manage Expense Claims In Xero

Purchase Xero Accounting Software Accounting Software Bookkeeping Services Accounting

Purchase Xero Accounting Software Accounting Software Bookkeeping Services Accounting

Xero Setup Workflow Products Number Nerd Bookkeeping Solutions Bookkeeping Business Accounting Software Creative Small Business

Xero Setup Workflow Products Number Nerd Bookkeeping Solutions Bookkeeping Business Accounting Software Creative Small Business

Expense Claim For Business Owner In Xero Ezzybills

Expense Claim For Business Owner In Xero Ezzybills

Get In Touch With The Best Xero Accountants At Abatax Ease Your Accounting Procedures With User Friendly Accounting Small Business Resources Word Bubble

Get In Touch With The Best Xero Accountants At Abatax Ease Your Accounting Procedures With User Friendly Accounting Small Business Resources Word Bubble

Xero Small Business Software Partners With Gust Com Inventory Management Software Accounting Software Business Accounting Software

Xero Small Business Software Partners With Gust Com Inventory Management Software Accounting Software Business Accounting Software

Arslan0000 I Will Help In Xero Reconciliation For 5 On Fiverr Com Small Business Ads Accounting Services Bookkeeping Services

Arslan0000 I Will Help In Xero Reconciliation For 5 On Fiverr Com Small Business Ads Accounting Services Bookkeeping Services

An Introduction To Running Your Business On The Australian Edition Of Xero Accounting Software Accounting Accounting Software Bookkeeping

An Introduction To Running Your Business On The Australian Edition Of Xero Accounting Software Accounting Accounting Software Bookkeeping

The Profit And Loss Report In Xero Xero Tv

The Profit And Loss Report In Xero Xero Tv

Hire A Bookkeepers Help You With Your Day To Day Business Transactions And Help Keep The Books Of In 2021 Bookkeeping Business Bookkeeping Small Business Bookkeeping

Hire A Bookkeepers Help You With Your Day To Day Business Transactions And Help Keep The Books Of In 2021 Bookkeeping Business Bookkeeping Small Business Bookkeeping

Bookkeeping Services Brisbane Xero Bookkeeper Brisbane Bookkeeping Services Bookkeeping Accounting

Bookkeeping Services Brisbane Xero Bookkeeper Brisbane Bookkeeping Services Bookkeeping Accounting

Xero Software Review Overview Features Pricing Balance Sheet Template Best Accounting Software Accounting

Xero Software Review Overview Features Pricing Balance Sheet Template Best Accounting Software Accounting

Xero Software Review Overview Features Pricing Online Invoicing Accounting Software Cloud Based

Xero Software Review Overview Features Pricing Online Invoicing Accounting Software Cloud Based