Do You Get A W2 If You Are Self Employed

You report your earnings for Social Security purposes when you file your federal income tax return. When you are a W2 employee you pay payroll tax based on your gross pay.

5 Valuable Tips For The Self Employed Money Under 30

5 Valuable Tips For The Self Employed Money Under 30

You may be self-employed in the eyes of the IRS if you received a 1099 form from an entity you did work for.

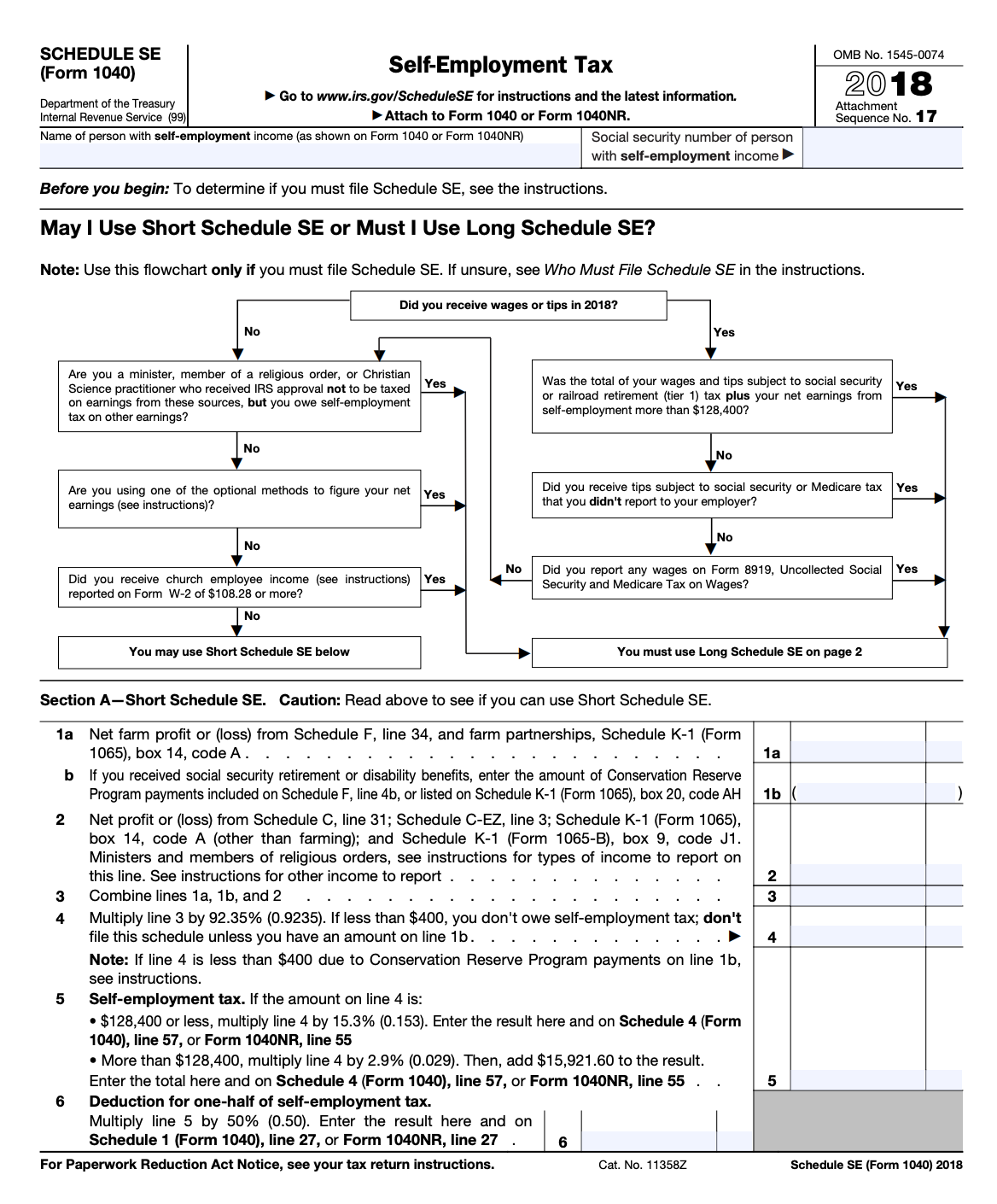

Do you get a w2 if you are self employed. Whereas employees only pay the employee share of payroll taxes for Social Security and Medicare self-employed workers have to pay the employer half as. Receiving W-2 and 1099 Tax Forms If you were employed for part of the year your employer will likely report your employee income to the Internal Revenue Service IRS on Form W-2. This means that your salary on Form W-2 Wage and Tax Statement the net profit on Schedule C and your housing allowance less pertinent deductible expenses are subject to self-employment tax on Schedule SE Form 1040 Self-Employment Tax.

How do i get a w-2 if i am self employed. If your net earnings are 400 or more in a year you must report your earnings on Schedule SE in addition to the other tax forms you must file. If you were employed you would split those taxes with your employer so you would pay only 3825.

Youre self-employed if you operate a trade business or profession either by yourself or as a partner. Instead of withholding Social Security taxes from each paycheckmany self-employed people dont get regular paychecks after allyou pay all the Social Security taxes. Youll figure your self-employment tax on Schedule SE.

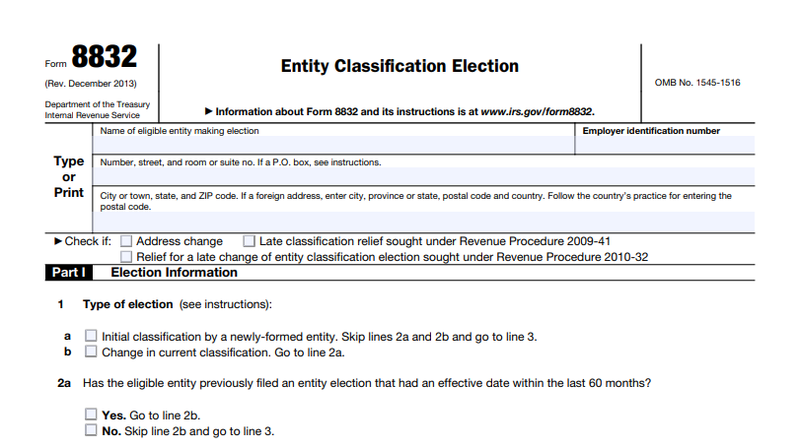

In this case your taxable income is your self-employment income so any income of the self-employment business is considered your income. June 6 2019 749 AM Neither - If you are reporting your self-employment income on Schedule C as part of your personal Form 1040 filing then you will not need to give yourself either a W-2 or a Form 1099-MISC. There is no W-2 self-employed specific form that you can create.

Generally you are self-employed if any of the following apply to you. Instead you must report your self-employment income on Schedule C Form 1040 to report income or loss from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit. When you are self employed business expenses will reduce both your taxable income and your self employment tax.

A W2 is a wage statement that your employer will give to you when you worked for them and they held out taxes for you. The 1099 is a reporting form and its not the same as trying to file income tax without a W2 which employers use to report wages and taxes withheld to the IRS. Estimated tax is the method used to pay Social Security and Medicare taxes and income tax because you do not have an employer withholding these taxes for you.

Receive a Form 1099-MISC or 1099-K instead of a W-2. Employees are limited to taking un-reimbursed business expenses as itemized deductions. These are the required forms when you are self-employed such as Schedule 2 Schedule SE Form 4562 and others.

For example if you are self-employed and made 50000 using the 2010 tax rates you would pay 7650 in self-employment taxes. Do I need to file a 1040 if Im self-employed. You will also need to include Schedule 1 and Schedule C with your tax return.

A 1099 is a wage statement that your employer will give to you when you worked for them and they did NOT hold out taxes for you. For the self-employed aggregate. June 4 2019 226 PM.

Yes you will need to file Form 1040. In addition you may also receive self-employment income that your customers reported to the IRS on a 1099-NEC form 1099-MISC in prior years. If you were self-employed the entire time you.

Your work history should include any traditional W-2 employment gig work and self-employment. You had 10828 or more in income from church employment. Therefore the IRS allows you to deduct 3825 from your taxable income because of the self-employment taxes that you pay.

Tax Season Is Here Integrity Tax Return Is Doing Free Quotes Over The Phone No Personal Info Needed We Are Offering Tax Season Free Quotes Tax Return

Tax Season Is Here Integrity Tax Return Is Doing Free Quotes Over The Phone No Personal Info Needed We Are Offering Tax Season Free Quotes Tax Return

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Tax Prep Tax Preparation

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

Tips For Filing Taxes When Self Employed Filing Taxes Tax Self

Tips For Filing Taxes When Self Employed Filing Taxes Tax Self

Retirement Plan Options For Self Employment Income Stokes Family Office

Retirement Plan Options For Self Employment Income Stokes Family Office

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Checklist

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Tax Document Document Store Income Statement Income Tax Drivers License California

W2 Tax Document Document Store Income Statement Income Tax Drivers License California

Tax Deductions For Self Employed Tax Deductions Tax Time Deduction

Tax Deductions For Self Employed Tax Deductions Tax Time Deduction

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

Getting Your 2015 2016 W 2 Form Online Filing Taxes W2 Forms Income Tax Return

Getting Your 2015 2016 W 2 Form Online Filing Taxes W2 Forms Income Tax Return

Get Organized For Tax Season In 2021 Tax Season Working Mom Life Tax Appointment

Get Organized For Tax Season In 2021 Tax Season Working Mom Life Tax Appointment

What Do I Do With My Self Employed Taxes Drive Now Network

The Disadvantage Of A 1099 Employee That There Is No Withholding As A 1099 Contractor You Are Going To Pay Income Taxes On It Pl Self Employment Employee Irs

The Disadvantage Of A 1099 Employee That There Is No Withholding As A 1099 Contractor You Are Going To Pay Income Taxes On It Pl Self Employment Employee Irs

How To Report Self Employment Income H R Block

How To Report Self Employment Income H R Block

20 Work From Home Jobs That Offer W2 Employment Remote Jobs Work From Home Jobs Work From Home Business

20 Work From Home Jobs That Offer W2 Employment Remote Jobs Work From Home Jobs Work From Home Business