How To Get Social Security 1099 For Deceased Parent

You can request an SSA - 1099 1042S for yourself or on behalf of a deceased beneficiary if you are receiving benefit s on the same record as the deceased. Certified copy is provided for an.

Https Www Reginfo Gov Public Do Downloaddocument Objectid 407201

I am re-posting this to Social Security in the hopes that it will draw you more answers.

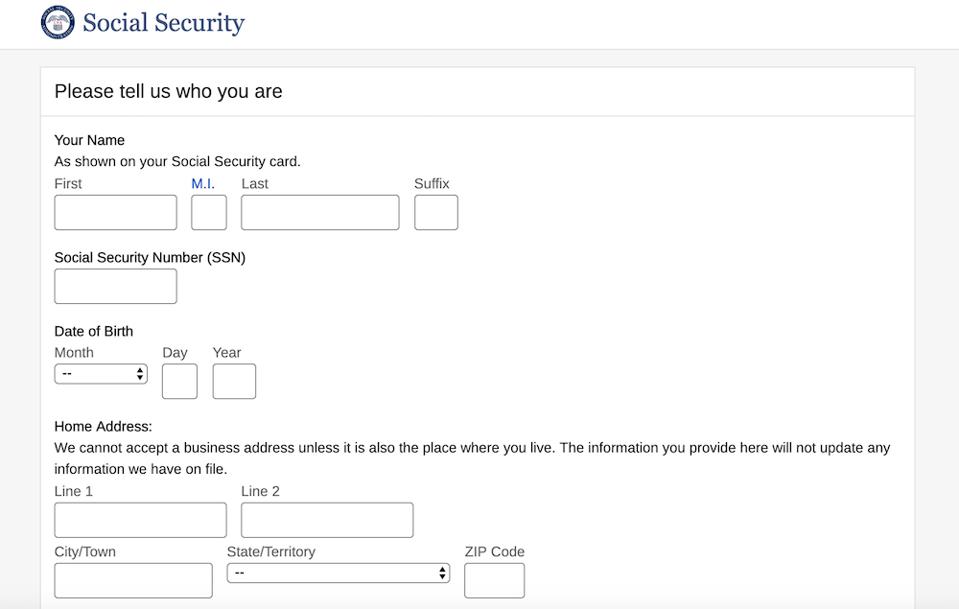

How to get social security 1099 for deceased parent. Second an estate administrator may need to file income tax returns for the estate Form 1041. A replacement SSA-1099 or SSA-1042S is available for the previous tax year after February 1. If you need to report a death or apply for benefits call 1-800-772-1213 TTY 1-800-325-0778.

View solution in original post. Unmarried children who are under 18 up to age 19 if attending elementary or secondary school full time can be eligible to receive Social Security benefits when a parent dies. There are two ways to obtain form SSA-1099.

Contacting your local Social Security office. The SSA-1099 is mailed in January to the last address in our records and is intended for the spouse or executor of the deceased. If SSN of deceased individual is not provided the fee is 2000.

If you need a replacement SSA - 1099 or SSA -1042S for an earlier tax year contact us. You should give the funeral home the deceased persons Social Security number if you want them to make the report. If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online call our toll-free number at 1-800-772-1213 or visit your Social Security office.

I included the one month payment in her MA estate return as it was part of the estate. A You can request a copy of your SSA-1099 online According to Social Security Administration. There is a limit however to the amount of money that we can pay to a family.

Calling 1-800-772-1213 TTY 1-800-325-0778 Monday through Friday from 7 am. If a child receives survivors benefits they can get up to 75 percent of the deceased parents basic Social Security benefit. If you do not have access to the mail at that address the executor will need to call the local field office.

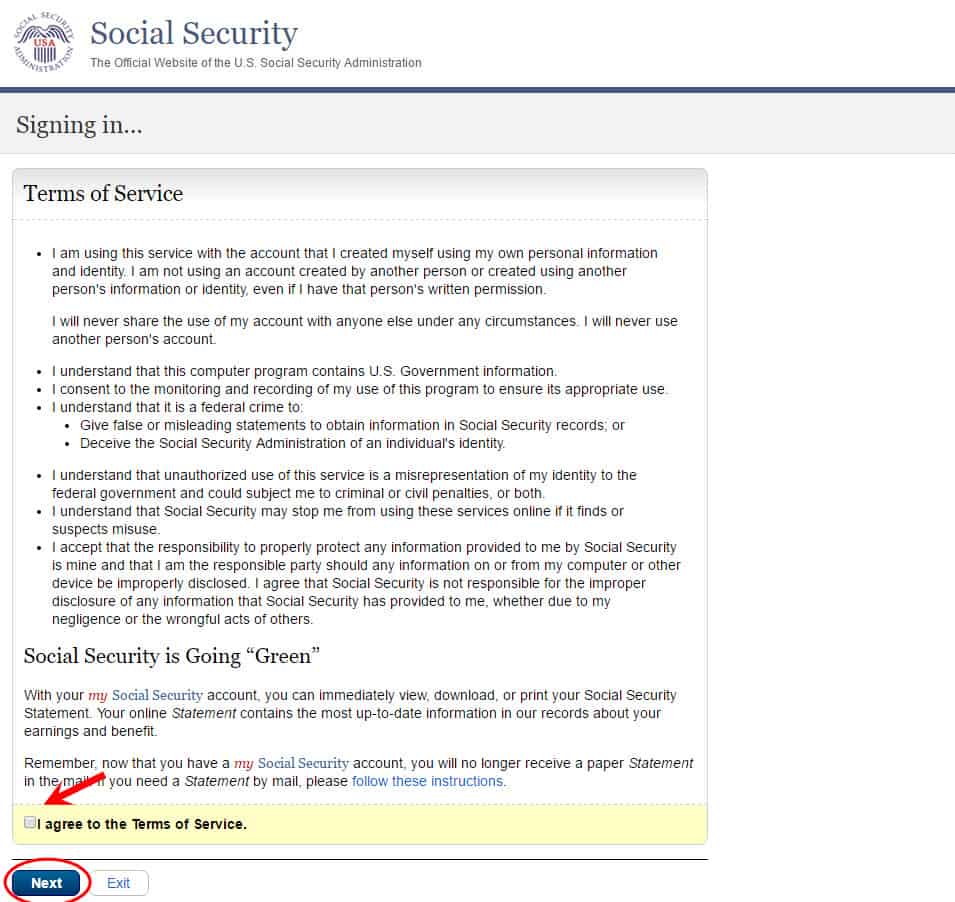

You can get more time to finish. If you are drawing a benefit off the deceaseds record you can order a copy of the 1099 online here. A transcript provides most of the line entries from the original tax return and may provide income information from Forms W2 1099 or 1098 if requested.

For help see the Filing the Final Tax Returns of a Deceased Taxpayer page. SSA paid me directly as the beneficiary. Their operators are usually pretty helpful.

If you already have a my Social Security account you can log in to your online account to view and print your SSA-1099 or SSA-1042S. If you dont have access to a printer you can save the document on your computer or laptop or even email it. If you are deaf or hard of hearing call our toll-free TTY number 1-800-325-0778 between 800 am.

You may request a transcript by mail using IRS Form 4506-T Request for Transcript of Tax Return and have it mailed to your address. The parents full retirement or disability benefit. If SSN of deceased individual is not provided the fee is 2100.

Of 1000 See instructions below SSN Search required. If you prefer you may pay by credit card. Since your ultimate goal is to file a tax return you may want to check on the requirements of who can sign a final tax return for an individual has died.

If you are not drawing off the record then the only choice is to call 1-800-772-1213 or visit your local office. To file this return you will need to get a tax identification number for the estate called an employer identification number or. This automated telephone system application will allow Social Security Title II as well as concurrent Title IIXVI beneficiaries to request a replacement Social Security Benefit Statement SSBS with the automated telephone portion of SSAs National 800 Number using interactive voice recognition or the.

Computer Extract of SS-5 May not contain the names of the individuals parents and the place of birth If SSN of deceased individual is provided the fee is 2000. To proceed make an electronic Request for Deceased Individuals Social Security Record. Megan C.

You can speak to a Social Security representative between 800 am. Or print and complete Form SSA-711 and send us a check or money order for the appropriate fee made payable to the Social Security Administration. Because of the timing of when my mother passed away she was owed one month of Social Security but it was withheld by the SSA until we filed the SSA-1724 form.

You can request an SSA-10991042S for yourself or on behalf of a deceased beneficiary if you are receiving benefits on the same record as the deceased. You may want to call the Social Security Administration. If you need a replacement SSA-1099 or SSA-1042S for an earlier tax year contact us.

The family maximum payment is determined as part of every Social Security. Replacement Social Security Benefit Statement SSA-10991042S Automated Telephone Application. To inquire about potential benefits you can call your local Social Security office.

I would expect that it should not be further taxable but I have received a SSA-1099-SM form from SSA.

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Tax Dictionary Form Ssa 1099 Social Security Benefit Statement H R Block

Tax Dictionary Form Ssa 1099 Social Security Benefit Statement H R Block

Https Www Ctcresources Com Uploads 3 1 6 2 31622795 Social Security Topics Open New Tab Pdf

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Https Www Reginfo Gov Public Do Downloaddocument Objectid 407101

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

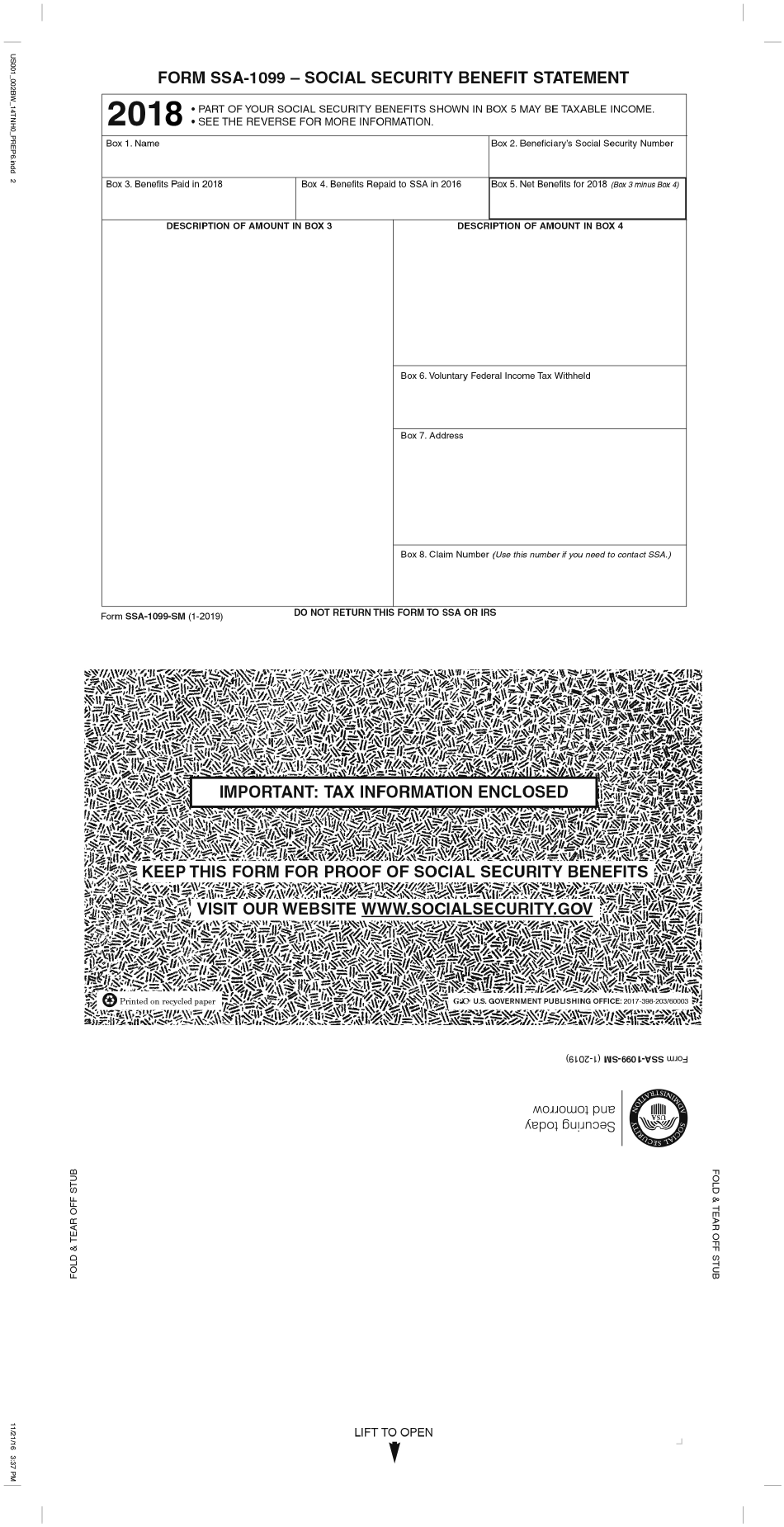

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Social Security Recipients Will Automatically Receive Stimulus Check Wztv

Social Security Recipients Will Automatically Receive Stimulus Check Wztv

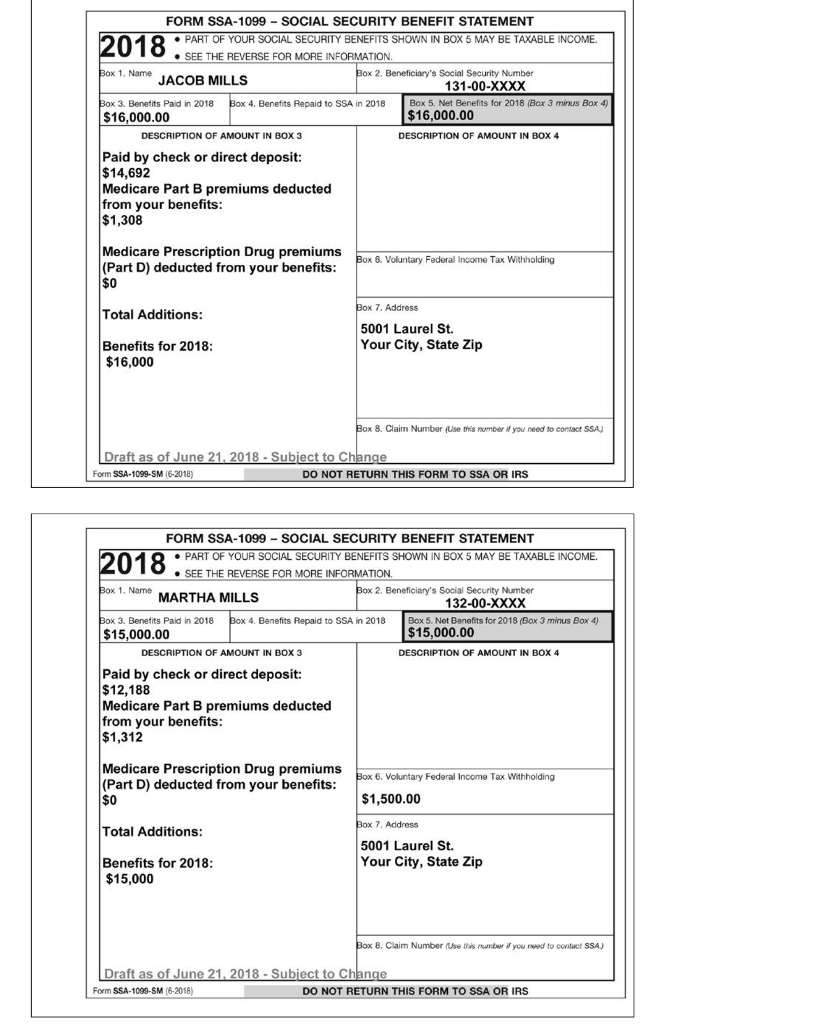

Solved Basic Scenario 7 Jacob And Martha Mills Direction Chegg Com

Solved Basic Scenario 7 Jacob And Martha Mills Direction Chegg Com

How Do I Get A Copy Of My Mother S Ssa 1099 For 2012 Tax Filing Us Social Security Offices Locations

How Do I Get A Copy Of My Mother S Ssa 1099 For 2012 Tax Filing Us Social Security Offices Locations

Social Security Benefits Covered Ca Magi Income Retirement

Social Security Benefits Covered Ca Magi Income Retirement

Https Oig Ssa Gov Sites Default Files Audit Full Pdf A 09 16 50114 Pdf

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Social Security Change Of Address 3 Different Methods

Social Security Change Of Address 3 Different Methods

How To Get A Replacement Ssa 1099 Social Security And Tax Forms

How To Get A Replacement Ssa 1099 Social Security And Tax Forms

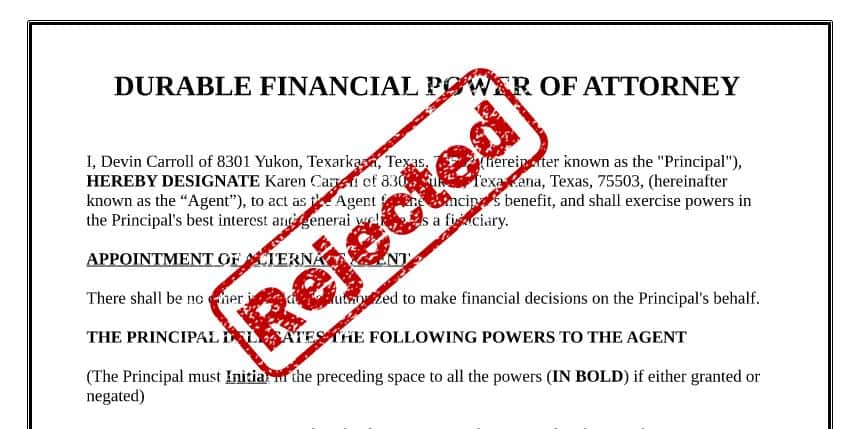

The Best Solution To Your Social Security Power Of Attorney Social Security Intelligence

The Best Solution To Your Social Security Power Of Attorney Social Security Intelligence

Https Www Reginfo Gov Public Do Downloaddocument Objectid 407201