Is A 1099 Misc The Same As A Schedule C

You can Create a new Schedule C or add the income to an existing Schedule C same type of work. When you receive a 1099-MISC reporting your income you can claim deductions against that income on a Schedule C which you can then use to calculate your profits from self-employment.

1099 K Vs 1099 Misc What S The Difference Zipbooks

If you receive a 1099-C you may have to report the.

Is a 1099 misc the same as a schedule c. Revisit the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry by following these steps. Type schedule c in the Search area then click on Jump to schedule c to make your entries. Establishing a conversation about the type of work she performed may lead you to a different conclusion.

Mark them for the Schedule C and be sure to enter a multi-form code that corresponds with the Schedule C involved. The income is taxable but it is not self-employment and does not need Schedule C. Independent contractors report their income on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship.

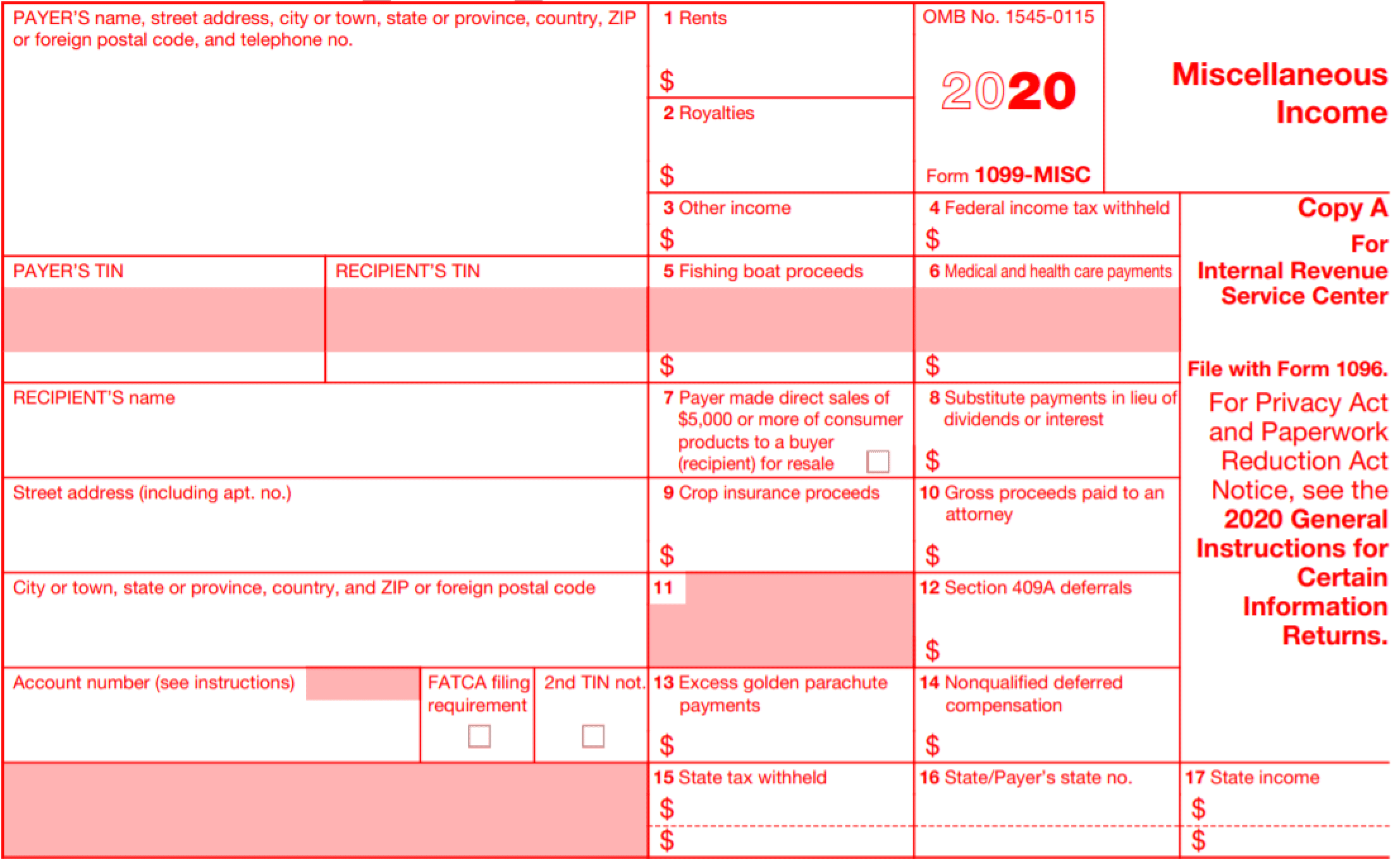

If your business sold goods you then subtract the cost of goods sold from that amount. ProWeb - Form 1099-Misc and Schedule C Form 1099-Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W-2. Income reported on Form 1099-NEC must be reported on Schedule C the program is trying to link these two forms together to be sure that it is reported correctly and on the right form.

This income can be for services rents royalties prizes etc. If the gross payment volume from sales of goods or services in a single calendar year is 600 or more then you are required to report the same in Form 1099-K. Further if the recipient has not provided you their TIN you must withhold taxes from their payments and report the same in your 1099 forms.

A Schedule C is something you fill out which. Generally any amounts in box 3 of the Form 1099-Misc can be reported as Other Income on Form 1040 Line 21. A 1099 form is received from someone who pays you money showing how much they paid you.

1099-Misc should be reported on a Schedule C. 1099 forms used by payers to report payments made to a taxpayer or recipient. If you have already entered the 99M99N screens and are now looking at multiple Schedule C screens to.

Click the link for more detailed info on Reporting Business Income and Expenses. To complete a Schedule C within the program go to. Because you received a 1099-K this is considered a Business and filing a Schedule C is requiredThe good news is that you can claim Expenses against the income reported on your 1099-K.

Enter the 99M99N screens for 1099-Misc reporting or 1099-NEC for nonemployee compensation. She may not reasonably have any expenses. The most popular 1099 form is the 1099-MISC which is used to report payments of 600 or more that were paid by the payer to a recipient.

Form 1099-MISC is what a business or sole proprietor sends to contractors and businesses other than corporations that they hire and pay. For more information about the 1099-K please click here. You may want to delete the 1099-MISC and re-enter it as sometimes editing.

No they are not the same. If you receive a 1099-K the IRS requires this income to be reported as income on the Schedule C. To get TurboTax to stop asking for Schedule C you have to answer the follow-up questions as below.

In addition to sending to the individual or business the information is reported to the IRS. If a lender cancels or forgives a debt of 600 or more it must send Form 1099-C to the IRS and the borrower to include on their tax return. Schedule C is the tax form included with a personal return that is used to report self-employment.

This form allows you to figure social security and Medicare tax due on your net self-employment income. If you are filing a 1099-MISC with income in Box 7 you will be prompted to Add the income to an existing Schedule C or create a new Schedule C after completing the 1099-MISC entry. However you should probe to determine if this is correct.

Is a 1099 misc the same as a schedule c. How To Streamline Your 1099-K Filings. Schedule C is part of your individual tax return and not a separate business tax return.

Line 1 of Schedule C should list your total business income for the year usually as reported on the Forms 1099 you have received. Enter a Schedule C with the profession business code and name of the business. If you have already added the 1099-MISC1099-NEC in the program you will need to take different steps to associate the Schedule C to the 1099-MISC1099-NEC.

Schedule C which is sent with Form 1040 is used to report self-employment income and calculate taxable profit. Also file Schedule SE Form 1040 Self-Employment Tax if net earnings from self-employment are 400 or more. The income from the 1099-Misc Box 7 or 1099-NEC will be automatically pulled to the Schedule C.

What Is A 1099 Misc And How To Fill Out For Irs Pdfliner

Irs Form 1099 Misc Alizio Law Pllc

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Tax Season Is A Time To Keep Cool A Writer S Guide To Missing 1099 Misc Forms And Unpaid Royalties Dalecameronlowry Com

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Form 1099 Nec For Nonemployee Compensation H R Block

What Information Is On My 1099 Misc Tax Form

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Moneypixels

Irs Tax Form 1099 How It Works And Who Gets One Ageras

10 Things You Should Know About Form 1099

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Form 1099 Misc Miscellaneous Income Definition

Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

1040 Erroneous Schedule C I Have A Schedule C Present In View After Deleting It In Data Entry How Can I Stop This From Being Created If You Have A Return That Continues To Create A Schedule C Or Schedule C Ez After It Has Been Deleted In Data Entry It

Understanding Taxes Simulation Using Form 1099 Misc To Complete Schedule C Ez Schedule Se And Form 1040

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service