Which Form(s) Of Business Is A Treated As A Distinct Legal Entity Separate From Its Owners

In terms of day-to-day business a separate entity runs separately from the owner with a separate bank account and transactions buying and selling products or services or both and receiving and paying out its own money. Tap again to see term.

Corporations And Llcs Course Hero

Partnership and Corporations aredistinct legalentities separate from their owners.

Which form(s) of business is a treated as a distinct legal entity separate from its owners. Previous question Next question. Both a limited partnership. The primary goal of financial management is to Amaximise current sales Bmaximise the value of shares Cminimise costs Davoid bankruptcy 3.

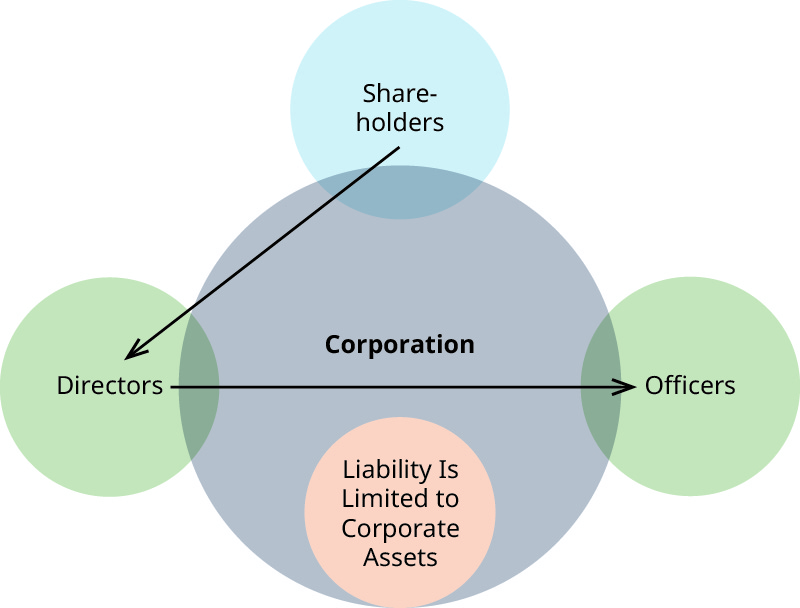

A C Corp is viewed as a separate and distinct legal entity. Non cash property contributed to a partnership is credited at estimated fair value o view the full answer. Among the most important features of a corporation is limited liability which.

A business created as a distinct legal entity composed of one or more individuals or entities is known as a Asole proprietorship Bpartnership Cjoint venture Dcompany 2. Answer is c 2 and 3. A separate entity is a business that is separate legally and financially from its owner or owners.

Click again to see term. A partnership and a corporation are also two separate entities. Click card to see definition.

Limited liability companies and corporations are common types of legal entities. The corporation is recognized by law as being a distinct legal entity apart from the individuals who own it. Tap card to see definition.

Which forms of business is a treated as a distinct legal entity separate from its owners. A company is a separate legal entity as distinct from its members therefore it is separate at law from its shareholders directors promoters etc and as such is conferred with rights and is subject to certain duties and obligations. For Purposes of Taxation Under both versions of the law partnerships are nottaxable entities so they do not pay income taxes.

This core principle of company law has come to be so closely associated with the case that it is widely known as the principle in Salomons case. The activities of the partners and shareholders must be kept separate from the actual partnership and any corporate transactions because they are distinct economic entities. When a business incorporates it is automatically treated as a C Corp.

Therefore if the corporation is sued then the owners are only liable if one of the aforementioned circumstances is met. When a business incorporates the law recognizes the business as a distinct legal entity which can enter contracts and acquire property among other rights and privileges. Under both versions of the law the partnership may keep business records as if it were a separate entity and its accountants may treat it as such for purposes of preparing income statements and balance sheets.

Chapter 6docx - A is a form of business ownership in which the business is considered a legal entity that is separate and distinct from its owners a Chapter 6docx - A is a form of business ownership in which. A _____ is a form of business ownership in which the business is considered a legal entity that is separate and distinct from its owners. The concept of separate business entity assumption does not apply to a legal entity in 100 percent of cases.

Business entity simply refers to the form of incorporation for a business. A corporation is a single entity which may be comprised of individuals or a company but is separate from its owners. Salomons case is usually regarded as a landmark case which finally established the fundamental principle that a company is a separate legal entity distinct from its members.

A _____ is a form of business ownership in which the business is considered a legal entity that is separate and distinct from its owners. S corporations are separate taxpaying entities that pay tax on their own income. School New River Community College Course Title BUS 101.

Think of a corporation as a separate person that can enter into agreements sue be sued and has an unlimited life as opposed to a sole proprietorship or partnership which may have limited life by agreement or by the lives of their owners.

Sole Proprietorship Bookkeeping Business Sole Proprietorship Accounting

Sole Proprietorship Bookkeeping Business Sole Proprietorship Accounting

S Corporation S Corporation Money Management Advice Learn Accounting

S Corporation S Corporation Money Management Advice Learn Accounting

Three Levels Of Strategy Corporate Business And Functional Explained

Three Levels Of Strategy Corporate Business And Functional Explained

Advantages And Disadvantages Of Limited Liability Company Limited Liability Company Liability Raising Capital

Advantages And Disadvantages Of Limited Liability Company Limited Liability Company Liability Raising Capital

Types Of Businesses Overview Of Different Business Classifications

Types Of Businesses Overview Of Different Business Classifications

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Consignment Finance Investing Money Management Accounting Basics

Consignment Finance Investing Money Management Accounting Basics

C Corporation Bookkeeping Business Business Notes C Corporation

C Corporation Bookkeeping Business Business Notes C Corporation

Sole Proprietorship Partnership Corp Or Llc Landscape Business

Sole Proprietorship Partnership Corp Or Llc Landscape Business

Corporate Law And Corporate Responsibility Business Ethics

Corporate Law And Corporate Responsibility Business Ethics

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

How Do Business Partnerships Work Lawsuit Org

How Do Business Partnerships Work Lawsuit Org

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

How Do Business Partnerships Work Lawsuit Org

How Do Business Partnerships Work Lawsuit Org

How Do Business Partnerships Work Lawsuit Org

How Do Business Partnerships Work Lawsuit Org