A Business Created As A Distinct Legal Entity Separate From Its Owners Is Called A(n)

Business entity simply refers to the form of incorporation for a business. It can be created for a limited duration or it can have perpetual existence.

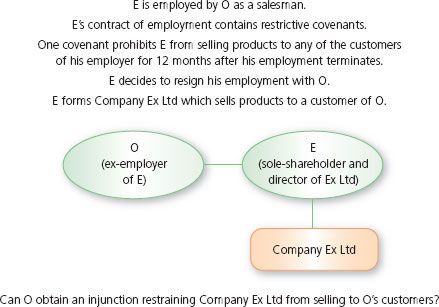

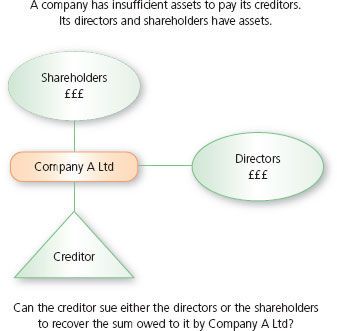

The Company As A Distinct And Legal Person

The Company As A Distinct And Legal Person

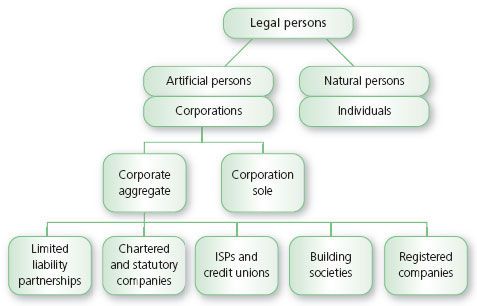

Limited liability companies and corporations are common types of legal entities.

A business created as a distinct legal entity separate from its owners is called a(n). A corporation is treated as a person with most of the rights and obligations of a real person. A corporation has its own identity separate from its shareholders or owners and as such can be sued enter into contracts buy or sell real estate. See Forms of Business Associations 30-2 A partner who has no right to participate in control of the business and who has limited liability is called a.

A corporation is not allowed to hold public office or vote but it does pay income taxes. At the other end of the spectrum a corporation is a distinct legal entity completely separate from its shareholders. Since it is a separate legal entity a corporation has continuity regardless of its owners.

A business created as a distinct legal entity and treated as a legal person is called a. A corporation is a legal entity meaning it is a separate entity from its owners who are called stockholders. If youre running a business as a sole proprietorship you really ARE the business and the business is you.

A corporation is a legal entity separate and distinct from its owners referred to as shareholders and formed by filing articles of incorporation. In other words the business owner and the business are two separate entities. Unlike a sole proprietorship or general partnership a corporation is a separate legal entity separate and distinct from its owners.

In terms of day-to-day business a separate entity runs separately from the owner with a separate bank account and transactions buying and selling products or services or both and receiving and paying out its own money. A legal entity that exists under authority granted by state law. A legal entity typically a business that is defined as detached from another business or individual with respect to accountability.

A separate entity is a business that is separate legally and financially from its owner or owners. A limited liability company is a business entity that is separate from its owners like a corporation. The primary goal of financial management is to Amaximise current sales Bmaximise the value of shares Cminimise costs Davoid bankruptcy 3.

This idea may also be known as the economic entity assumption and it posits that all businesses other related businesses and business owners should be accounted for separately. Terms in this set 21 A _____ is a form of business ownership in which the business is considered a legal entity that is separate and distinct from its owners. They can enter contracts.

A business created as a distinct legal entity composed of one or more individuals or entities is called a. 1 Corporations enjoy most of the rights and responsibilities that individuals possess. Separate business entity refers to the accounting concept that all business-related entities should be accounted for separately.

First a sole proprietorship is NOT a separate legal entity apart from its owner. A business created as a distinct legal entity composed of one or more individuals or entities is known as a Asole proprietorship Bpartnership Cjoint venture Dcompany 2. A separate legal entity may be set up in the case of a corporation or a limited liability company to separate the actions of.

A corporation is a legal entity that is separate and distinct from its owners. When a business incorporates the law recognizes the business as a distinct legal entity which can enter contracts and acquire property among other rights and privileges. For example a corporation can sue and be sued in its own name It can enter into.

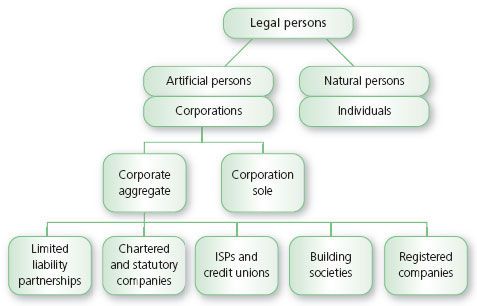

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Understanding Dbas And How They Can Be Dangerous For Your Small Business Incfile

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

Business Name How To Name A Business

Business Name How To Name A Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Payroll Concepts Chapter 3 20c

Payroll Concepts Chapter 3 20c

The Company As A Distinct And Legal Person

The Company As A Distinct And Legal Person

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

The Company As A Distinct And Legal Person

The Company As A Distinct And Legal Person

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

Sole Proprietorship Partnership Corp Or Llc Landscape Business

Sole Proprietorship Partnership Corp Or Llc Landscape Business

Chapter 7 Corporations And Legal Personality

Chapter 7 Corporations And Legal Personality

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)