How To Get My 1099 G Form From Unemployment

Call your local unemployment office to request a copy of your 1099-G by mail or fax. Myunemploymentwisconsingov Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms.

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

For Pandemic Unemployment Assistance PUA claimants the.

How to get my 1099 g form from unemployment. After each calendar year during which you get Unemployment Insurance benefits we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld. Look for the 1099-G form youll be getting online or in the mail. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

Press 2 Other questions about your 1099-G. Then you will be able to file a complete and accurate tax return. How to Get Your 1099-G online.

Follow the prompts to schedule a callback. Yes any unemployment compensation received during the year must be reported on your federal tax return. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

These forms will be mailed to the address that DES has on file for you. Please complete the following form if you need your 1099-G Form. To access this form please follow these instructions.

You can also download your 1099-G income statement from your unemployment benefits portal. For additional information visit IRS Taxable Unemployment Compensation. Form 1099G is now available in Uplink for the most recent tax year.

If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office. You can access your Form 1099G information on your Correspondence page in Uplink account. I have not received my 1099-G form and have been trying to get it through my state unemployment department and the IRS website but keep hitting walls.

How will I know how much unemployment compensation I received. You may choose one of the two methods below to get your 1099-G tax form. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. These forms are available online from the NC DES or in. Click here for the Request for Change in Withholding Status form.

Enter the Social Security number that appears first on your New Jersey Gross Income Tax return and the tax year you wish to view. This information is also sent to the IRS. We do not issue Form 1099-G for pensions or unemployment or family leave insurancefamily leave during unemploymentdisability during unemployment.

Ask Your Own Tax Question. Ive heard that if I file myself online which I usually do and dont add my 1099 the IRS will basically fix it and send me a bill. Lost my pandemic unemployment 1099G form and unable to reset password request copy online.

Unemployment is taxable income. 1099Gs are available to view and print online through our Individual Online Services. Claimants may also request their 1099-G form via Tele-Serve.

Your local office will be able to send a replacement copy in the mail. Press 2 Individual. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form.

If you have not received your 1099-G form please be advised that forms are being processed in batches by the Department. 31 there is a chance your copy was lost in transit. I cant file my taxes until I get my 1099 G form and cant get any help to resolve this matter.

If you havent received your 1099-G copy in the mail by Jan. Form 1099-Gs issued from 2009 through 2019 are available online by logging into the unemployment benefit system and going to your correspondence box. Your 1099-G will be sent to your mailing address on record the last week of January.

How will unemployment compensation affect. Corrected with updated information. You can elect to be removed from the next years mailing by signing up for email notification.

If you need a Form 1099-G for a year prior to 2009 please contact the Unemployment Hotline at 603 271-7700 and. This will help save taxpayer dollars and allow you to do a small part in saving the environment. Benefits are taxed based on the date the payment was issued.

Unemployment benefits are taxable income meaning benefit payments must be reported on your federal tax return when filing taxes with the Internal Revenue Service IRS. Sent to you through email or mail. To view and print your current or previous year 1099-G tax forms online logon to the online benefits services website.

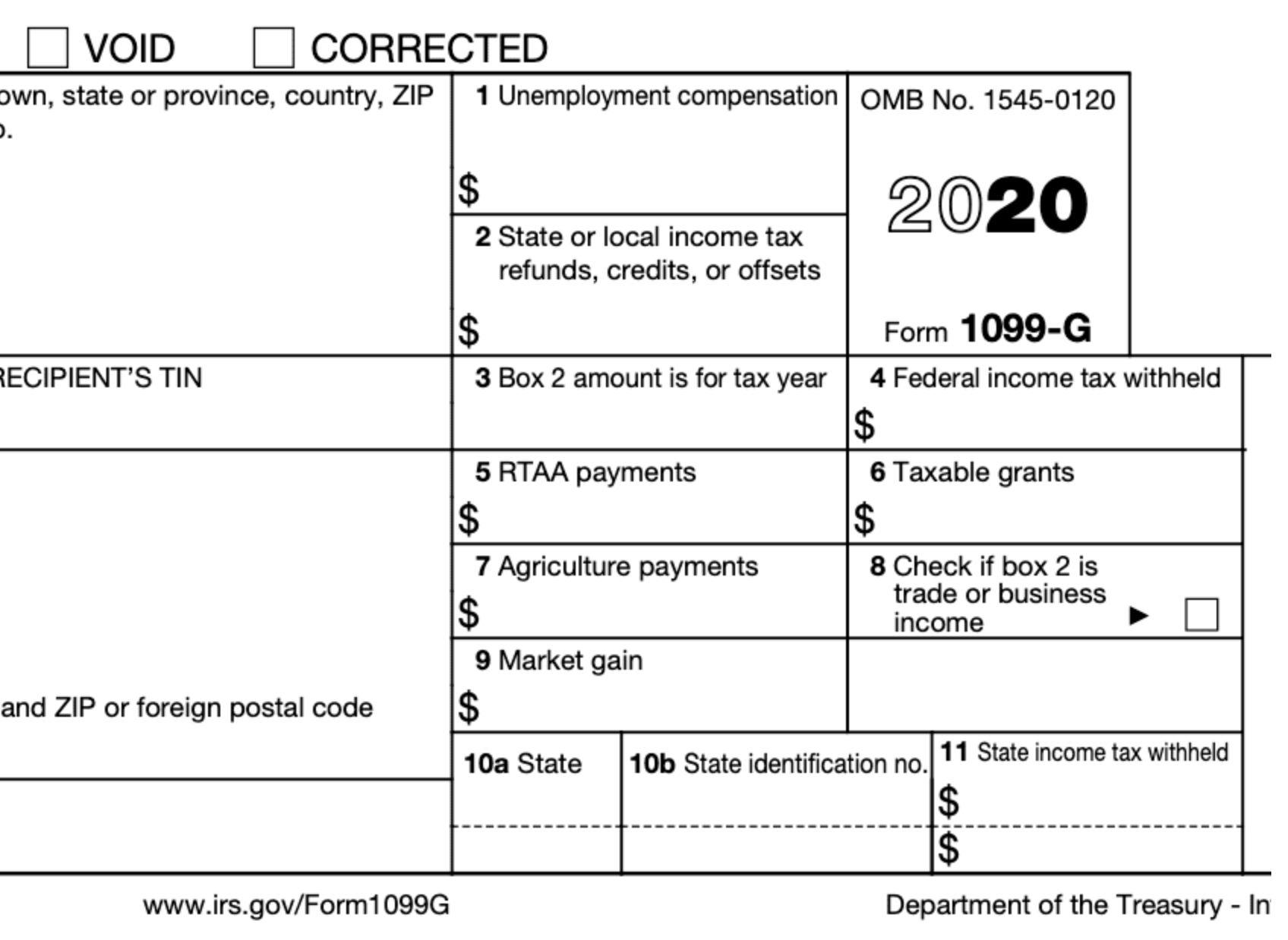

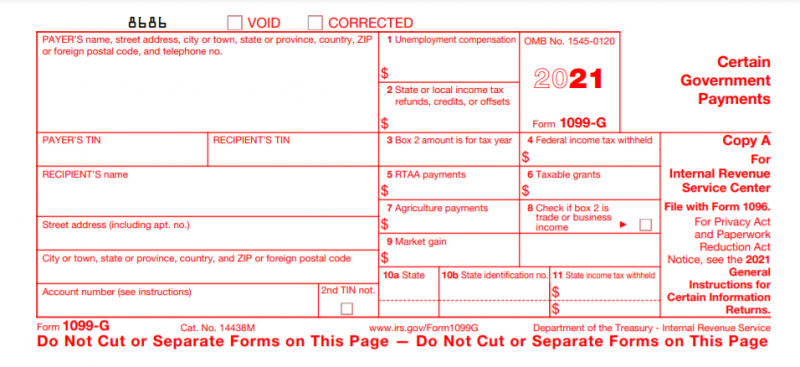

1099 G Form 2021 Irs Forms Zrivo

1099 G Form 2021 Irs Forms Zrivo

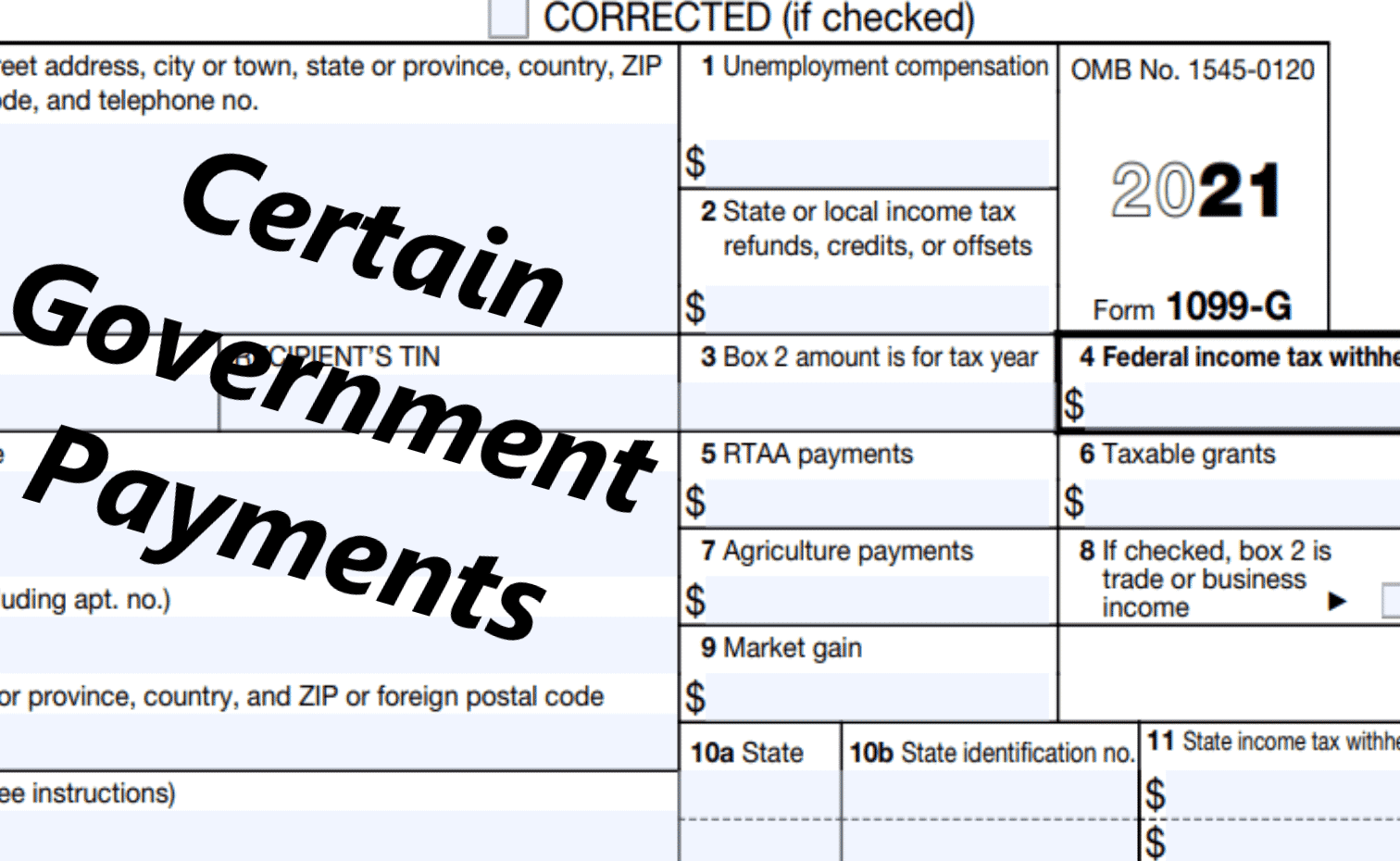

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

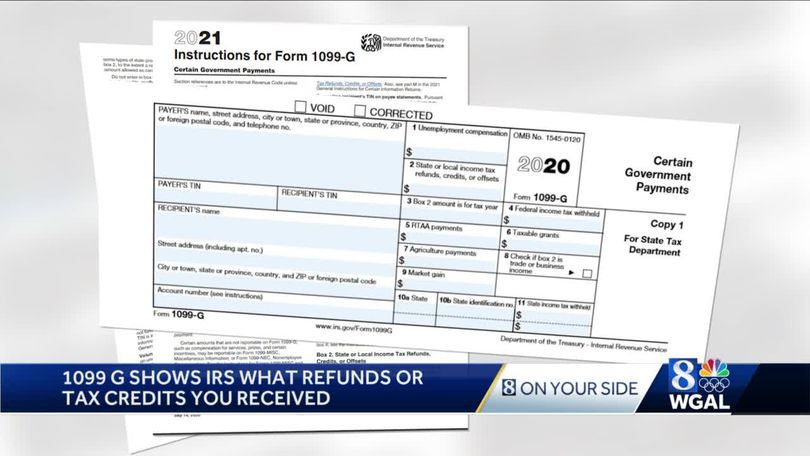

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

Unemployment Benefits Are Taxable Look For A 1099 G Form 13newsnow Com

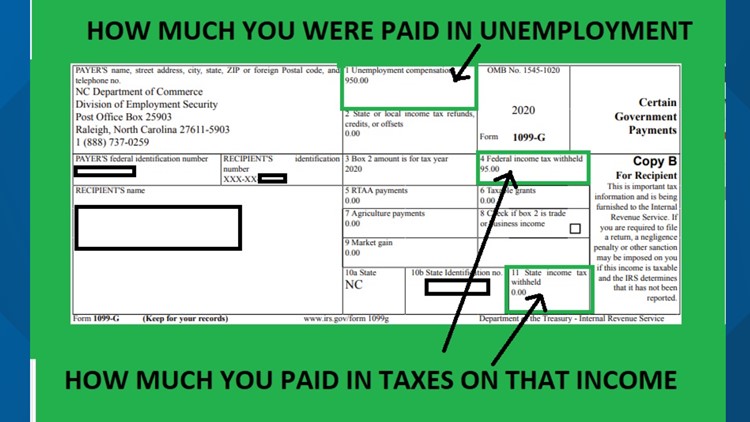

Printable 1099 G Form Get 2020 Blank And Fill It

Printable 1099 G Form Get 2020 Blank And Fill It

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

Users Report Problems Accessing 1099 G Form On Florida S Unemployment Website

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Warning If You Get A 1099 G Form And You Ve Never Applied For Unemployment You May Be A Victim Of Fraud Cbs Chicago

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

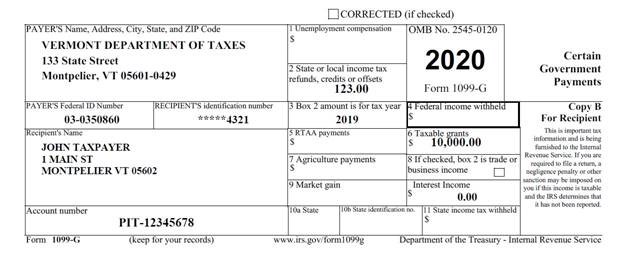

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

1099 Form Available For 2017 Unemployment Recipients

1099 Form Available For 2017 Unemployment Recipients

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition