Is An S Corp 1099 Exempt

You shouldnt report income based on Forms 1099-MISC. You may wonder Are S Corps 1099 reportable As an S Corporation if you have utilized independent contractors it is very likely you will have form 1099 reporting requirements.

W2 Vs 1099 Which Is Better For Employees 1099 Tax Form Efile Online

W2 Vs 1099 Which Is Better For Employees 1099 Tax Form Efile Online

This regulation provides specific instances where an eyeball test can be applied to determine that a payee is a corporation and possibly exempt from Form 1099 reporting.

Is an s corp 1099 exempt. Regulation section 16049-4 eyeball test. If a Form 1099-C Cancellation of Debt for canceled debt is issued to an S Corporation the income inclusion or exclusion is applied at the corporate level. Form 1099-MISC although they may be taxable to the recipient.

A tax-exempt organization must file required information returns such as Form 1099-MISC PDF. However see Reportable payments to corporations later. A 1099 for S corporation is a crucial form that employers must use when they hire independent contractors.

While the IRS requires you to issue 1099 forms to self-employed contractors there are exceptions for S corporations. For-profit medical and health care providers organized as a. Account for the purposes of chapter 4 of Internal Revenue Code as described in Regulations section 11471.

In some states S-corporations must also pay additional fees and taxes. Form 1099-MISC reports payments issued to a contractor or service provider. There are a few exceptions where corporations must receive a Form 1099-MISC.

Most of the time however businesses issue the 1099-MISC forms for payments made directly to the contractors they used for business services during the tax year in question. Check the box if you are a US. However a few exceptions exist that require a.

Hence the IRS exempts corporations which have stringent federal and state administrative. A 1099-MISC helps individuals and businesses report income on their personal tax returns while affording the IRS a mechanism to track income. And there are many instances where a corporation is not exempt.

For example in California an S-corporation must pay tax of 15 percent on its income with a minimum annual amount of 800. S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes. As with larger corporations an S-corporation has both start-up and ongoing legal and accounting costs.

Exceptions to the 1099 Rules There are some exceptions to the general rules. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. If corporations are exempt from 1099-MISC how are they taxed for this income.

Form MISC 1099s serve several purposes. An organization does not withhold income tax or social security and Medicare taxes from or pay social security and Medicare taxes or federal unemployment tax on amounts it pays to an independent contractor non-employee. You do not need to provide a corporation including an S-corporation a Form 1099-MISC.

LLC with S or C corporation status No 1099-MISC The business that made the payment to the independent contractor is the one who must report the payments to the IRS and then send a copy to the provider. Payments for which a Form 1099-MISC is not required include all of the following. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation.

Lawyers operating as a C or S corporation need a 1099. The 1099-MISC operates like a W-2 for independent contractors. Rather you should keep adequate records of your business income and expenses and base your return on those records.

Under this rule if there are exempt and nonexempt transferors you must file Form 1099-S only for the nonexempt transferor. S corps by contrast are exempt from federal tax on most earningsthere are a few exceptions on certain capital gains and passive incomeso they can distribute more gains to stockholders. The 1099 allows the independent contractors to properly account for and report their income as well as the businesses they contract with to measure their contractor.

Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate. Payer that is reporting on Forms 1099 including reporting distributions in boxes 1 through 3 and 9 through 12 on this Form 1099-DIV as part of satisfying your requirement to report with respect to a US.

This tax is not required for sole proprietors.

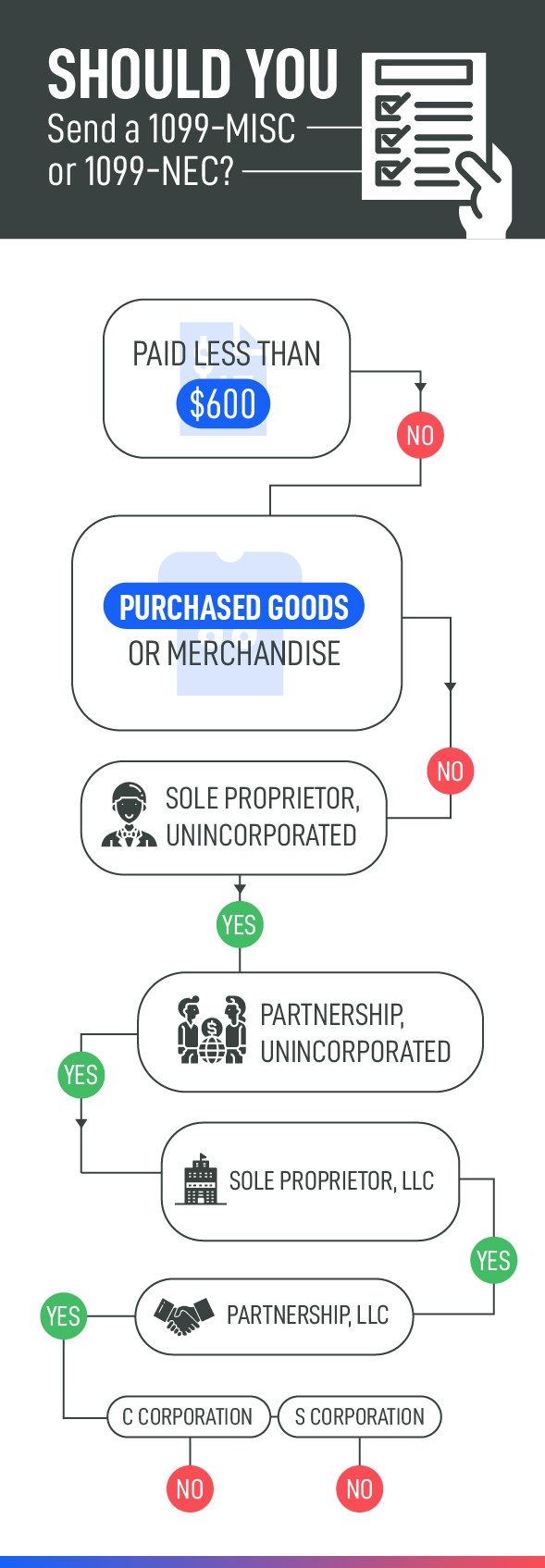

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

/1099c-5606545f559b4f28883a0de35905889b.jpg) Form 1099 C Cancellation Of Debt Definition

Form 1099 C Cancellation Of Debt Definition

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Misc Archives W9manager

Form 1099 Misc Archives W9manager

What Is An Irs Schedule C Form And What You Need To Know About It

What Is An Irs Schedule C Form And What You Need To Know About It

S Corp Vs C Corp Business Structure Accounting Services Tax Accountant

S Corp Vs C Corp Business Structure Accounting Services Tax Accountant

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

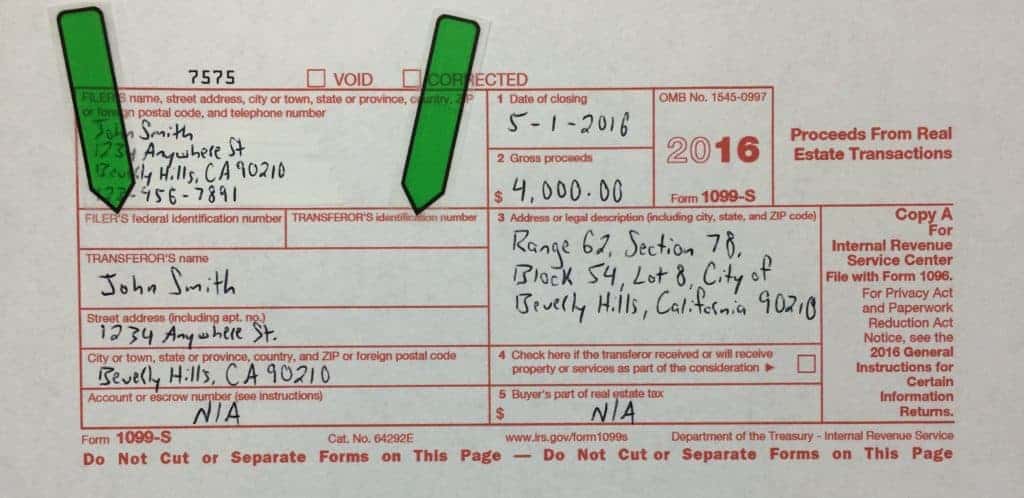

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It