Do Grant Recipients Receive 1099

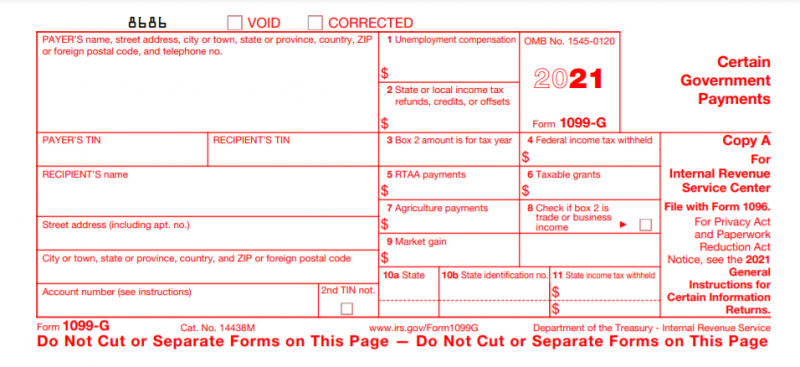

Form 1099-G Certain Government Payments Form 1099-G Certain Government Payments is provided to a taxpayer that received certain kinds of payments from federal state or local governments. The early information released by the Small Business Administration created a lot of confusion on this topic.

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

In the letter to county commissioners.

Do grant recipients receive 1099. CRF aid was provided as part of the federal Coronavirus Aid Relief and Economic Security CARES Act. This is because these funding sources are considered wages and are reported on a IRS Form W-2. Not sure what to do.

Earners can calculate what they should ask for by adding up all 1099 revenue for 2019 up to 100000 divide that number by 12 months and then multiply that by 25 months. KFW does not withhold taxes from grant awards or other taxable income but is required to report all grant awards as other income to the IRS on the form 1099-MISC. Grant recipients are responsible for including.

The Art Grant I received was reported by the non-profit charitable organization on a 1099-MISC box 7 Non-Employee Income. IRS Form 1099 for Grant and Cooperative Agreement Recipients. KFW does not withhold taxes from grant awards or other taxable income but is required to report all grant awards as other income to the IRS on the form 1099-MISC.

I was postbaccalaureate fellow at the NIH for a year between undergrad and grad school and my income was reported on a 1099-G. Yes you will receive a Form 1099 if you received and retained within the calendar year 2020 a total net payment from either or both of the Provider Relief Fund and COVID-19 Claims Reimbursement to Health Care Providers and Facilities for Testing Treatment and Vaccine Administration for the Uninsured that is in excess of 600. Several people have asked how the Paycheck Protection Program forgivable loans sometimes referred to as grants created by the CARES Act apply to 1099 independent contractors.

Personally over my time innear academia I received awarded income on five occasions. When in doubt contact the granting agency for specific instructions on how to handle tax forms. Grant recipients are responsible for including information concerning these funds on their personal income tax statement.

Does KFW withhold taxes on grant awards or taxable income. 31 2021 and must be filed with the IRS by March 1 2021. It is recommended recipients of grant or cooperative agreement awards consult their tax advisor regarding any tax requirements.

These are due to recipients by Jan. I received an Art Grant from a non-profit and it is not supposed to be taxable. They reported it on a 1099-MISC.

A recipient may use grant funds for room board travel research clerical help or equipment that are incidental to the purposes of the scholarship or fellowship grant. Awards of 600 or more are reportable. June 4 2019 446 PM You are correct that you do need to pay income taxes on your grant income as reported to you on Form 1099-MISC.

Contractors sole proprietors and 1099 earners are eligible for PPP loans up to 100000 in annual income. According to the IRS website A federal grant is ordinarily taxable unless stated otherwise in the legislation authorizing the grant. Other payments for which a Form 1099-MISC is not required include.

For example if an independent contractor earned 100000 in 1099 revenue in 2019 then that individual should. For example because February 28 falls on a Sunday in 2021 the due date for 2020 forms is March 1 2021. I was on a training grant in my first year of grad school and my income was reported on a 1099-MISC in Box 3.

For example in the case of scholarships or fellowship grants you wont need to issue a 1099. IRS Rules Septic Grant Recipients Should Receive 1099s And Pay Taxes On Funds. Generally payments to a corporation although there are always exceptions.

Accordingly nonprofit organizations and government entities would generally be exempt from receiving 1099 forms. The grant qualifies as a prize or award that is excludible from gross income under Internal Revenue Code section 74b if the recipient is selected from the general public. The Internal Revenue Service has stated that Suffolk County residents who have received grants for septic upgrades should pay tax on the funds.

However although you must pay ordinary income taxes on this income you do not have to pay Social Security and Medicare taxes on it as well as you would if this were instead self-employment income. Cities that used Coronavirus Relief Funds CRF to provide grants and forgivable loans will need to issue Form 1099-G to qualifying recipients. Grant recipients will be asked to complete a W-9 IRS Form.

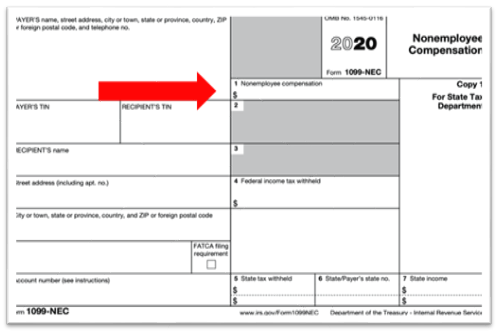

Per the IRS website its not taxable. Many states have released instructions for reporting payments with a. Tuesday Channel 3 obtained a letter raising concerns about Escambia County sending its grant recipients 1099-NEC forms or non-employee compensation forms.

Do business grant recipients receive 1099. These payments are entered on the individuals tax return and may be considered taxable income. February 28 of the year after the tax year is the due date for 1099-MISC forms for both payees and the IRS however the due date changes each year for holidays and weekends.

When and Where Do I File 1099-MISC Forms.

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

1099 G 2020 Public Documents 1099 Pro Wiki

1099 G 2020 Public Documents 1099 Pro Wiki

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Find The Quicker Path To File Your 1099s And W 2s Http Www Pureinfographics Com Find Quicker Path File 1099s W 2s Filing Taxes Business Tax Tax Forms

Find The Quicker Path To File Your 1099s And W 2s Http Www Pureinfographics Com Find Quicker Path File 1099s W 2s Filing Taxes Business Tax Tax Forms

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Fillable Form Bittorrenttracker Blog Doctors Note Template Letter Template Word Fillable Forms

1099 Misc Fillable Form Bittorrenttracker Blog Doctors Note Template Letter Template Word Fillable Forms

How Do I Understand My 1099 Tax Form From Children S Council Children S Council

How Do I Understand My 1099 Tax Form From Children S Council Children S Council

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients The Southern Maryland Chronicle

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients The Southern Maryland Chronicle

The Irs 1099 G Form What It Is And Who Receives

The Irs 1099 G Form What It Is And Who Receives