Does Turbotax Generate 1099

I still have my 2012 copy of the TT program. At a much later point TurboTax will ask you about the foreign tax paid under Deductions Credits - Estimates and Other Taxes Paid - Foreign Taxes.

Solved How Do I Issue 1099 Misc

Solved How Do I Issue 1099 Misc

Click the Prepare 1099s button.

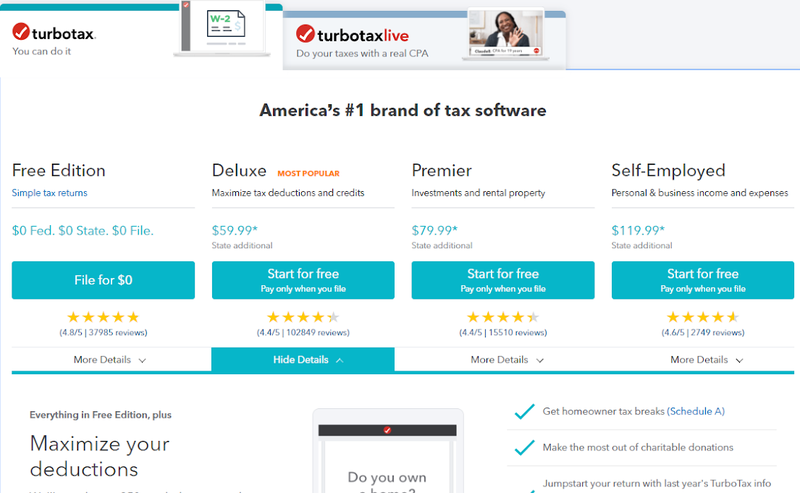

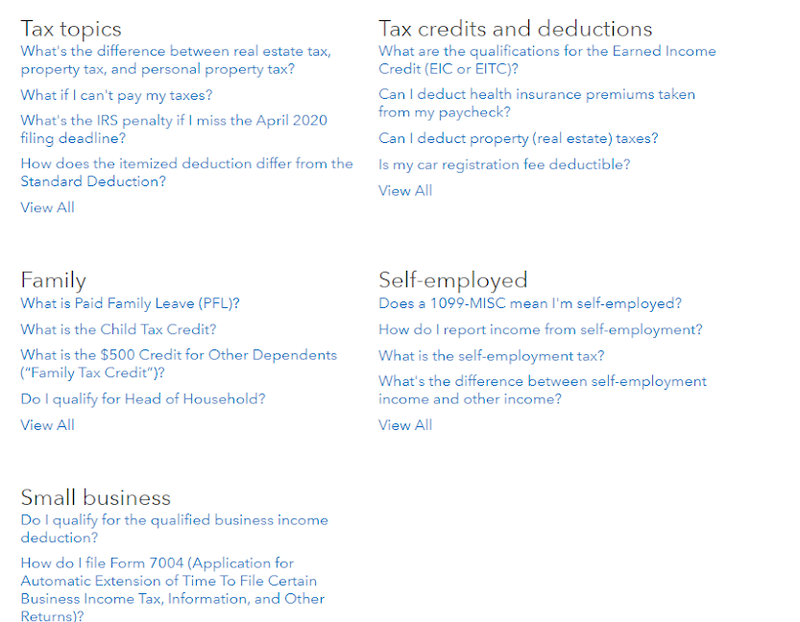

Does turbotax generate 1099. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. After you enter the 1099-DIV TurboTax says nothing about exceeding the 300600 threshold or needing a Form 1116. The software company said they couldnt do anything around other than waiting for the IRS EFC.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. If you only have a W-2 from work and various Form 1099s you may only need the TurboTax Free Edition. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

Available in mobile app only. Go to the Workers menu. Click 1099 contractors below the threshold.

Choose easy and find the right product for you that meets your individual needs. Available in mobile app only. 1099-NEC Snap and Autofill.

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. For a complete comprehensive and expert look at all 20 1099s you can talk to a Turbo Tax professional about which forms you should be expecting. Once you are done just print the 1099-misc form and give the forms to the contractors.

E-file online with direct deposit to receive your tax refund the fastest. It comes with a 60-day money back guarantee from Intuit so if it doesnt work to your satisfaction you. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting by end of. So I decided to use the FIRE system to file the corrected 1099 instead since I couldnt do so within the software system. TurboTax online makes filing taxes easy.

If the LLC performed services for your business and the payment is 600 or more in the year you must send them a 1099-MISC or 1099-NEC reporting the payments. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct. Also remember you can E-file your 1099-misc forms so you dont have to send anything to the IRS yourself the software will do it for you.

Without the Accepted status the software doesnt generate the e-file for corrected 1099 which I subsequently need to e-file. To create a Form 1099-MISC in TurboTax Self-Employed. 1099-MISC Miscellaneous Income 1099-INT Interest Income.

Choose the Contractors tab. Open continue your return in TurboTax Self-Employed. Available in mobile app only.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. You can use TurboTax Self-Employed TurboTax Self-Employed Live TurboTax Home Business for Windows and TurboTax Business to create W-2 and 1099 forms including 1099-NEC and 1099-MISC for your employees and contractors. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

Even though you generally dont need to send form 1099-MISC or 1099-NEC to a Corporation a common mistake is not sending a 1099-MISC or 1099-NEC to an LLC. Instructions for TurboTax Self-Employed and TurboTax Self-Employed Live. Where do I generate a 1099 in the Turbotax Self-Employed software.

At tax time I imported the VG 1099-R but didnt prompt TurboTax to generate the 8606. The Form 1099s the Basic version supports are. 1099-NEC Snap and Autofill.

Try it for FREE and pay only when you file. Once there go to the Type of contractors drop-down arrow. You continue with the rest of your entries as usual.

Binance Tax Reporting You can generate your gains losses and income tax reports from your Binance investing activity by connecting your account with CryptoTraderTax. You can still generate 1099 forms for your vendors and contractors who were paid less than 600. The overall purpose of the 1099 is to make sure that you your source of income and the IRS are all in agreement about your earnings.

The most popular is TurboTax Business not the personal edition which will help you file your return and also generate both 1099-MISC and W-2 payroll forms for you. Go to Step number 4 by clicking Next. 1099-NEC Snap and Autofill.

TurboTax is the easy way to prepare your personal income taxes online. If your return isnt open youll need to sign in and click Take me to my return Click the drop-down arrow next to Tax Tools lower left of your screen. It looks to me that TT counted that 5k as income and that I overpayed my 2012 taxes.

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

Turbotax Self Employed 2021 Discounts Service Codes

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

Entering Form 8949 Totals Into Turbotax Tradelog Software

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

1099 Nec Schedule C Won T Fill In Turbotax

1099 Nec Schedule C Won T Fill In Turbotax

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Solved How Do I Issue 1099 Misc

Solved How Do I Issue 1099 Misc