How To Register For Vat Ireland

Register online through ROS. VAT registration is done using the following forms.

Vat Guide Exports Revenue Tax Economy

Vat Guide Exports Revenue Tax Economy

However a person carrying on exempt activities or non taxable activities may have to register for VAT in certain situations for example.

How to register for vat ireland. Add your company information and. To help you better understand the registration process weve outlined the steps needed to get a VAT number using Ireland as an example. Generally you must register for VAT if you are an accountable person.

What is VATable activity. Form TR1 is used to register an individual partnership trust or unincorporated body Form TR2 is used for registration if trading as a company. What you need to get a VAT number in Ireland.

To register for VAT in Ireland you need to register with the Irish Revenue. Setting up a Limited Company in Ireland involves submitting an application to the Companies Registration Office CRO to incorporate your company. Your business may need to register for VAT in order to account for VAT on that supply.

If you are eligible for the Union scheme the following rules apply if. There is no threshold for VAT if you receive services from outside Ireland and the place of supply of the service is in Ireland. Alternatively your tax agent or small company accountant can do this for you on your behalf.

A person carrying out only exempt activities or non taxable activities may not register for VAT. Acquiring goods from other Member States. You have established your business in.

Get in touch with our Client Services. Dublin City Centre Revenue District 9-10 Upper OConnell Street Dublin 1. Choose a specific EU country and register through their national VAT MOSS.

Tax registration is completed through Irish Revenue. Some businesses may elect to register for VAT before they meet any of the above criteria but you should speak to an accountant about your situation first. You or your tax agent can register your business for VAT through Revenues Online Services ROS.

Certain parts of this website may not work without it. VAT on services applies generally where a VAT registered provider or a provider who should be VAT registered because it exceeds the relevant annual turnover threshold supplies a serviceVAT may also apply in another country where the services are provided there in which cases the home country Irish provider may need to register for VAT in. Information on how to register for calculate pay and reclaim VAT VAT rates and VAT on property rules.

For most foreign businesses the Irish VAT. This is a sale. Youll need to register for the VAT MOSS scheme in an EU country by the 10th day of the month after your first sale to an EU customer.

In 2021 the VAT registration in Ireland is supervised by the Irish Revenue. You can register for VAT MOSS by registering online. In receipt of goods from the other EU Member States over the value of.

Companies and natural persons required to register for VAT in this country can conclude the process through the Revenues Online Services ROS portal. Example If you make your first sale on 12 January 2021 then. Read our handy guide to find out.

VAT registration Information on registering for VAT registration for VAT groups and liquidators and state bodies. Making sales or carrying out services in Ireland may require you to register for VAT in Ireland. To secure an Irish VAT number non-resident businesses must submit their completed application to.

VAT registration is mandatory if you meet any of the following criteria. It looks like you have JavaScript disabled. Register for VAT Most businesses can register online - including partnerships and a group of companies registering under one VAT number.

Selling over 37500 for the sale of services or 75000 for the sale of goods means your company needs to register for VAT in Ireland. You can submit a VAT registration application via Revenue Online Service ROS. By doing this youll register for VAT and create a.

We would always recommend you seek expert advice when registering for VAT as mistakes may be costly. Businesses established in Ireland will register for MOSS through the MyServices section in their Revenue Online Service ROS account. Once your company has been set up and you have received your company number you.

It is not currently possible to register for VAT online. To avail of this facility your business must be established in.

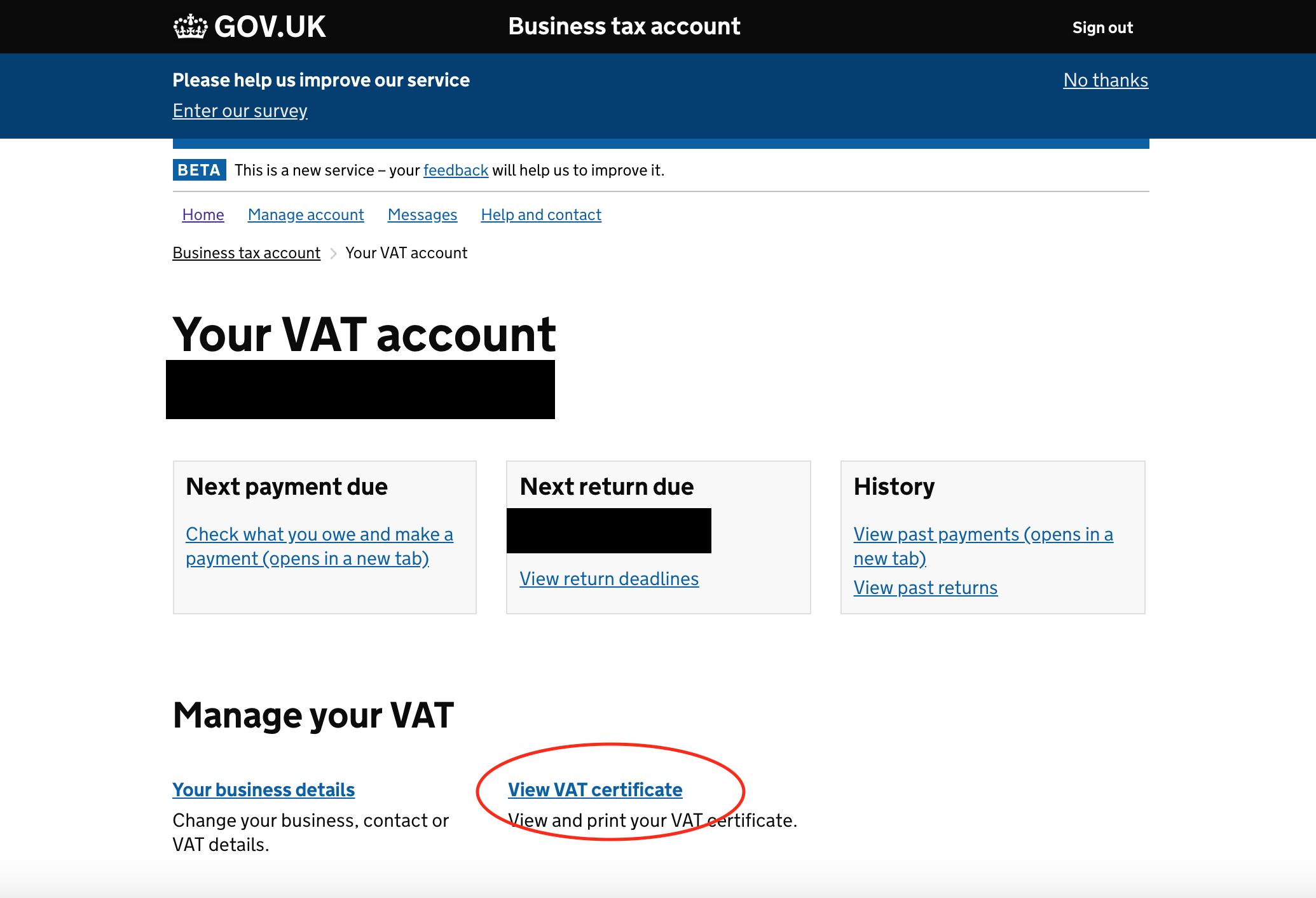

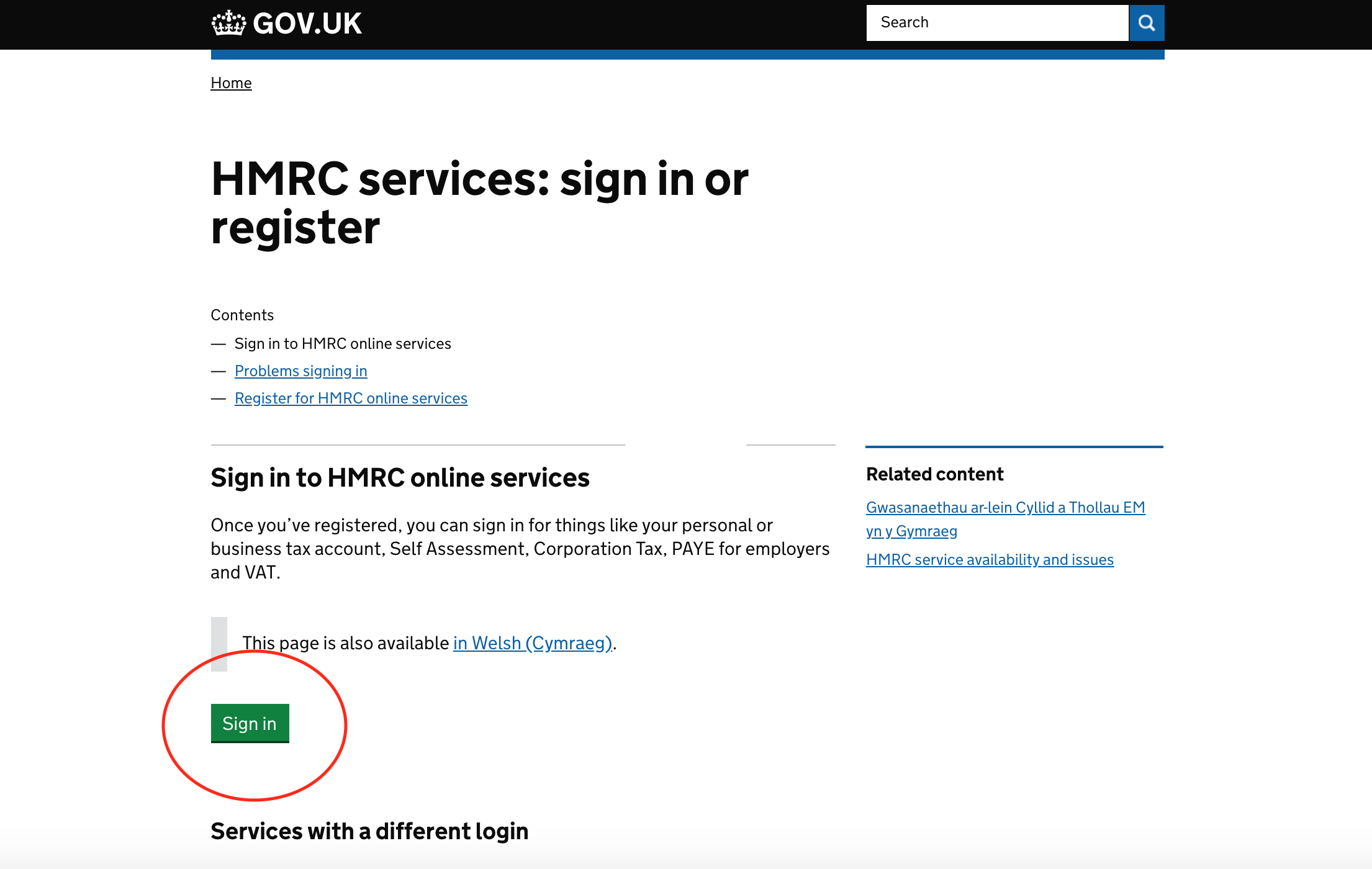

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Using An External Web Service For Eu Vat Number Validation Signavio

Using An External Web Service For Eu Vat Number Validation Signavio

Woocommerce Eu Vat B2b Stylelib Woocommerce Plugins Wordpress

Woocommerce Eu Vat B2b Stylelib Woocommerce Plugins Wordpress

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

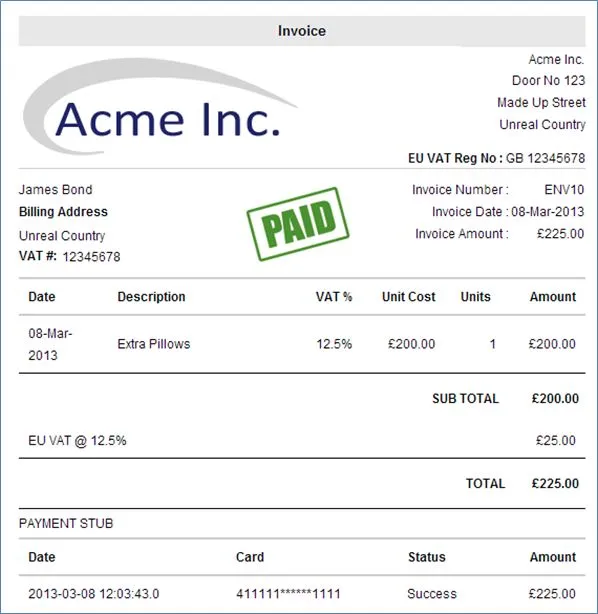

What Is A Vat Invoice Charging Value Added Tax To Eu Clients

What Is A Vat Invoice Charging Value Added Tax To Eu Clients

Irish Company Formation Setup Your Company In Ireland Limited Company Company Irish

Irish Company Formation Setup Your Company In Ireland Limited Company Company Irish

What Are The Documents Required For Setting Up A Private Limited Company In Singapore Find Here The A Private Limited Company Create A Company Limited Company

What Are The Documents Required For Setting Up A Private Limited Company In Singapore Find Here The A Private Limited Company Create A Company Limited Company

How To Register For Vat On Efiling

How To Register For Vat On Efiling

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

Retail Export Scheme Tax Free Shopping For Tourists Tax Free Shopping Free Shopping Tax Free

Retail Export Scheme Tax Free Shopping For Tourists Tax Free Shopping Free Shopping Tax Free

The Endometriosis Challenge Time To End The Silence Sale Artwork Still Life Photography Paintings For Sale

The Endometriosis Challenge Time To End The Silence Sale Artwork Still Life Photography Paintings For Sale

Https Revenue Ie En Tax Professionals Tdm Income Tax Capital Gains Tax Corporation Tax Part 38 38 01 03b Pdf

Hmrc Vat Helpline Trying To Register For New Moss Service Budget Planner Free Logos Income Tax

Hmrc Vat Helpline Trying To Register For New Moss Service Budget Planner Free Logos Income Tax

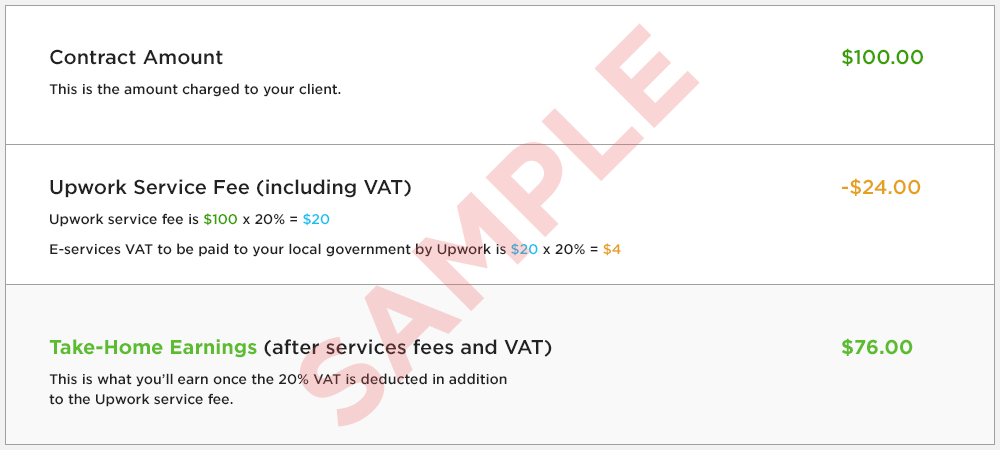

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Like This Template You Can Set Up An Online Store With The Motion Theme For Nopcommerce Follow The Link For More Information Responsive Theme Motion Online

Like This Template You Can Set Up An Online Store With The Motion Theme For Nopcommerce Follow The Link For More Information Responsive Theme Motion Online