Itr Form For Partnership Business

Otherwise usually the due date of filing of return for non-audit cases is 31st July. If the requirements of audit are applicable the due date of filing of return is 30th September.

Professional Tax Law Accounting Services Accounting Services Tax Services Income Tax

Professional Tax Law Accounting Services Accounting Services Tax Services Income Tax

The ITR 3 form can be filed by the person who is.

Itr form for partnership business. A partner in a partnership firm or LLP Earning income from salary house property capital gain other sources and under the head Profits or gains of business or profession and not eligible to opt for Presumptive Taxation Scheme. 1701 shall be filed by individuals who are engaged in tradebusiness or the practice of profession including those with mixed income ie those engaged in the tradebusiness or profession who are also earning compensation income in accordance with Sec. ITR 4 known as Sugam can be used by any individual HUF or a partnership firm which wishes to offer their income on presumptive basis.

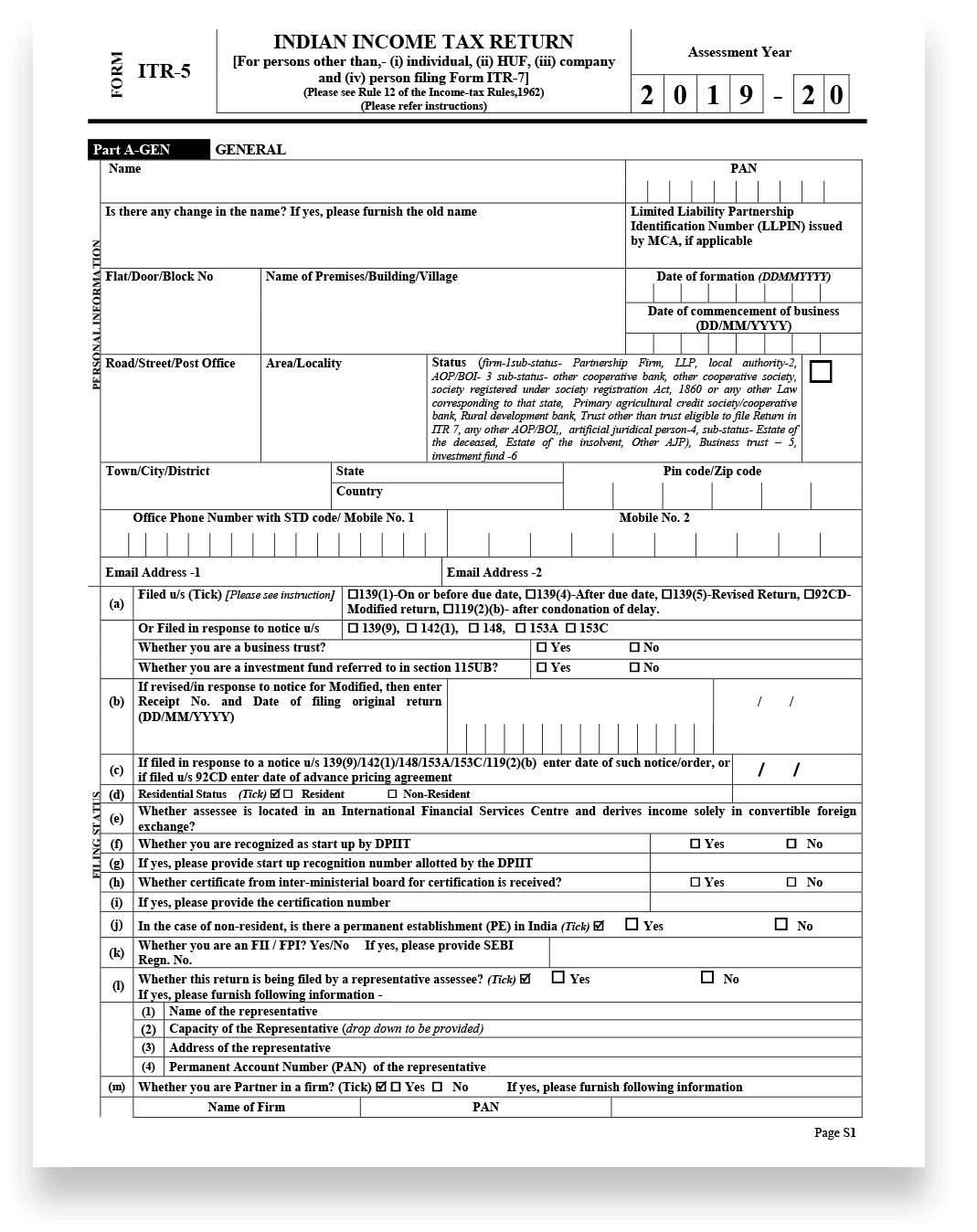

Partnership firm LLP etc can file ITR Form 5. Companies are required to use ITR-6 form while charitable trusts institutions need to file the ITR-6 form. The most common forms of business are the sole proprietorship partnership corporation and S corporation.

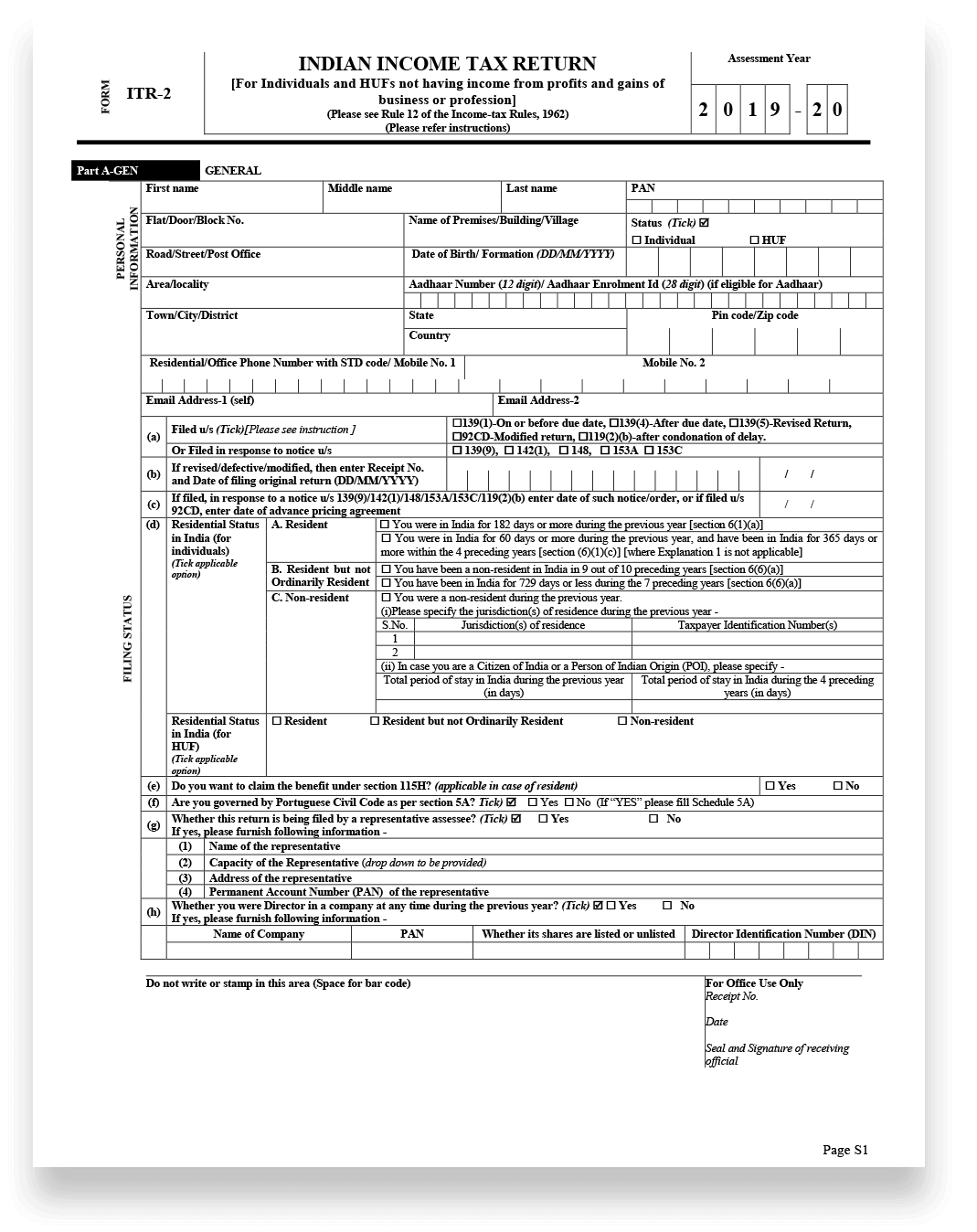

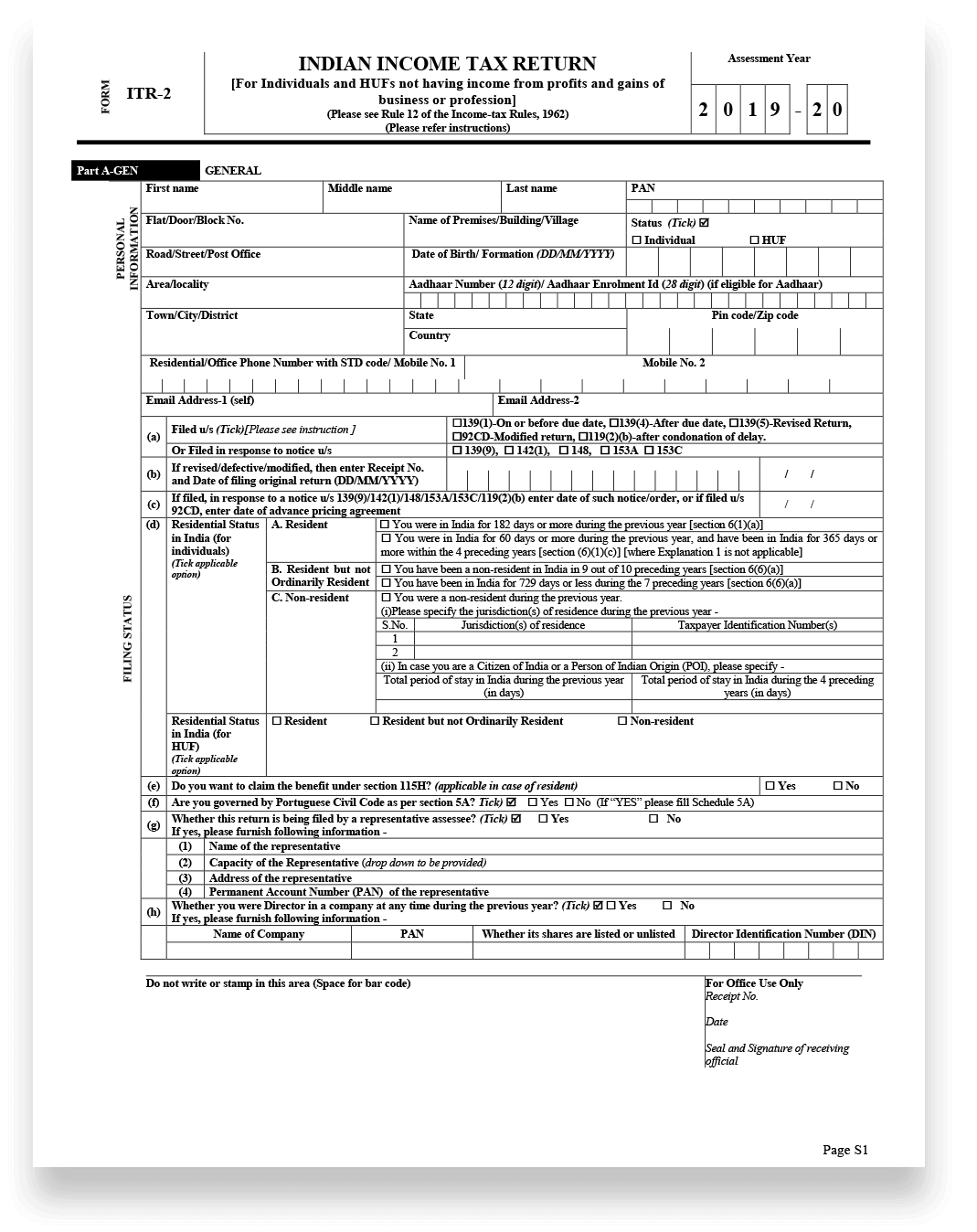

For individuals and HUFs having income from profits and gains of business or profession. The Income Tax Return of a Partnership firm is filed in form of ITR-5 with the Income Tax Department. Partnership firms are required to file income tax return in form ITR3.

51 of the Code as amended. Download a PDF of the Partnership tax return 2019 PDF 407KB This link will download a file. What is the ITR-4 Form.

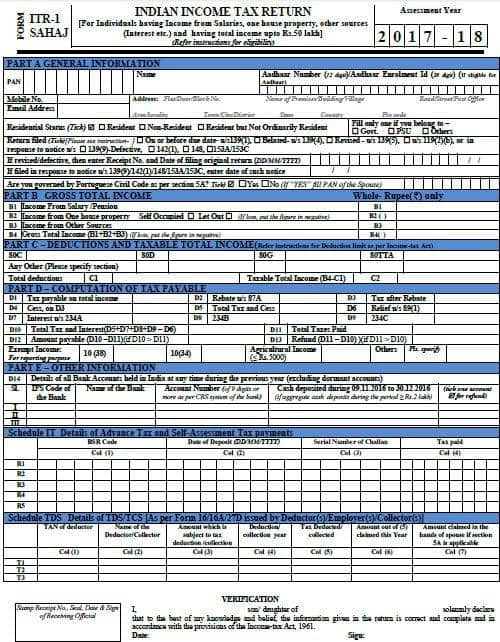

If you are an individual in a partnership you may need to file the forms below. The ITR-4 Form is applicable for individuals or HUFs who have income from proprietary business or are carrying on a profession. Refer to Partnership tax return instructions 2019.

Nevertheless the taxpayer must save all documents belonging to the business and present the same before tax authorities when requested. ITR-3 form is applicable to taxpayer who is partner in a partnership firm and earning salary remuneration interest and profits from firm. Form 965-A Individual Report of Net 965 Tax Liability.

Yes the entire process of the ITR filing and audit can be done online. Partnership tax return 2019. Form 8990 Limitation on Business Interest Expense Under Section 163j Forms for Individuals in Partnerships.

-Persons other than individual HUF and companies iE. Who wish to file Income-tax return of professional income. When beginning a business you must decide what form of business entity to establish.

ITR for Proprietors with Business Income. Form Sugam ITR-4 For Individuals HUFs and Firms other than LLP being a resident having total income upto Rs50 lakh and having income from business and profession which is computed under sections 44AD. Form ITR-3 in PDF Format for AY 2020-21FY 2019-20.

Like all other income tax forms ITR 3 is an attachment less form and there is no requirement for submitting any documents or statements along with a partnership firm tax return. Your form of business determines which income tax return form you have to file. -Individuals and HUFs not having income from business or profession and not eligible for filing Sahaj can file ITR-2 while those having income from business or profession can file ITR Form 3.

Can filing of partnership annual compliances be done online. It Is Filed By Partnership If It Cannot File Itr 4 Example-Audit Case Or Capital Gain Or 2 House Property ITR Forms for Partners of Partnership Firm If they have some other business they have to file ITR 3 If they do not have any other business they file ITR 2. Schedule E Form 1040 Supplemental Income and Loss.

A Limited Liability Company LLC is a business structure allowed by state statute. The Partnership tax return 2019 NAT 0659-62019 is available in Portable Document Format PDF. Hense ITR-5 is applicable for partnership firms other than those qualifying for ITR-4 LLPs Association of Persons Body of Individuals etc to whom no other form applies.

Moreover the ITR-3 is applicable for individuals and Hindu Undivided Families who wish to file Income-tax return of business income. - Companies can file ITR Form 6.

Know More About Itr Form 2 At Taxraahi Taxraahi Is Your Online Tax Return Filing Companion In Delhi Gurgaon Noida An Income Tax Return Tax Return Income Tax

Know More About Itr Form 2 At Taxraahi Taxraahi Is Your Online Tax Return Filing Companion In Delhi Gurgaon Noida An Income Tax Return Tax Return Income Tax

Income Tax Forms Ay 10 10 Top 10 Fantastic Experience Of This Year S Income Tax Forms Ay 10 Tax Forms Income Tax Income Tax Return

Income Tax Forms Ay 10 10 Top 10 Fantastic Experience Of This Year S Income Tax Forms Ay 10 Tax Forms Income Tax Income Tax Return

Income Tax Return Itr 5 Filing Form How Do I File My Itr 5 Form

Income Tax Return Itr 5 Filing Form How Do I File My Itr 5 Form

What Is Itr3 Form Informative Filing Taxes Income Tax Return

What Is Itr3 Form Informative Filing Taxes Income Tax Return

See What The New And Simplified Income Tax Return Form Looks Like

See What The New And Simplified Income Tax Return Form Looks Like

Itr 3 Form Filing Finpathways Consultancy Services Pvt Ltd

Itr 3 Form Filing Finpathways Consultancy Services Pvt Ltd

Which Itr To File Income Tax Return Income Tax Tax Return

Which Itr To File Income Tax Return Income Tax Tax Return

Table1 Assessment Filing Taxes Tax Payer

Table1 Assessment Filing Taxes Tax Payer

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Income Tax Return Filing Is Very Important For Every Person Who Are Having Income More Than The Taxable S Income Tax Return Tax Return Income Tax Return Filing

Income Tax Return Filing Is Very Important For Every Person Who Are Having Income More Than The Taxable S Income Tax Return Tax Return Income Tax Return Filing

Limited Liability Partnership Registration Limited Liability Partnership Liability Partnership

Limited Liability Partnership Registration Limited Liability Partnership Liability Partnership

Cleartax S Infographic Of What Incomes And Losses The Different Itr Forms Include And Exclude Income Tax Return Residual Income Business Income Tax

Cleartax S Infographic Of What Incomes And Losses The Different Itr Forms Include And Exclude Income Tax Return Residual Income Business Income Tax

Share Market Share Market House Property Income

Share Market Share Market House Property Income

Itr Filing Get It Done In One Go Filing Taxes Income Tax Return Getting Things Done

Itr Filing Get It Done In One Go Filing Taxes Income Tax Return Getting Things Done

Form 7004 Tax Extension Form Income Tax Income Tax Return Tax Refund

Form 7004 Tax Extension Form Income Tax Income Tax Return Tax Refund

13 Changes In New Income Tax Return Forms Released By It Dep For Ay 2020 21 Faceless Compliance

13 Changes In New Income Tax Return Forms Released By It Dep For Ay 2020 21 Faceless Compliance

Efiling Income Tax Mymoneykarma Income Tax Income Tax Guide

Efiling Income Tax Mymoneykarma Income Tax Income Tax Guide

Income Tax Return Itr 2 Filing Form How Do I File My Itr 2 Form

Income Tax Return Itr 2 Filing Form How Do I File My Itr 2 Form

Steps For Filing Tax In India You Can Easily File Your Income Tax In India Filing Taxes Income Tax Tax Return

Steps For Filing Tax In India You Can Easily File Your Income Tax In India Filing Taxes Income Tax Tax Return