Business Loan Origination Fees Tax Treatment

A packaging fee works much like an origination fee in that its meant to cover various lender costs. If you take out a loan to buy commercial real estate the points and loan origination fees cannot be deducted as business expensesthey have to be.

Making Sense Of Deferred Tax Assets And Liabilities

Making Sense Of Deferred Tax Assets And Liabilities

Often these fees range from two to six percent of the loans principal.

Business loan origination fees tax treatment. Loan origination fees are tax deductible when the fees reflect the prepaid interest on a loan. Items 4 and 5 must be capitalized as costs of getting a loan and can be deducted over the period of the loan. If loans produce the banks income loan origination costs are the ordinary expenses associated with that production of income.

The following are settlement fees and closing costs you cannot include in your basis in the property. Specifically the loan costs allocable to loans repurchased for money were deductible when the loans were repurchased and the loan costs allocable to loans exchanged for new term loans were deductible upon the exchange. The IRS concluded that all of the unamortized loan costs were deductible.

For a 10000 loan two hundred to six hundred dollars in fees will. Points discount points loan origination fees b. Another type of commitment fee also referred to as a standby charge is an upfront amount paid by a borrower for the right to borrow loans over a set term.

Loan origination fees are charged at a rate of 05 to 1 of the loan value. However businesses often pay at a rate of 1 to 6. 162 as business expenses rather than under Sec.

If these costs relate to business property items 1 through 3 are deductible as business expenses. Charges connected with getting or refinancing a loan such as. Instead they should be written off as part of the gain or loss on the sale of the loan.

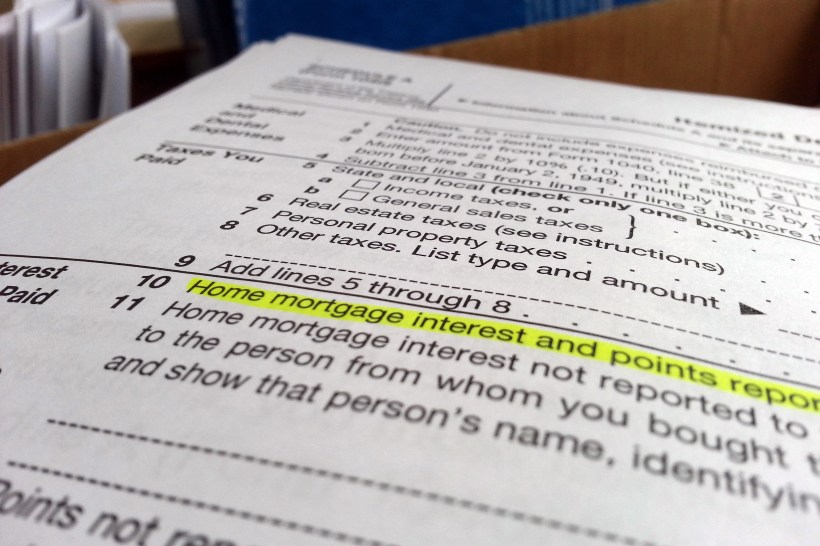

Origination fees are usually calculated as a percentage of the total loan amount with many falling in the 05 to 2 range. For example if it cost you 3000 to refinance your 30-year mortgage youd be able to deduct 100 per year for the next 30 years. Are loan origination fees tax deductible for a business With the wide variety of lending institutions available today the fees are at the discretion of the lender.

Loan origination and rebate focuses are both tax-deductible as well as interest and property taxes. Neither the Internal Revenue Service Service nor any court has ruled on this issue. Although lenders have long deducted loan origination costs without Service opposition Service Field.

If the loans are classified as held for sale the net fees and costs should not be amortized. Deferred loan origination fees and costs should be netted and presented as a component of loans. One question that commonly arises is.

Points or loan origination fees. When a loan is acquired. In the event that loan origination focuses were high yet you didnt pay other costs for example escrow account arrangement charge home appraisal and attorney fees and so forth the loan origination expense isnt tax-deductible.

Whether loan origination costs should be deducted as ordinary and necessary business expenses or capitalized over the life of the loan. However the Third Circuit also needed to overturn the Tax Courts determination that the costs were capital expenses. Additionally if the seller pays a part of the interest for you these fees are also tax deductible because you can claim a deduction for the points the seller paid.

The Advice supports a dichotomy between the federal income tax treatment for commitment fees for credit fees based on the current amount of unissued commitment and that for unused commitment fees lending fees based on the unused amount of a commitment to loan money. In both cases the IRS concluded that the commitment fees were deductible under Sec. Appraisal fees if required by the lender The costs associated with obtaining a mortgage on rental property are amortized spread out over the life of the loan.

91 requires among other things that loan origination costs be capitalized and amortized as a yield adjustment over the life of the associated loan. Lending institutions have fees and loan costs they customarily pass to commercial enterprises. This article discusses IRS guidance on the various types of fees.

Rent or other charges relating to occupancy of the property before closing. It also requires that the capitalization and amortization of loan commitment fees is a prime source of divergence between tax and financial accounting. In the case of the bank in the particular example they use the fees were deductible as a period expense for tax purposes as opposed to being amortized which is the requirement for GAAP because the banks loan marketing activities were a core activity of its day-to-day business.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs That Are And Aren T Tax Deductible Lendingtree

![]() Tax Law Provisions Changed Or Extended Https Cookco Us News Tax Law Provisions Changed Or Extended In 2020 Tax Advisor Tax Internal Revenue Service

Tax Law Provisions Changed Or Extended Https Cookco Us News Tax Law Provisions Changed Or Extended In 2020 Tax Advisor Tax Internal Revenue Service

Are Loan Origination Fees Tax Deductible For Your Business

Are Loan Origination Fees Tax Deductible For Your Business

Are Closing Costs Tax Deductible Smartasset

Are Closing Costs Tax Deductible Smartasset

Are Small Business Loans Tax Deductible A Guide To Tax Deductions

Are Small Business Loans Tax Deductible A Guide To Tax Deductions

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Tax Considerations For Direct Investments Middle Market Growth

Tax Considerations For Direct Investments Middle Market Growth

What Closing Costs Are Tax Deductible Vs Added To Basis

What Closing Costs Are Tax Deductible Vs Added To Basis

What Are Intangible Assets Henry Horne

What Are Intangible Assets Henry Horne

Is Your Business Loan Tax Deductible Camino Financial

Is Your Business Loan Tax Deductible Camino Financial

Case Presentation Percentage For Your Dental Practice Case Presentation Dental Practice Dental Practice Management

Case Presentation Percentage For Your Dental Practice Case Presentation Dental Practice Dental Practice Management

Is Your Business Loan Tax Deductible Camino Financial

Is Your Business Loan Tax Deductible Camino Financial

Irs Laws On Tax Deductible Mortgage Broker Fees

Irs Laws On Tax Deductible Mortgage Broker Fees

Is Your Business Loan Tax Deductible Camino Financial

Is Your Business Loan Tax Deductible Camino Financial

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points Deduction Itemized Deductions Houselogic

3rd Renewable Energy Expo 2009 In New Delhi India Green Electronics Energy Renewable Energy

3rd Renewable Energy Expo 2009 In New Delhi India Green Electronics Energy Renewable Energy

Pin On Martin Alvarado Lending

Pin On Martin Alvarado Lending

Full Circle Financial Planning Financial Planning Insurance Investments Investing

Full Circle Financial Planning Financial Planning Insurance Investments Investing