Do I Send 1099 To Utility Companies

Use form 1099-NEC to report payments to independent contractors. Is any foreign entity eg foreign individual foreign company etc.

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

Anyone who checks any box other than corporation needs to be sent a 1099-MISCform if you paid them 600 or.

Do i send 1099 to utility companies. Beware that a limited liability corporation LLC is not a corporation and those companies should be included in your 1099 reporting. Apr 28 2011 0511 PM The new requirement to send 1099s to virtually everyone was revoked last month so you need NOT send 1099s to the utility company. Dont use Form 1099-MISC to report payments to employees.

You will need to provide a 1099 to any vendor who is a. You should obtain a completed Substitute Form W-9 when initiating any transaction with a new vendor that could be reportable on a 1099-MISC. Use Form W-2 for all payments to employees including business travel allowances and expense reimbursements.

The primary purpose of the 1099-MISC is to report income individuals independent contractors etc receive to. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099. To e-file them through TurboTax Home Biz Windows you would need to prepare them through Quick Employer Forms QEF.

You do not have to send 1099s to corporations. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. If you are in business whether self-employed or running a company you must send a 1099 form with copies to the IRS to anyone that you pay money to unless the payments meet one or more of the.

Do not furnish a Form 1099-MISC to banks public utilities or tax exempt organizations. You are required to include the taxpayer identification number of the payee on your. An easy test is if the word Inc is in the companys name then its a corporation.

You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. Anytime that you pay someone more than 600 during the year for services which they have performed you should have that person or company fill out a W-9 form for you. 16041-3 c exempts payments for freight services from the general requirement for payors to issue Form 1099 to independent contractors and others with which they do business.

While utility bills technically count as payment when theyre rolled into your rent they dont belong on a 1099-MISC if you pay utility companies directly. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. On that form they are required to check whether they are taxed as a sole proprietor partnershipor corporation.

6 rows Items that do NOT need to be reported on Form 1099-MISC. The IRS requires businesses to send out Form 1099s to small businesses or individuals that serve as independent contractors or participate in specific transactions with the provider company. The exception to this rule is with paying attorneys.

However there are other names for corporations such as PA so if in doubt ask. Thus trucking companies need not issue Form 1099s to owner-operators. If you personally hire a vendor to do work unrelated to your company you dont have to send a 1099-MISC.

The Substitute Form W-9 is available on the. This also applies if your landlord is the one who passes along monthly utility bills to you that arrive from utility providers to allow you to pay directly. Also most corporations will not be issued a Form 1099-MISC unless they have been paid 600 or more in a calendar year for certain services including medical or legal services and including gross proceeds paid to attorneys.

Does the employer send a 1099 misc to the irs. You made the payment to someone who is not your employee. See the instructions for more details.

If the following four conditions are met you must generally report a payment as nonemployee compensation. Vendors who operate as C- or S-Corporations do not require a 1099. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

Yes employers are responsible for preparing and filing Form 1099-MISC with the IRS.

Utility Bill Generator Fill Out And Sign Printable Pdf Template Signnow

Utility Bill Generator Fill Out And Sign Printable Pdf Template Signnow

1099 B Software To Create Print And E File Form 1099 B Irs Forms Irs Tax Forms

1099 B Software To Create Print And E File Form 1099 B Irs Forms Irs Tax Forms

Utility Gas Natural Home Bill Statement Proof Of Address Connecticut New England Verification Applicat In 2021 Worksheet Template Energy Bill Credit Card App

Utility Gas Natural Home Bill Statement Proof Of Address Connecticut New England Verification Applicat In 2021 Worksheet Template Energy Bill Credit Card App

Pacific Power Bill Statement Power Bills Gas Bill

Pacific Power Bill Statement Power Bills Gas Bill

Utility Maryland Cooperative Bill Statement Electric Proof Of Address Fake Energy Gas Smeco Gas Company Doctors Note Gift Card Generator

Utility Maryland Cooperative Bill Statement Electric Proof Of Address Fake Energy Gas Smeco Gas Company Doctors Note Gift Card Generator

Usa California Pg E Electricity Utility Bill Template In Word Format Bill Template Utility Bill Electricity

Usa California Pg E Electricity Utility Bill Template In Word Format Bill Template Utility Bill Electricity

What Are Utilities Costs For The Ppp Bench Accounting

What Are Utilities Costs For The Ppp Bench Accounting

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

1099 R Software E File Tin Matching Print And Mail 1099 R Forms And Envelopes Data Is Entered Onto Windows That Resemble The Irs Forms Irs Tax Forms

1099 R Software E File Tin Matching Print And Mail 1099 R Forms And Envelopes Data Is Entered Onto Windows That Resemble The Irs Forms Irs Tax Forms

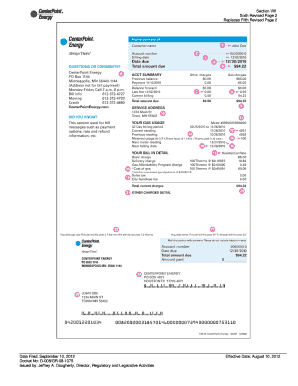

Fake Utility Bill Template Unique Centerpoint Provider Energy Electric Houston Texas Bill Template Energy Bill Gas Bill

Fake Utility Bill Template Unique Centerpoint Provider Energy Electric Houston Texas Bill Template Energy Bill Gas Bill

Fpl Florida Power Light Energy Electric Utility Statement Bill Gas Water Sanitation Credit Card App Bill Template Certificate Of Completion Template

Fpl Florida Power Light Energy Electric Utility Statement Bill Gas Water Sanitation Credit Card App Bill Template Certificate Of Completion Template

Ambit Energy Statement Ambit Energy Energy Bill Template

Ambit Energy Statement Ambit Energy Energy Bill Template

Paystubs Proof Of Income Employment Earnings Job Fake Work Verification Custom Printab Payroll Template Statement Template Resume Design Template Free

Paystubs Proof Of Income Employment Earnings Job Fake Work Verification Custom Printab Payroll Template Statement Template Resume Design Template Free

Utility Bill Template Fill Online Printable Fillable Blank Pdffiller

Utility Bill Template Fill Online Printable Fillable Blank Pdffiller

Usa California Socal Gas Utility Bill Template In Word Format Bill Template Utility Bill Rental Agreement Templates

Usa California Socal Gas Utility Bill Template In Word Format Bill Template Utility Bill Rental Agreement Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Canada Maritime Electric Utility Bill Template In Word Format Bill Template Utility Bill Templates

Canada Maritime Electric Utility Bill Template In Word Format Bill Template Utility Bill Templates