Florida Business Tax Registration Dr-1

An employer is liable to pay reemployment tax if it meets any of the. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Https Floridarevenue Com Forms Library Current Gt800020 Pdf

Questions in bold print.

Florida business tax registration dr-1. 3 Oversee property tax administration involving 109. If you hold an active certificate of registration or reemployment tax account issued by the Department because you previously submitted a Florida Business Tax Application Form DR-1 use the Application for Registered Businesses to Add a New Florida Location Form DR-1A to register. Florida Business Tax Application.

This gives businesses the right to operate inside the county. City business tax Some city governments also require their own local business tax. Every applicant must complete Sections A and K and must answer the questions in bold print at the beginning of every section and subsection.

Every applicant must complete Sections A and K and must answer the. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. 0115 You must complete and submit Form DR-1 to register to collect accrue report and pay the taxes surcharges and fees listed below if you engage in any of the activities listed beneath each tax or fee.

There is no fee to register your business for reemployment tax purposes. This application will be rejected if the required information is not provided. County business tax Most county tax collectors require businesses to pay local business tax occupational license.

Determine if You Need to Register Your Business in Florida. We last updated the Florida Business Tax Application R0115 in April 2021 so this is the latest version of Form DR-1 fully updated for tax year 2020. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

Start a Business Step 1. The Florida Business Tax Application online or paper Form DR-1 asks you to answer a series of questions about your business that will assist you in identifying your tax responsibilities and to register to collect report and pay the following Florida taxes and fees. Once you have determined your formal business structure and registered your new business name you will want to check with your state to determine the business registration requirementsEach state has its own set of guidelines and you must follow them precisely.

3 Oversee property tax administration involving 109. Instructions for Completing the Florida Business Tax Application Form DR-1N. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

This application will be rejected if the required information is not provided. Florida Business Tax Application Please read the Instructions for Completing the Florida Business Tax Application Form DR-1N. Research Starting a Business.

Communications services tax Rental car surcharge Documentary stamp tax Reemployment. New users must create a user profile with a username and password to begin or complete the registration application. Decide on a Corporate Structure.

You can also register by completing and submitting a paper Florida Business Tax Application Form DR-1. The Department recommends that employers register to pay reemployment tax using the online Florida Business Tax Application or complete and submit a paper Florida Business Tax Application Form DR-1. For returning users enter your user profile credentials to log in and begin or complete the Florida Business Tax Registration application.

The paper form contains sections to register your business for a variety of state taxes. Instructions for Completing the Florida Business Tax Application Page 2 of 9 Tax and Taxable Activity Descriptions DR-1N R. Please read the.

Blank forms are available for download from the Forms and Publications section of the DOR website. You can register using the online registration system or submit a paper Florida Business Tax Application. Form a Profit or Non-Profit Corporation.

This application will be rejected if the required information is not provided. Profit Articles of Incorporation Non-Profit Articles of Incorporation. Every applicant must complete Sections A and J and must answer the questions in bold print at the beginning of every section and subsection.

Visit your Taxpayer Service Center. For more information see Registering Your Business Form DR-1N or visit the Departments Taxpayer Education webpage Learn More with Guides and Tax Tutorials. You can print other.

Instructions for Completing the Florida Business Tax Application Page 2 of 9 Tax and Taxable Activity Descriptions DR-1N R. Florida Business Tax Application Please read the Instructions for Completing the Florida Business Tax Application Form DR-1N. At the beginning of every section and subsection.

Register to collect or remit taxes online. If you do not have a username and password select the Create User Profile button below. 1013 You must complete and submit Form DR-1 to register to collect accrue report and pay the taxes surcharges and fees listed below if you engage in any of the activities listed beneath each tax or fee.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Contact yours for more information More local resources. Getting Started with a Florida Business.

Registration applications you may need instead of the Florida Business Tax Application. A new business must report its initial employment in the month following the calendar quarter in which employment begins. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Identify Your Type of Business. You can download or print current or past-year PDFs of Form DR-1 directly from TaxFormFinder. To register on paper use Form DR-1 Florida Business Tax Application.

List of Florida county tax collectors.

Business Partner Number Fill Online Printable Fillable Blank Pdffiller

Business Partner Number Fill Online Printable Fillable Blank Pdffiller

Https Floridarevenue Com Rules Pdf Dr1 Pdf

Https Floridarevenue Com Rules Pdf Dr1n Pdf

How To Register For A Sales Tax Permit In Floridataxjar Blog

How To Register For A Sales Tax Permit In Floridataxjar Blog

Https Floridarevenue Com Taxes Documents Flprintsutresalecert Pdf

How To Report Florida Sales Tax Xendoo

How To Report Florida Sales Tax Xendoo

Https Floridarevenue Com Forms Library Current Dr1c Pdf

Https Floridarevenue Com Forms Library Current Gt800053 Pdf

Https Floridarevenue Com Forms Library Current Gt800016 Pdf

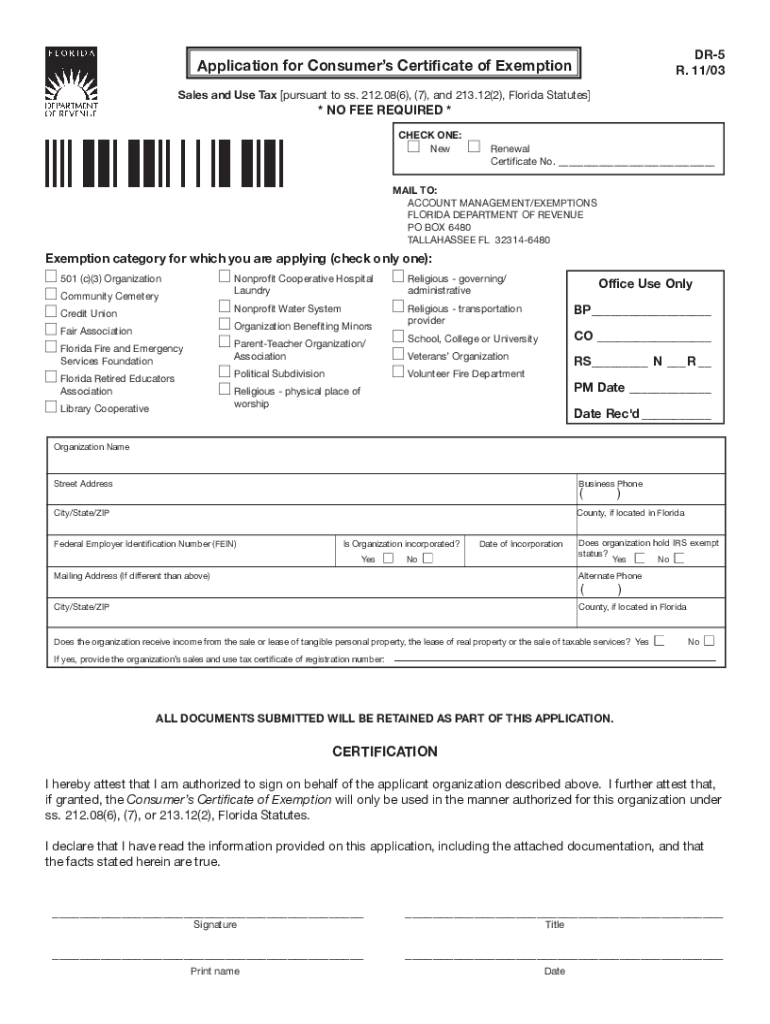

2003 Form Fl Dor Dr 5 Fill Online Printable Fillable Blank Pdffiller

2003 Form Fl Dor Dr 5 Fill Online Printable Fillable Blank Pdffiller

How To File And Pay Sales Tax In Florida Taxvalet

How To File And Pay Sales Tax In Florida Taxvalet

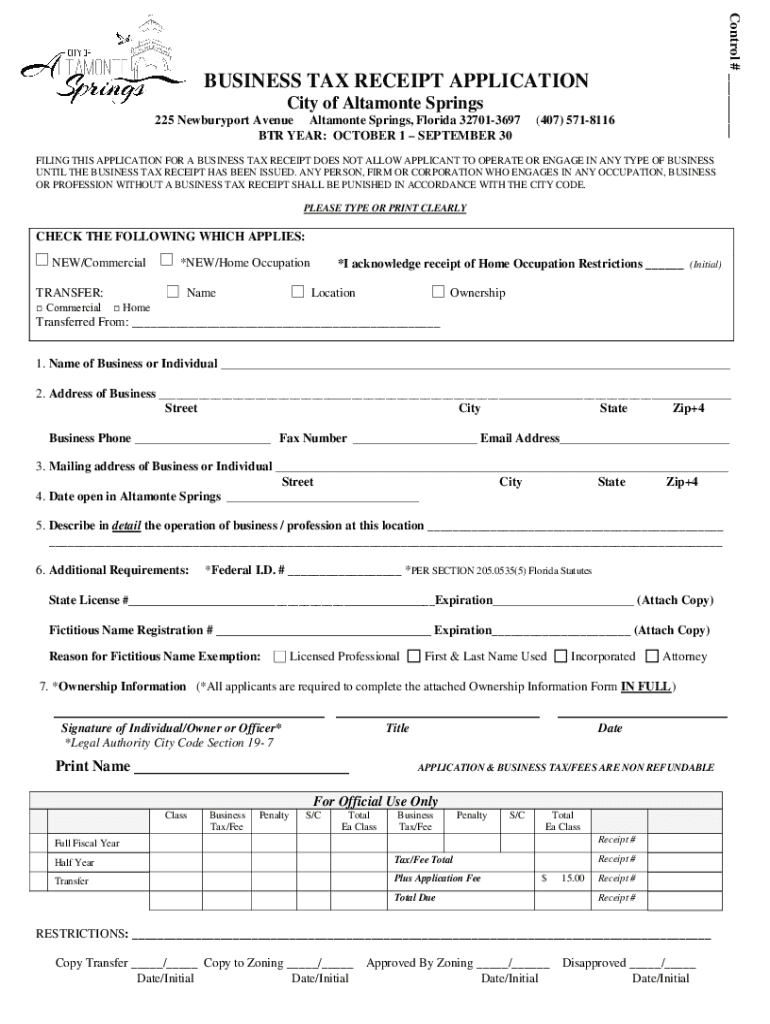

Fl Business Tax Receipt Application Fill Out Tax Template Online Us Legal Forms

Fl Business Tax Receipt Application Fill Out Tax Template Online Us Legal Forms

Register For Sales Use Tax Permits In Every State Harbor Compliance

Register For Sales Use Tax Permits In Every State Harbor Compliance

How To File And Pay Sales Tax In Florida Taxvalet

How To File And Pay Sales Tax In Florida Taxvalet

Https Floridarevenue Com Forms Library Current Gt800009 Pdf

Florida Business Partner Number Fill Online Printable Fillable Blank Pdffiller

Florida Business Partner Number Fill Online Printable Fillable Blank Pdffiller

Https Floridarevenue Com Taxes Documents Overlooked Taxes Pdf

Https Www Multi Fab Com Sites Default Files 2019 06 Fl Resale Certificate Application Pdf

Https Floridarevenue Com Forms Library Current Gt800006 Pdf