Gst Form For Small Business

With this method the money flowing through your business is more closely connected with good and services tax liabilities so it makes it easier to manage cash flow. However if you voluntarily register you may be reimbursed for GST that you pay out for business expenses.

Export Invoice Gst Invoicing Software Invoice Format In Excel Invoice Design

Export Invoice Gst Invoicing Software Invoice Format In Excel Invoice Design

Attend our GST webinar to help you to understand GST and its implications for business.

Gst form for small business. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. Annual GST Return Filing Each business will have to file an annual return known as GSTR 9. GST Return form for small business owners Yes all small business owners have to submit GST returns.

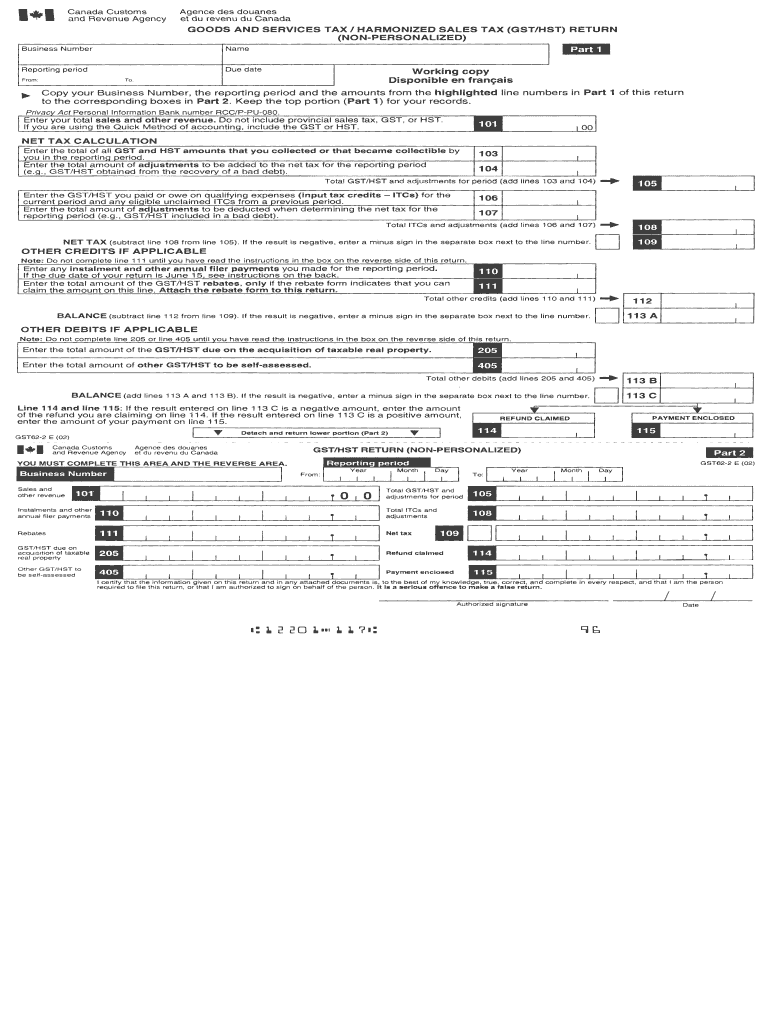

Under the presumptive income scheme small businesses need to file the simplified return form called ITR-4 Sugam. Most Canadian businesses must register to collect and pay the goods and services tax GST and harmonized sales tax HST on eligible itemsIf you are operating a Canadian business and registered for the GSTHST you can get back the GSTHST youve paid out during a particular reporting period by claiming it through input tax credits ITCs on your GSTHST return. GST10 Application or Revocation of the Authorization to File Separate GSTHST Returns and Rebate Application for Branches or Divisions.

You can also register for GST via the Business Portal on the ATO website or HR Block can help you register. Register for change or close a GSTHST account. Well notify you in writing of your GST registration details including the date your registration is effective and your ABN details if.

This will be on top of the monthly returns and is to be filed by 31 st December of the next financial year. Open or manage an account. According to the Indian govt GST rules small businesses can file their returns online through Forms ITR-3 or ITR-4.

Form GST189 General Application for Rebate of GSTHST reason code 23 Rebate application for the Ontario First Nations point-of-sale relief and credited by a supplier If you are a builder who is required to complete Schedule A line 111 will automatically be calculated based on the information that you entered on Schedule A. If you are a recently self-employed Canadian or you are thinking about starting your own businessadding extra income with a side gig you may be curious about what the tax requirements and implications would be. You can order a form using our online publication ordering service External Link.

Instead they can pay the entire amount in one go by the 31st March of the relevant fiscal year. By completing the Add a new business account NAT 2954 form. Determine which rate to charge manage receipts and invoices and learn what to do with the tax you collect.

Also small business does not require to pay Advance Tax four times a year. The small businesses which are new to this provision are in a state of confusion and are developing a lot of myths about the e-Invoicing system. To get a non-personalized version of the paper return Form GST62 use.

But if you have the choice that doesnt necessarily mean you should avoid collecting GST. When to register for and start charging the GSTHST. To get a new access code for GSTHST NETFILE or GSTHST TELEFILE go to GSTHST Access Code Online.

GST17 Election Concerning the Provision of a Residence or Lodging at a Remote Work Site. Charge and collect the tax. To request a new GST34-2 or GST34-3 call the Business Enquiries phone line at 1-800-959-5525.

Register for goods and services tax GST Goods and services tax GST is a tax of 10 on most goods services and other items sold or consumed in Australia. Business tax tips GST for small business. The importance of using accounting programs.

The offline or manual filling is only allowed for certain taxpayers. Businesses generating less than 75000 of income per year are exempt from charging GST. Find out if you have to register and start charging the GSTHST.

Aside from the extra info youll include on your tax return you might also be required to register for a GSTHST account and become a GSTHST Registrant. Visit the GST portal and click ServicesRegistrationNew Registration. There has been a sharp rise in the e-Invoicing mandated businesses wef April 1 st 2021 after the government decided to lower the aggregate turnover slab to 5 Cr to be eligible for e-Invoicing under GST.

The ABR is the central registry of Australian business information so as well as getting an ABN and registering for GST you can get a business tax file number TFN apply for pay-as-you-go PAYG withholding and register your business name. How To Register For GST. Enter all the details such as PAN email address phone number.

Composite Taxpayer and GST Filing. There are 4 parts involved in the registration process for GST which we will share here. Should you be charging GST.

Most small businesses use the cash accounting method for GST. Election and application forms available to all businesses or individuals. If your business is registered for GST you have to collect this extra money one-eleventh of the sale price from your customers.

Home GST for small business. Generating GST Application Form. Registering for GST is mandatory for all small businesses with gross annual revenue greater than 30000 unless your product or service is exempt.

Ingrid Thompson - April 7 2010 2 MIN READ. You pay this to the Australian Taxation Office ATO when.

Australian Gst Invoice Template Intended For Sample Tax Invoice Template Australia 10 Professiona Invoice Template Invoice Template Word Price List Template

Australian Gst Invoice Template Intended For Sample Tax Invoice Template Australia 10 Professiona Invoice Template Invoice Template Word Price List Template

Gst Purchase Bill And Proper Format In India Sag Infotech Invoice Format Bills Printing Companies

Gst Purchase Bill And Proper Format In India Sag Infotech Invoice Format Bills Printing Companies

Tax Hst Gst Form Fill Online Printable Fillable Blank Pdffiller

Tax Hst Gst Form Fill Online Printable Fillable Blank Pdffiller

Tax Invoice Template Templates Free Word Excel Gst Bill Format Receipt Sample Payment Templat Invoice Template Invoice Template Word Vector Business Card

Tax Invoice Template Templates Free Word Excel Gst Bill Format Receipt Sample Payment Templat Invoice Template Invoice Template Word Vector Business Card

Gst Is The Single Indirect Tax That Is Levied On The Supply Of Goods And Services Between Different Entit Indirect Tax Goods And Service Tax Goods And Services

Gst Is The Single Indirect Tax That Is Levied On The Supply Of Goods And Services Between Different Entit Indirect Tax Goods And Service Tax Goods And Services

Simple Gst Invoice Format In Pdf1 Simple Invoice Template Word Details Of Simple Invoice Template Wor Invoice Format Invoice Template Word Invoice Template

Simple Gst Invoice Format In Pdf1 Simple Invoice Template Word Details Of Simple Invoice Template Wor Invoice Format Invoice Template Word Invoice Template

Gst Invoice Format Invoice Template Word Invoice Template Invoice Format

Gst Invoice Format Invoice Template Word Invoice Template Invoice Format

Consent Letter Format For Gst Registration In Word In 2021 Consent Letter Consent Letter Format Consent Letter Sample

Consent Letter Format For Gst Registration In Word In 2021 Consent Letter Consent Letter Format Consent Letter Sample

Abn Invoice Template Free Australian Gst Invoice Template Invoice Without Abn Invoice Template Invoicing Templates

Abn Invoice Template Free Australian Gst Invoice Template Invoice Without Abn Invoice Template Invoicing Templates

Invoice Format For Contractors Gst Labour Contractor Cis In Cis Invoice Template Subcontractor 10 Profes Invoice Template Invoice Format Letterhead Template

Invoice Format For Contractors Gst Labour Contractor Cis In Cis Invoice Template Subcontractor 10 Profes Invoice Template Invoice Format Letterhead Template

Gold Jewellery Invoice Template Meltemplates Jewelry Receipt Throughout Jewelry Invoice Template 10 Invoice Format In Excel Invoice Format Invoice Template

Gold Jewellery Invoice Template Meltemplates Jewelry Receipt Throughout Jewelry Invoice Template 10 Invoice Format In Excel Invoice Format Invoice Template

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format In Excel Invoice Format Invoice Template

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format In Excel Invoice Format Invoice Template

44 Tax And Non Tax Invoice Templates Invoices Ready Made Office Templates Invoice Template Invoice Design Invoice Sample

44 Tax And Non Tax Invoice Templates Invoices Ready Made Office Templates Invoice Template Invoice Design Invoice Sample

Fake Medical Bills Format Unique Image Result For Simple Gst Invoice Format In Excel Invoice Format In Excel Invoice Format Invoice Template Word

Fake Medical Bills Format Unique Image Result For Simple Gst Invoice Format In Excel Invoice Format In Excel Invoice Format Invoice Template Word

Sample Of Invoice Register Example Not Registered For Gst Download For Invoice Register Template 10 Profes Invoice Template Templates Professional Templates

Sample Of Invoice Register Example Not Registered For Gst Download For Invoice Register Template 10 Profes Invoice Template Templates Professional Templates

Australian Gst Invoice Template With Sample Tax Invoice Template Australia 10 Professional Templates Ideas Invoice Template Business Template Create Invoice

Australian Gst Invoice Template With Sample Tax Invoice Template Australia 10 Professional Templates Ideas Invoice Template Business Template Create Invoice

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

Simple Order Form Template Word An Efficient Way To Collect Orders Jotforms Free Order Form Templates Are Order Form Template Order Form Words

Simple Order Form Template Word An Efficient Way To Collect Orders Jotforms Free Order Form Templates Are Order Form Template Order Form Words

Tax Invoice Template Australia Rent Excel Gst Format In Word Free Throughout Sample Tax Invoice Template Australia 10 P Invoice Template Word Free Templates

Tax Invoice Template Australia Rent Excel Gst Format In Word Free Throughout Sample Tax Invoice Template Australia 10 P Invoice Template Word Free Templates