How To Register A Company On Sars

Your tax registration numbers. The registration number 5.

How To Get Your Proof Of Tax Registration Letter Sars Efiling Method Youtube

How To Get Your Proof Of Tax Registration Letter Sars Efiling Method Youtube

For the owners of private companies registering a new company through the CIPC website often leads to automatic SARS registration.

How to register a company on sars. 2 Activate your TCS service You only need to activate your Tax Compliance Status once and it will remain active. To create a Florida limited liability company LLC OR correct your rejected online filing. Should you need to register for tax manually with SARS you should use Form IT77C.

Alternatively you can do this via MobiApp which can be downloaded on the Play Store or App Store. Form a Profit or Non-Profit Corporation. Or see SARS COVID-19 news items and tax relief measures here.

The SARS tax number 4. Then click on Company Registrations button and from the options that are given choose Register a New Company. Identify Your Type of Business.

Name of the company 2. To complete the registration process you will need at hand. You can register once for all different tax types using the client information system.

Proof of bank details. If you register your company in this way you will shortly receive an email from SARS informing you of your new company tax number. Then a SARS eFiling registration form will open up wherein you will need to input your personal information to authenticate your claim.

Change of name address or when no longer operating as an employer etc. Review the instructions for filing the Articles of Organization. EFilers will register as Please select and click on the appropriate option below.

Start a Business Step 1. SARS has now created a shared platform. VAT vendors can also request and obtain a VAT Notice of Registration on eFiling.

The companys banking details 6. Login to SARS eFiling 3. The address and contact number 3.

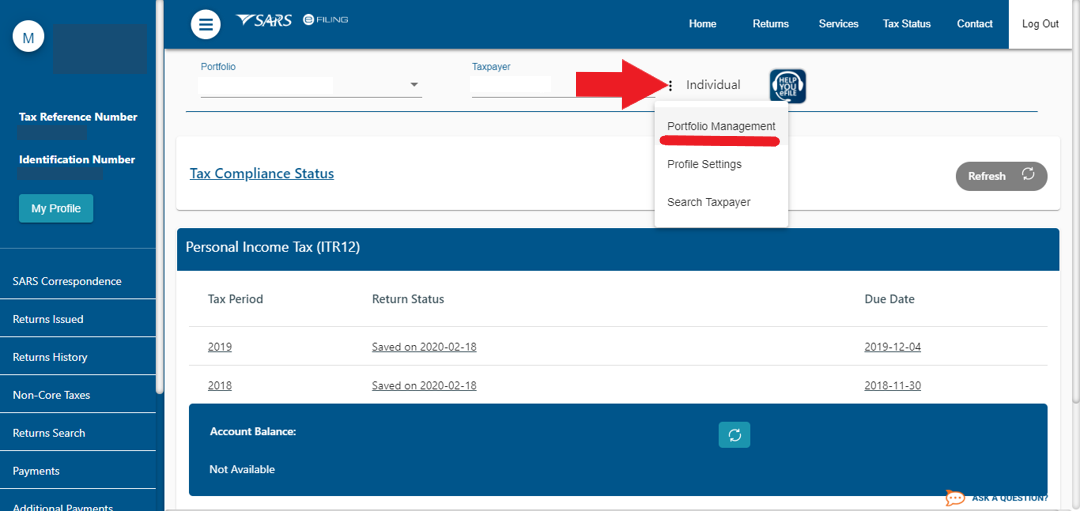

You can then add an organisation to your profile. If you already have an efiling profile it should be easier to just add the company to your. On the Individual portfolio select Home to find the SARS Registered Details functionality On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the Organisations menu tab 3.

You need to be registered for eFiling and have one tax type activated on your eFiling profile in order to activate the TCS service. Follow these easy steps. If you are not yet an eFiler register at wwwsarsefilingcoza.

You will need the following. Beware of scams pretending to be from SARS. The efiling profile must be created for an individual.

To set up a new eFiling profile for a company you will need to ensure that you have all your valid documents ready to use during the process. See our latest list of scams here. File or Correct Florida LLC Articles of Organization.

A company can be registered using Form IT77C. Once youre on the site simply click Register Now to get started. Form IT77 for individuals has been discontinued and the only way to register as an individual is to visit a SARS branch where you will be registered on the system.

For CIPC registered companies you are not required to perform a separate SARS tax registration for Income Tax as your company will automatically be registered via a direct interface with CIPC. Clicking on the Maintain Registered particulars on eFiling. All you need is internet access.

Gather all information required to complete the form. Select Notice of Registration 6. The easiest way to register with SARS is to visit the eFiling website.

An individual if they are operating in their personal capacity. Input the identification number of the companys director. Visit the national COVID-19 Online Resource and News Portal at wwwsacoronaviruscoza.

To register as a branch separately from the main branch an EMP102e form Payroll Taxes Application for Branch Registration must be filled in and sent to SARS. Click SARS Registered details on the side menu 5. You can verify and update the RAV01 details by.

Change of registered details An employer must let SARS know within 21 business days of any changes in registered particulars eg. Research Starting a Business. Have a valid form of payment.

Navigate to SARS Registered Details functionality. Once youre registered SARS will automatically issue you with a tax reference number. Profit Articles of Incorporation Non-Profit Articles of Incorporation.

Decide on a Corporate Structure. Dont click on any links please send it to phishingsarsgovza. You must register within 60 days of first receiving an income.

Go to the Organizations main menu 4. Getting Started with a Florida Business. Before completing your ITR14 make sure that that the contact address banking and public officer details of the company are correct by verifying and updating it if required on the Registration Amendments and Verification Form RAV01.

You will also provide your identification number as well as your cell phone number before clicking on Register. So click on Customer Login at the left side of your computer screen. The Florida Department of State is committed to our customers and we are implementing critical investments to our systems and processes which will improve efficiency and.

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling

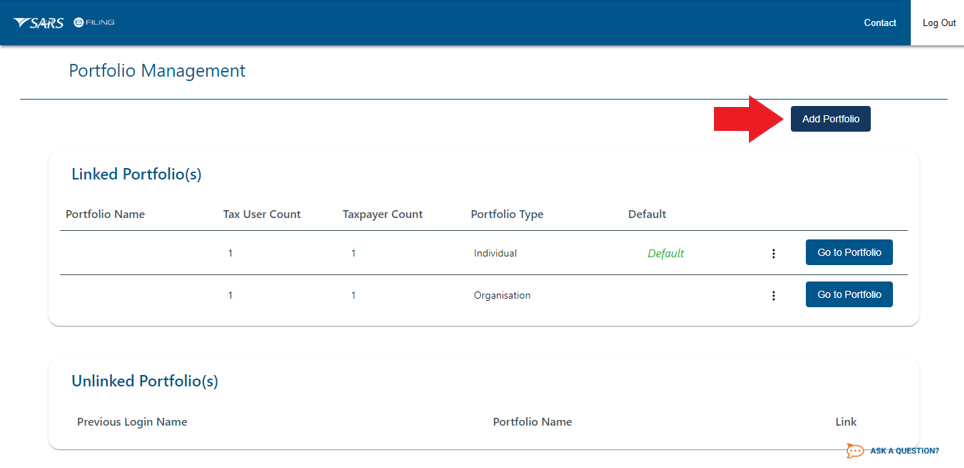

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

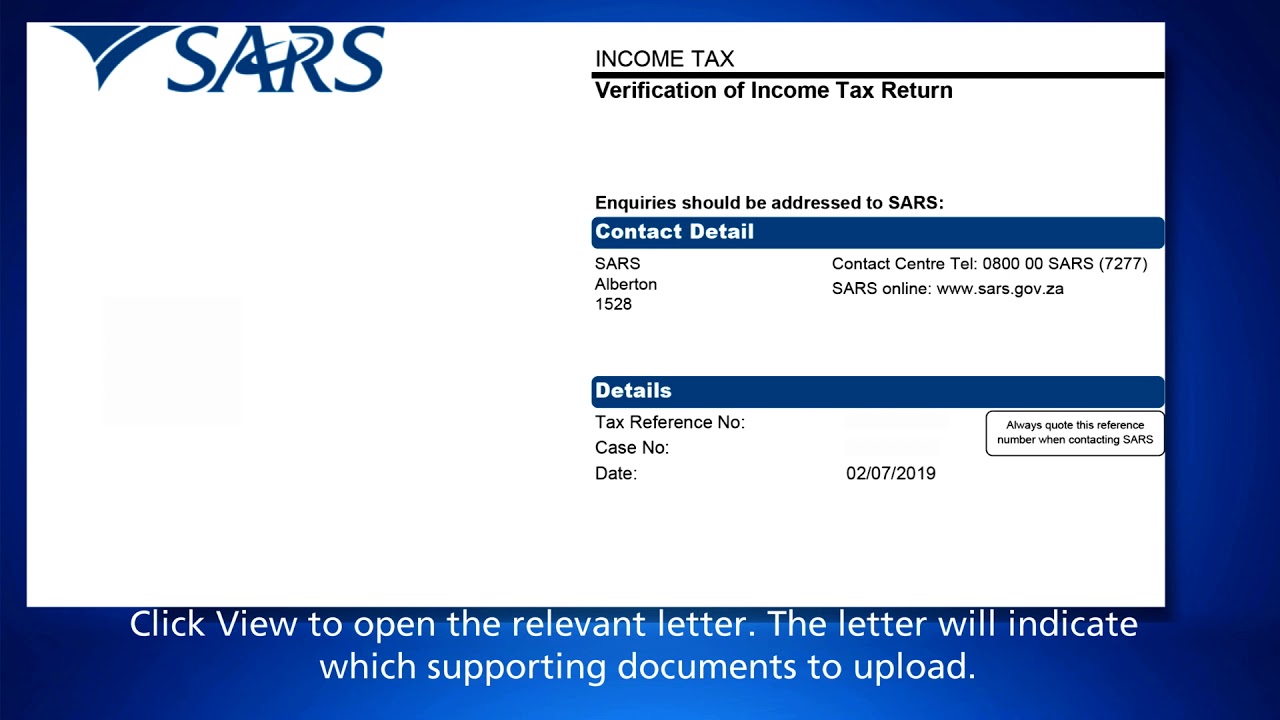

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Documents Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register For Vat On Efiling

How To Register For Vat On Efiling

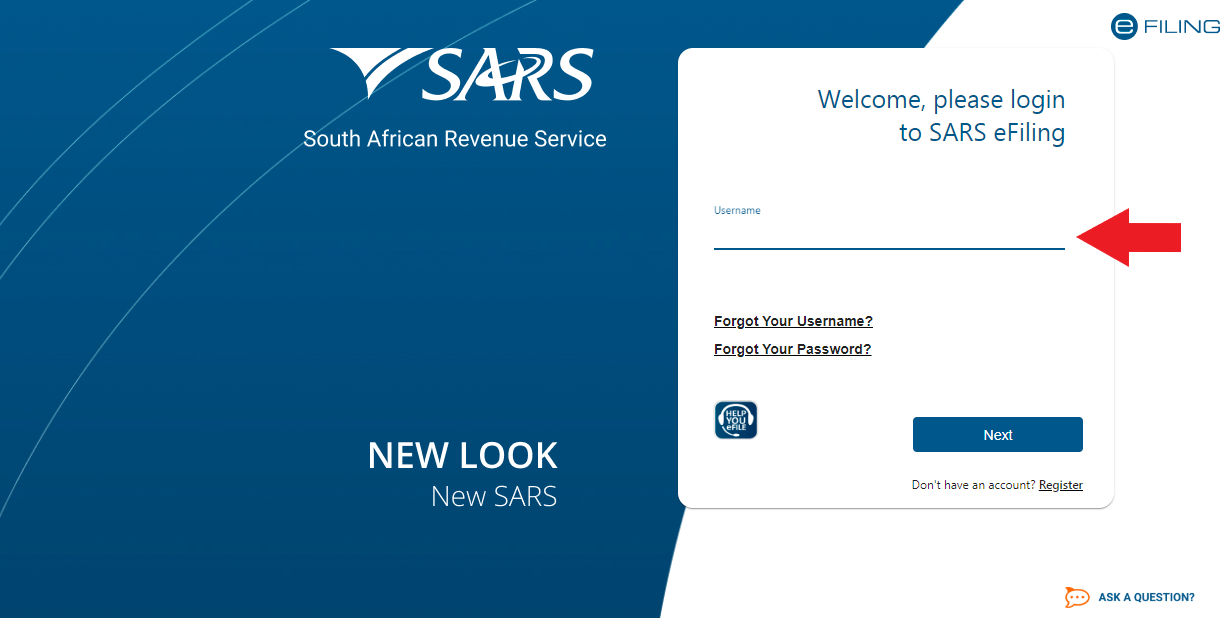

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Adding Clients To An Efiling Profile

Adding Clients To An Efiling Profile

How To Register For Sars Efiling Taxtim Sa

How To Register For Sars Efiling Taxtim Sa

How To Register For Paye On Efiling

How To Register For Paye On Efiling

How To Update Your Sars Registered Details On Sars Efiling Youtube

How To Update Your Sars Registered Details On Sars Efiling Youtube

Register On Sars Efiling Business Tax Types Youtube

Register On Sars Efiling Business Tax Types Youtube

How To Authorise A Tax Practitioner To Do Your Sa Taxes

How To Authorise A Tax Practitioner To Do Your Sa Taxes

How To Register For Sars Efiling Youtube

How To Register For Sars Efiling Youtube