How To Fill Financial Particulars Of Business In Itr 4

In case of any doubt. This form needs to be filled by business enterprises only if their turnover is below Rs.

Download Employment Application Form Download Z83 Form Application For Employm Meeting Agenda Template Job Application Letter Sample Printable Job Applications

Download Employment Application Form Download Z83 Form Application For Employm Meeting Agenda Template Job Application Letter Sample Printable Job Applications

Part A General Information.

How to fill financial particulars of business in itr 4. All other forms are available offline. On Income Tax Return Page. ITR 4 Indian Income Tax Return for Individuals and HUFs.

The Income Tax Return ITR that most people refer to is actually the annual tax form that individuals file every April 15th of the following year. Schedule IT of Income Tax Return Form ITR 4 Part 21 is for providing details regarding the payment Advance Tax during the year and self-assessment tax paid at the end of the period. Part A has 5 sections and Part B has 35 Schedules.

Hi I am filing ITR 4 presumptive income as I did some transactions in f and o. In case of any doubt please refer to relevant provisions of the Income-tax Act. This Schedule requires the assessee to fill the information given on the payment challan such as BSR Code Serial Number of Challan date of payment amount etc.

I take it that I can show zero 0 against these columns while filling up. Instructions for filling out FORM ITR-3 for AY. Provide information about the ITR- Original Revised income tax return.

If the turnover of the business or profession under 2 crores ITR Form 4 comes into play. However only three forms out of the seven have been uploaded online for individuals to file their returns. With the new Tax Reform Laws TRAIN there are now 3 types of forms available for you to file your annual ITR.

Instructions for filling ITR-4 SUGAM AY. In case of any doubt please refer to relevant provisions of the Income-tax Act 1961 and the Income-tax Rules 1962. The three forms that are available online are ITR-1 ITR-2 and ITR-4.

You all must b. You can download the Form 4 SUGAM from the official website of the Income Tax department. ITR 4 is the form used by the individuals and Hindu Undivided Family having income from proprietary business or profession to declare their Income Tax Return.

Click on Income Tax Return Option under e-File menu STEP 5. There are no charges on the download of Form 4. This form summarizes all of the income or loss you have incurred for the past year.

5 Select Submission Mode as prepare and submit online. This video explains how a small businessman can prepare his own balance sheet in very easy and simple manner with the help of an excel format. 1 2 Your PAN will be auto-populated Select Assessment Year 3 4 Select ITR form Name as ITR-4 Select Filing Type as applicable.

It would be great help for me if. There is no business for me do I need to fill cash in hand and other particulars. How to fill ITR 4 Sugam Form.

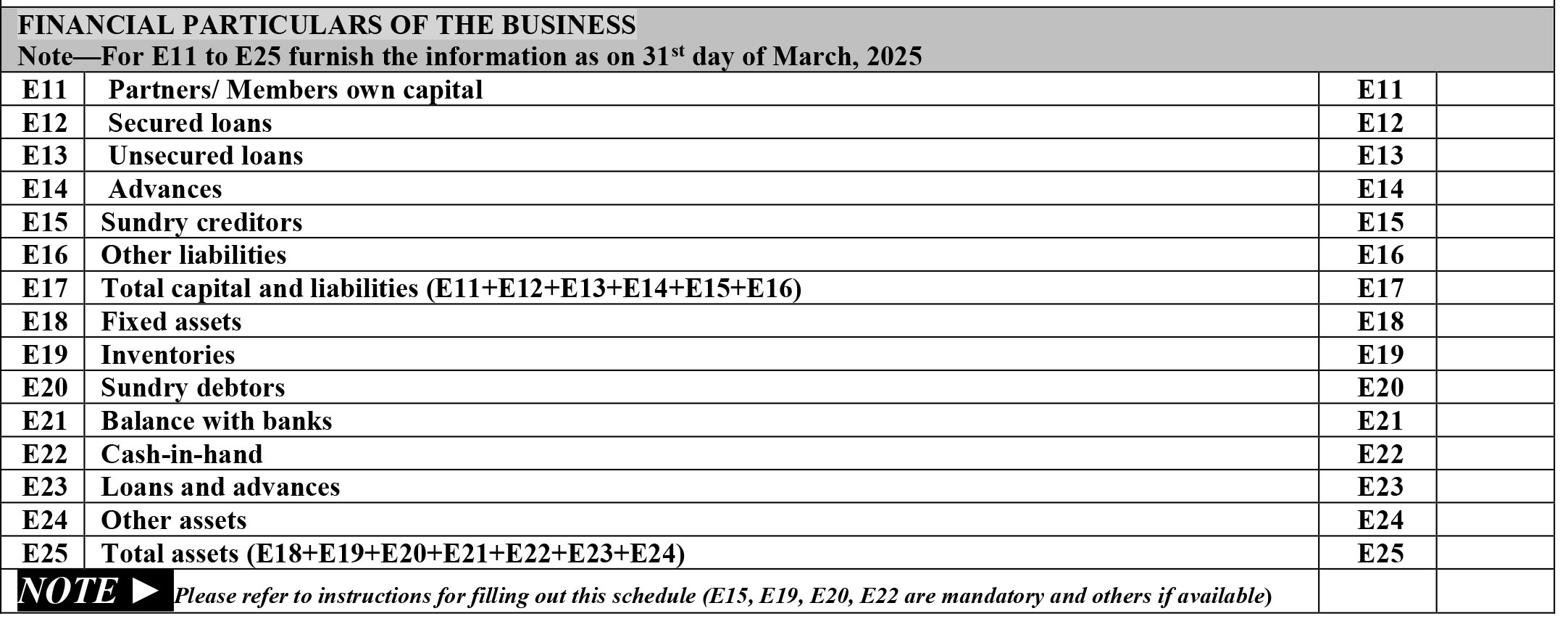

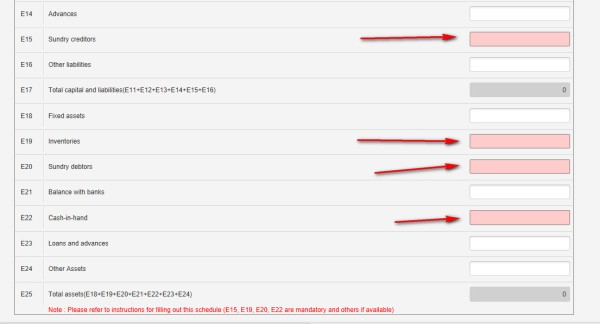

Nature of filing the ITR. In the Instructions for filling up ITR 4S the financial particulars which comes under Schedule BP Columns E-11 to E-25 it has been stated that Columns E-15 Sundry creditors E-19 Inventories E-20 Sundry debtors E-22 Cash-in-hand are mandatory. If the turnover of the business or profession under 2 crore ITR Form 4S who opted under the scheme as per Section 44AD and Section 44AE is on the driving seat.

Instructions for filling out FORM ITR -2 These instructions are guidelines for filling the particulars in this Return Form. ITR 4 form has two parts Part A and Part B. Instructions for filling ITR-4 SUGAM.

CBDT started jhatpat filing processing for ITR-1 and ITR-4. The seven different ITR forms that have been issued by the CBDT are ITR-1 ITRITR-2 ITR-3 ITR-4 ITR-5 ITR-6 and ITR-7. Latest Update in Form ITR 4.

In case of any doubt please refer to relevant provisions of the Income-tax Act 1961 and the Income-tax Rules 1962. These instructions are guidelines for filling the particulars in Income-tax Return Form-3 for the Assessment Year 2019-20 relating to the Financial Year 2018-19. The ITR-4S return form has been discontinued from FY 2016-17 AY 2017-18.

If the turnover of the aforementioned business becomes more than Rs 2 crores then the taxpayer cant file ITR-4. General Instructions These instructions are guidelines to help the taxpayers for filling the particulars in Income-tax Return Form-4 for the Assessment Year 2020-21 relating to the Financial Year 2019-20. Structures of ITR 4 Form.

You can fill the form online and submit the same using a. Basic Personal Information such as name PAN date of birth address taxpayer status and nature of employment. Instruction sheets for filling the particulars in Form IT Return 4 for the FY 2019-20.

The ITR 4 Sugam is divided into the following parts and schedules. Assessment Year for which this Return Form is applicable. 2019-20 General Instructions These instructions are guidelines to help the taxpayers for filling the particulars in Income-tax Return Form-4 for the Assessment Year 2019-20 relating to the Financial Year 2018-19.

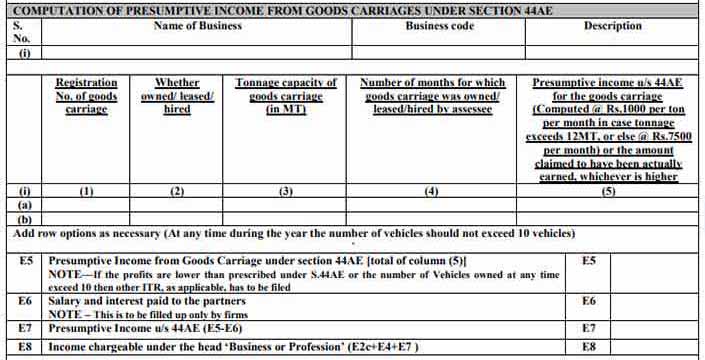

The ITR-4 Form is the Income Tax Return form for those taxpayers who have opted for the presumptive income scheme as per Section 44AD Section 44ADA and Section 44AE of the Income Tax Act.

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

How To Fill Form 26qc Online Challan Cum Statement Tds U S194ib

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form Filling How To Download And Fill Itr 4 Form Online

Itr 4 Form Filling How To Download And Fill Itr 4 Form Online

Balance Sheet For Itr 4 Ay 2018 19 How To Prepare Balance Sheet Youtube

Balance Sheet For Itr 4 Ay 2018 19 How To Prepare Balance Sheet Youtube

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

Step By Step Guide To File Itr 4 Form Online For Ay 2020 21

How To File Income Tax Return Itr 4 Ay 2020 21businessman Itr 4 Fy 2019 20 Ay 2020 21 Live Filing Youtube

How To File Income Tax Return Itr 4 Ay 2020 21businessman Itr 4 Fy 2019 20 Ay 2020 21 Live Filing Youtube

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation Balance Sheet Accounting Balance

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation Balance Sheet Accounting Balance

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Financial Particulars Of The Business In Itr4 Income Tax

Financial Particulars Of The Business In Itr4 Income Tax

How To File Itr 4 For Assessment Year 2020 2021 Edutaxtuber

How To File Itr 4 For Assessment Year 2020 2021 Edutaxtuber

Infografia Como Hacer Un Levantamiento Topografico Map Map Screenshot

Infografia Como Hacer Un Levantamiento Topografico Map Map Screenshot

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Image Result For Salary Slip Format For 25000 Per Month Salary Payment Slip

Image Result For Salary Slip Format For 25000 Per Month Salary Payment Slip

Itr 4 Presumptive Income Mandatory Changes Taxation Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Itr 4 Sugam Who Can File Who Cannot File Itr 4 How To File Itr 4

Itr 4 Sugam Who Can File Who Cannot File Itr 4 How To File Itr 4

How To Fill Financial Particulars Of Business In Itr Itr 4 Ay 2018 19 Youtube

How To Fill Financial Particulars Of Business In Itr Itr 4 Ay 2018 19 Youtube

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win

Itr 4 Form For Income Tax Return Filing Ay 2020 21 Updated Tax2win