Do Corporations Get 1099-div

Distributions arent generally income to you as the shareholder and they are not deducted as an expense just like dividends arent deductible. Sole proprietors partnerships and unincorporated contractors do.

Irs Approved 1099 B Tax Forms A Broker Is Any Person Who In The Ordinary Course Of A Trade Or Business Stands Ready To Effect S Tax Forms Irs Tax Preparation

Irs Approved 1099 B Tax Forms A Broker Is Any Person Who In The Ordinary Course Of A Trade Or Business Stands Ready To Effect S Tax Forms Irs Tax Preparation

Certain distributions commonly referred to as dividends.

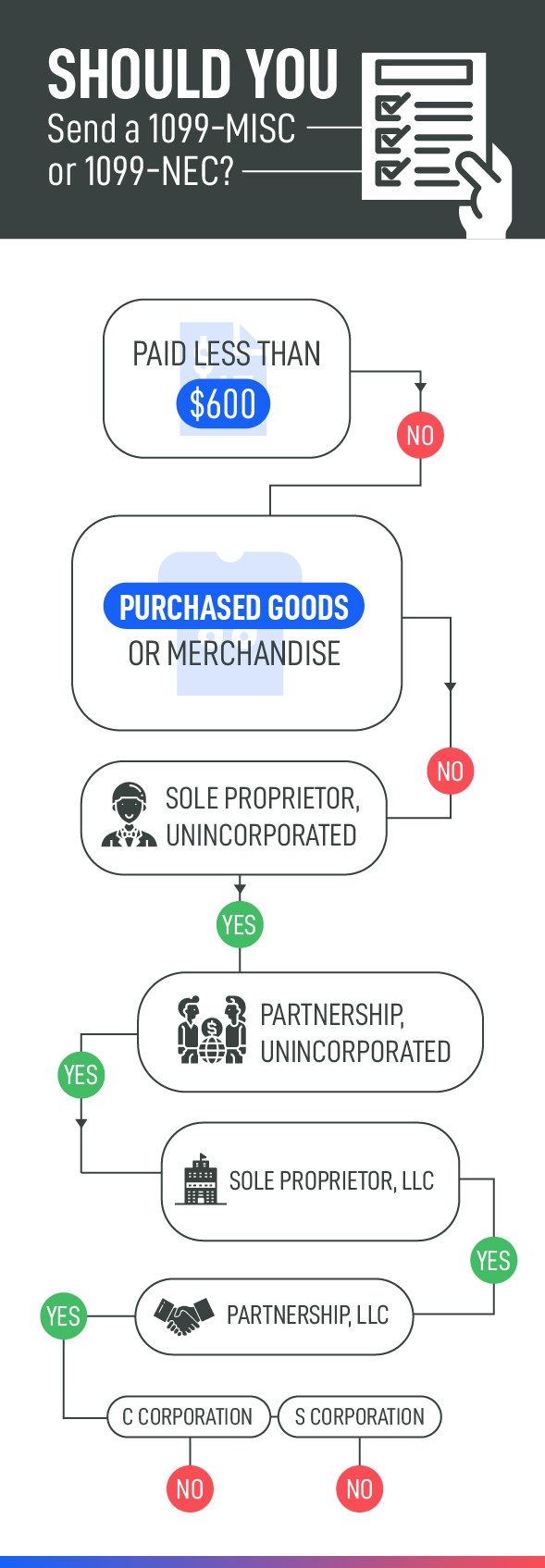

Do corporations get 1099-div. If you earned more than 10 in dividends from a company or other entity youll receive a 1099-DIV. Possession or registered securities or commodities dealer. An easy way to remember the IRS rule is that corporations do not receive 1099 forms regardless of whether they are S or C corporations.

Form 1099-DIV is used to report dividends and certain other distributions to investorstaxpayers. These accounts never generate a 1099-DIV. S-Corp Distribution and 1099-DIV.

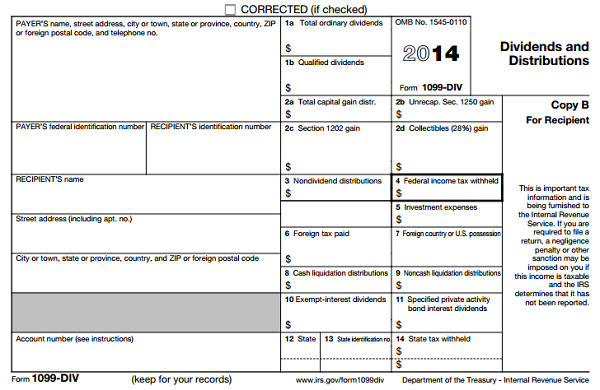

Form 1099-DIV is used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. A 1099-DIV tax form is a record that a company or other entity paid you dividends. Exempt registrations such as corporations money purchase pension plans profit-sharing plans certain types of trusts and charities.

Dividends are typically paid in the form of cash but may be paid in other types of property. Agency state the District of Columbia US. Dividends are distributions of property by a corporation to the shareholder or owner of the corporation out of the earnings or profits of the corporation.

About Form 1099-DIV Dividends and Distributions. Payments made to certain payees. Source Income Subject to Withholding.

Also these dividends are not eligible for the. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. Banks investment companies and other financial institutions are required to provide taxpayers with a 1099-DIV by Jan.

However a few exceptions exist that require a. You wont receive a Form 1099-DIV unless you have earnings that require it. Companies provide a copy of the Form 1099-DIV to the investor.

About Form 1099-OID Original Issue Discount. If you own a dividend stock and the company stops issuing a dividend youll stop receiving annual Form 1099-DIVs. Payments made to certain payees.

Information about Form 1099-DIV Dividends and Distributions Info Copy Only including recent updates related forms and instructions on how to file. Most payments to incorporated businesses do not require that you issue a 1099 form. You should also issue 1099-MISC forms for.

If you pay any dividends or distributions to shareholders or company officers you must issue a 1099-DIV. Certain distributions commonly referred to as. The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments.

You can deduct these payments as business expenses. Since you are taxed as an SCorp you pay income tax on the net income of the business whether you take the money out or not. These include a corporation tax-exempt organization any IRA Archer MSA health savings account HSA US.

About Form 6251 Alternative Minimum Tax - Individuals. The person who receives the dividends. Report as ordinary dividends in box 1a of Form 1099-DIV payments of 404 k dividends directly from the corporation to the plan participants or their beneficiaries.

Accounts registered to nonresident aliens who receive Form 1042-S instead. Section 404 k dividends are not subject to backup withholding. IRAs and other tax-deferred retirement accounts.

About Form 1042-S Foreign Persons US. These include a corporation tax-exempt organization any IRA Archer MSA health savings account HSA US. You dont need to issue 1099s for payment made for personal purposes.

This exception also applies to limited liability companies that elect to be treated as corporations. Possession or registered securities or commodities dealer. Agency state the District of Columbia US.

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Irs Approved W 2 Pressure Seal Forms Pressure Seal Forms Save You Time And Frustration Pressure Seal Forms Turn The For Tax Forms Business Solutions W2 Forms

Irs Approved W 2 Pressure Seal Forms Pressure Seal Forms Save You Time And Frustration Pressure Seal Forms Turn The For Tax Forms Business Solutions W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Earn Dividend Income Every Week With These 12 Stocks Dividend Income Real Estate Investment Trust Investing

Earn Dividend Income Every Week With These 12 Stocks Dividend Income Real Estate Investment Trust Investing

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager