What Information Is Included In A Payroll Register

The W-4 provides information on an employees federal income tax withholding. It is structured in a way that allows easy access and understanding of data.

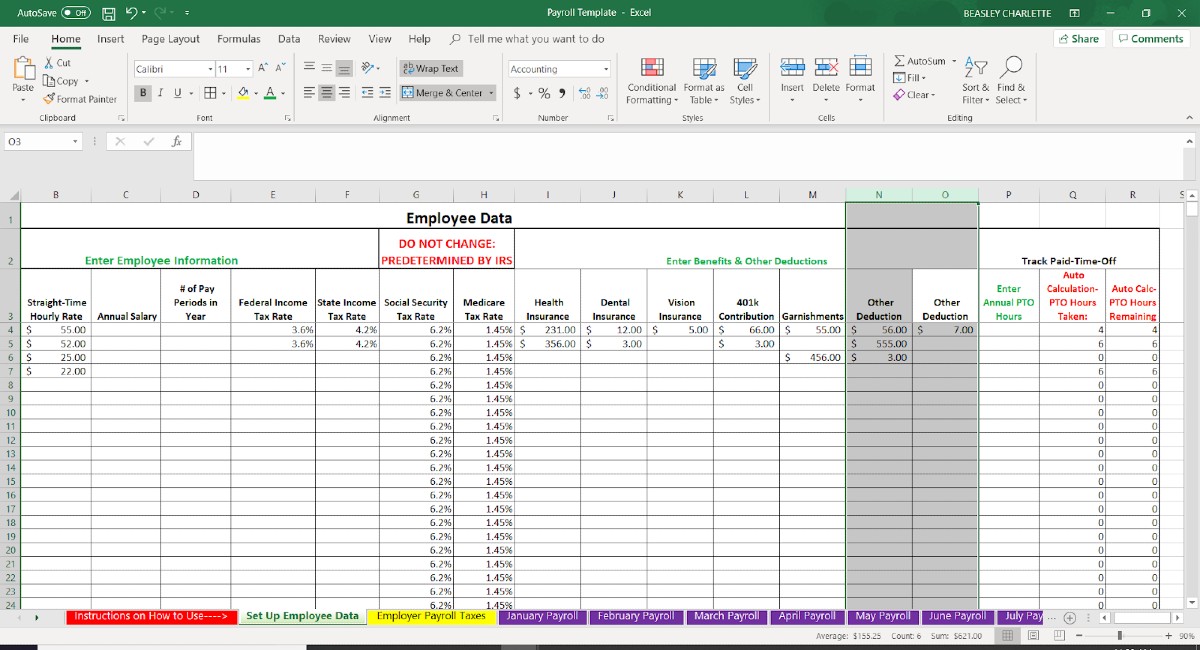

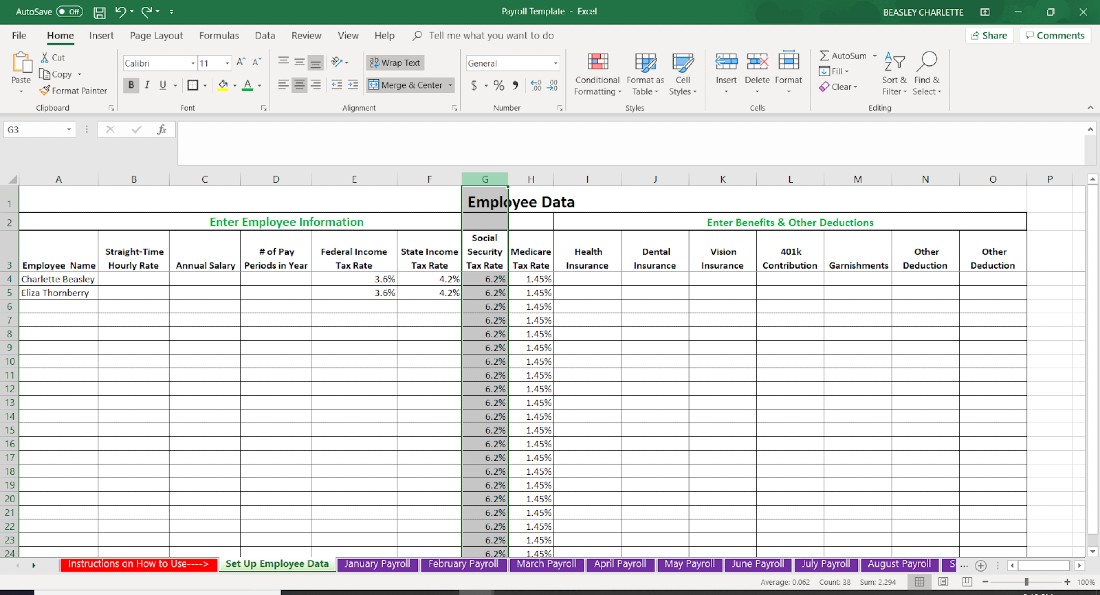

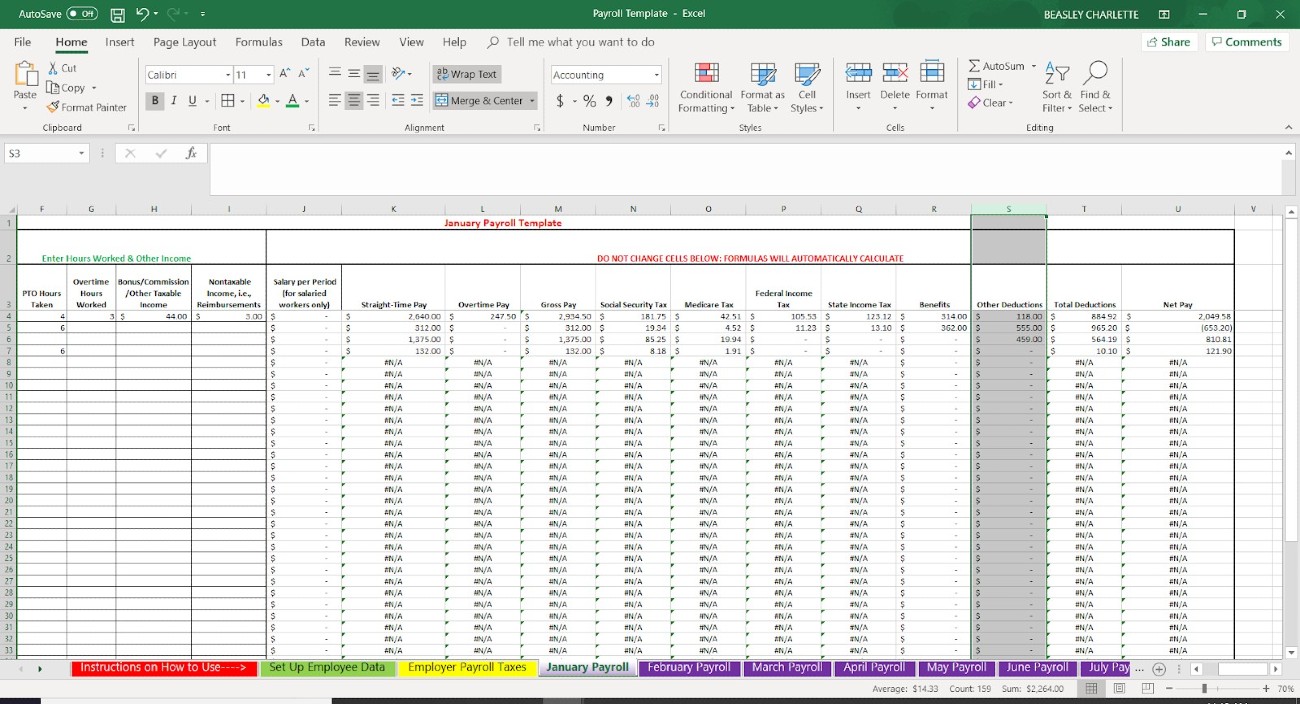

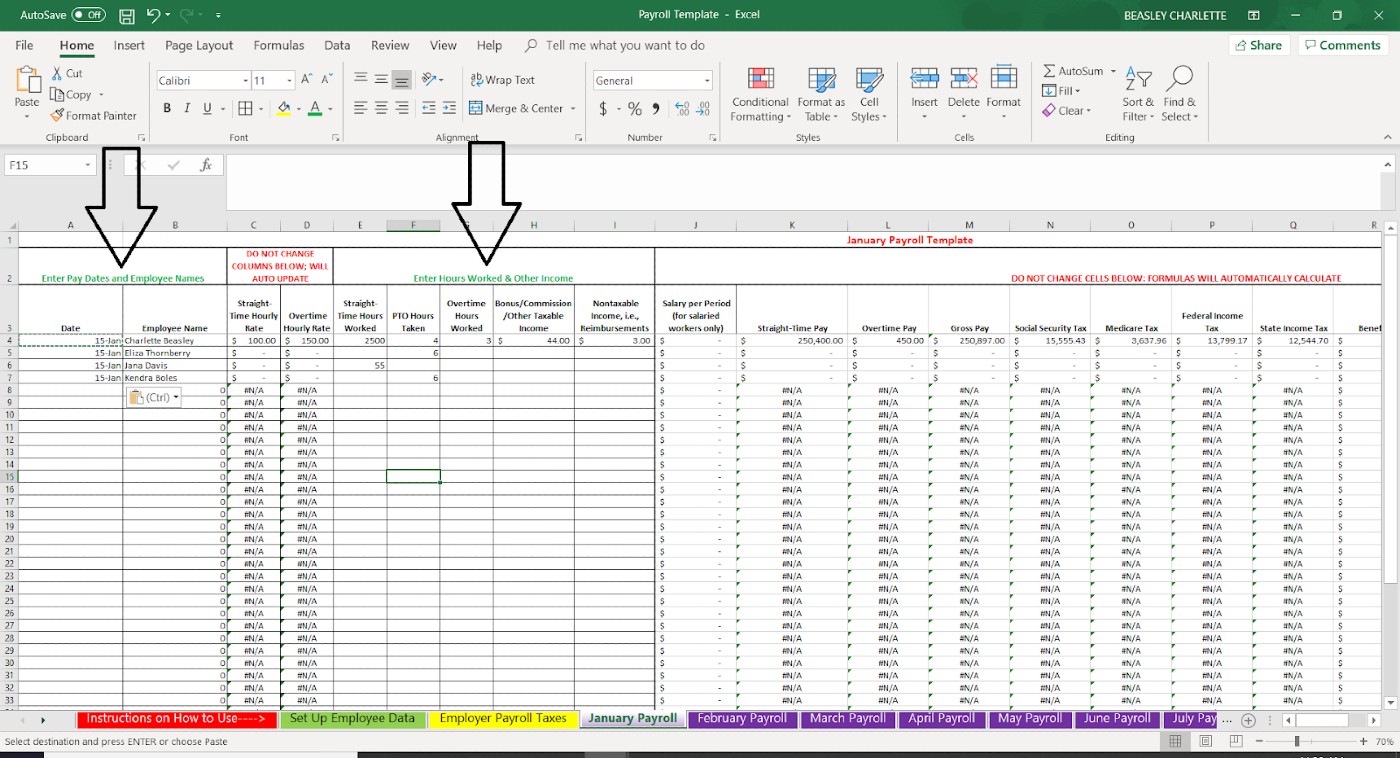

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

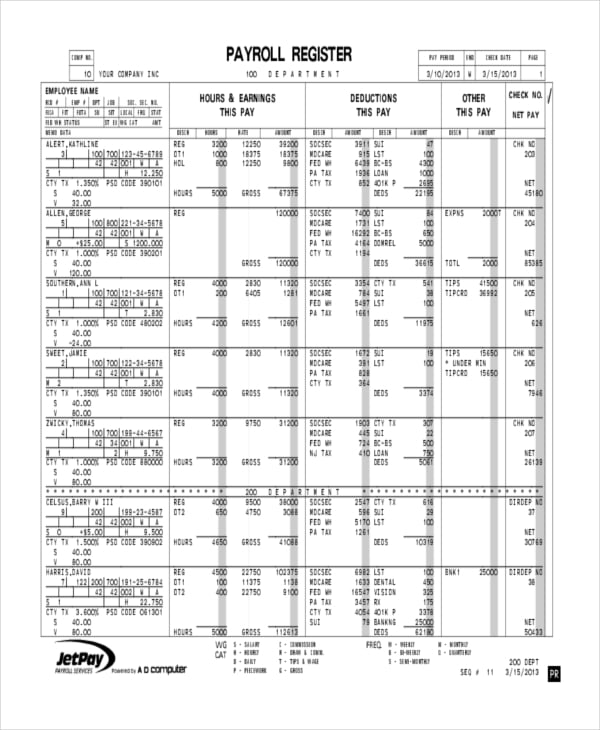

The payroll register typically includes each of the payroll taxes Medicare Social Security and income tax and regular deductions such as health.

What information is included in a payroll register. A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date. This payroll register template is built in excel format which mentions payroll details of the employees by pay date wise. The payroll register should consist of a row for each employee with columns for each of the following pieces of information for the time period youre looking at.

What is included on a payroll register. The payroll register typically includes each of the payroll taxes Medicare Social Security and income tax and regular deductions such. It then shows the payroll details for each employee starting with the hours worked in the current period.

The payroll register of any firm needs to have specific details on every employee. This should be followed by the details of the employee like his name employee code and designation. It displays pay date employee id name wage rate per hour the number of hours worked tax deductions insurance deductions and net payment payable.

After the employer has calculated the amounts for federal income tax withholding and FICA taxes and withheld these amounts from employee paychecks they must. Working Hours The payroll register needs to record the hours each employee has served in the firm in a day. For employees paid monthly there are 12 payrolls for.

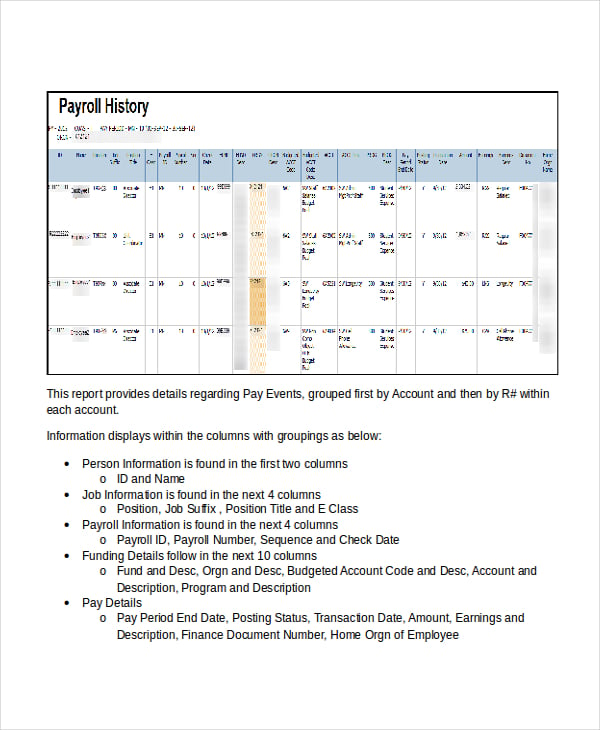

HR005 Departmental Payroll Register ID An alpha-numeric code assigned to an employee used in place of social security number Payroll Number Each payroll event is assigned a number. However some payroll registers might include this information anyway. You can think of it as a summary of all the payroll activity during a period.

A payroll register form should comprise of the details of the company like name of the employer name of the company location etc. Some of the information listed by a payroll for each payroll period includes total gross pay total deductions and total net pay. The payroll tax process involves depositing and reporting taxes to the IRS.

A the employees namesocial security numberand addressB the name of the firm and the payroll accountantC the beginning and ending dates of the pay period. The IRS recommends workers review their withholdings every year. Complete name of the employee employee company identification number employee tax identification number pay period schedule payday regular working hours overtime hours rendered basic pay ratebasic salary payroll deductions for absences and late mandated government taxes that should.

Information for payroll professionals and their clients. Making payroll tax deposits Submitting quarterly payroll tax reports to. Calculate the amount they as a business must pay for FICA taxes and set aside those amounts.

Employee name Employee number Employee social security number Gross pay Net pay Payroll deductions Tax withholdings Regular hours worked Overtime hours worked Other types of hours worked. Employer contributions for Social Security and Medicare taxes Federal unemployment tax State unemployment tax. D the total gross paydeductionsand net.

Next would be the payment details like gross salary deductions applicable and finally the net salary. All of this information will help you process payroll and distribute employee paychecks. Likewise there is a lot of information to keep track in a payroll register this information may include.

What is included on a payroll register. The information stated in a payroll register can include the following. It also includes an employees personal information such as their name address and Social Security number.

This page includes links to information on employment taxes worker classification electronic filing employment tax related forms and publications news and events and more. In other words a payroll register is the document that records all of the details about employees payroll during a period. These details include the employee id number the department they belong their job profile etc.

A payroll register is usually part of an online accounting software package or online payroll applicationThe information in the payroll register is used to help you with several important payroll tax tasks. A typical register starts with details about each employee including their name social security number birthdate and employee number. Date range for payroll register Employee name Employee ID number Employees federal tax allowances Pay rate.

The payroll register contains ______________________________________. A payroll register can be in the form of hard copies or electronic documents or a feature of a payroll software program.

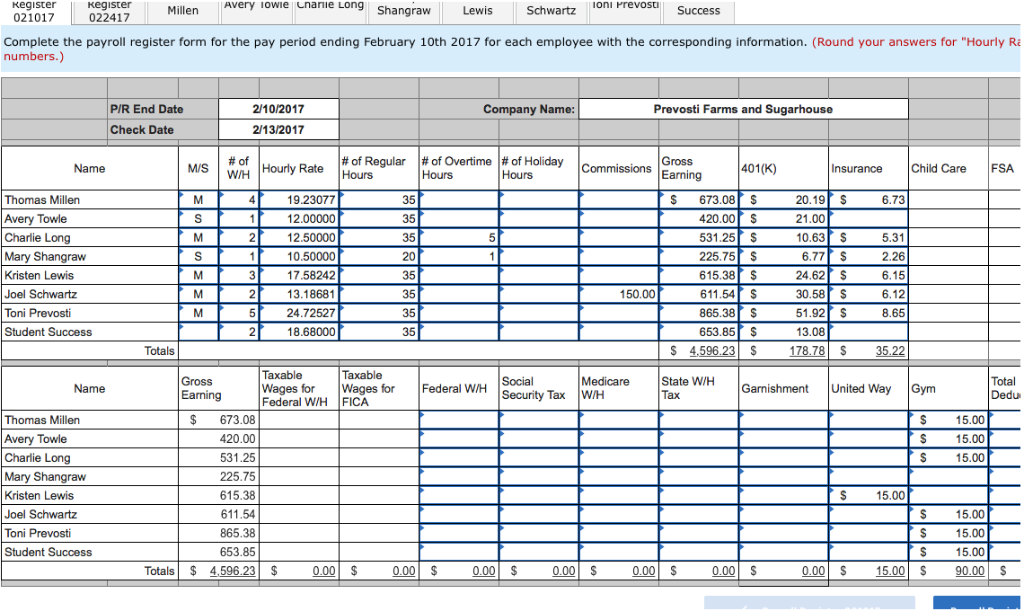

Prevosti Farms And Sugarhouse Pays Its Employees A Chegg Com

Prevosti Farms And Sugarhouse Pays Its Employees A Chegg Com

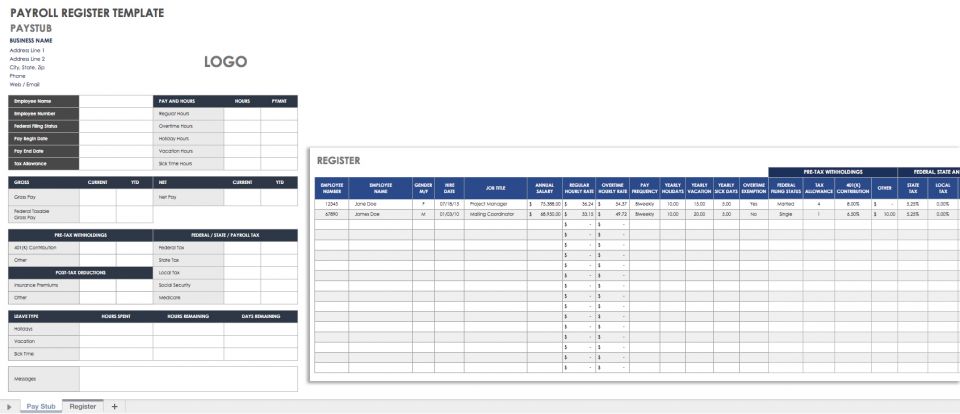

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Worksheet Template

41 Free Printable Payroll Templates Free Template Downloads

41 Free Printable Payroll Templates Free Template Downloads

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free Payroll Template For Excel Payroll Template Payroll Bookkeeping Templates

Free Payroll Template For Excel Payroll Template Payroll Bookkeeping Templates

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Get Our Sample Of Employee Payroll Register Template For Free Payroll Template Payroll Spreadsheet Template

Get Our Sample Of Employee Payroll Register Template For Free Payroll Template Payroll Spreadsheet Template

Quality Employee Payroll Record Template In 2021 Payroll Template Payroll Schedule Template

Quality Employee Payroll Record Template In 2021 Payroll Template Payroll Schedule Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

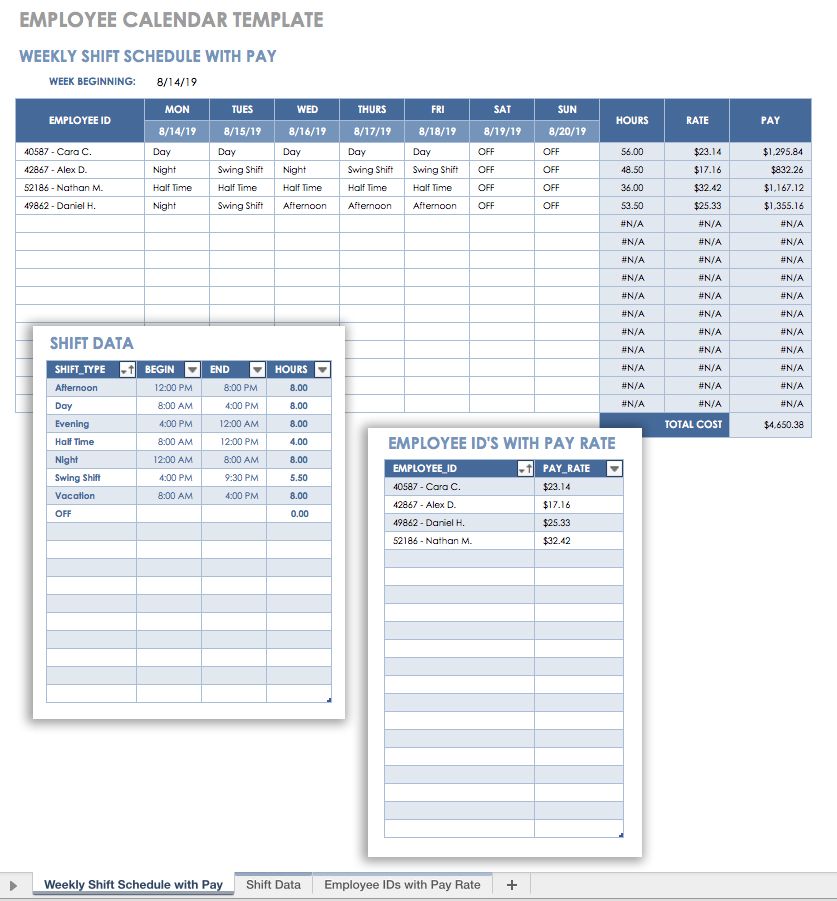

15 Free Payroll Templates Smartsheet

15 Free Payroll Templates Smartsheet

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

Payroll Register Template 7 Free Word Excel Pdf Document Downloads Free Premium Templates

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

15 Free Payroll Templates Smartsheet

15 Free Payroll Templates Smartsheet

Free 7 Sample Payroll Register Templates In Ms Word Pdf

Free 7 Sample Payroll Register Templates In Ms Word Pdf