1099-r Affect Taxes

Section 2202 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 provides for special distribution options and rollover rules for retirement plans and IRAs and expands permissible loans from certain retirement plans. The Distribution Code listed in Box 7 should be G Trustee to Trustee transfers occur when the financial institution holding the IRA sends the payment or distribution directly to another financial institution.

OR Use the Tools menu if online version left side and then Search Topics for 1099-R which will take you to.

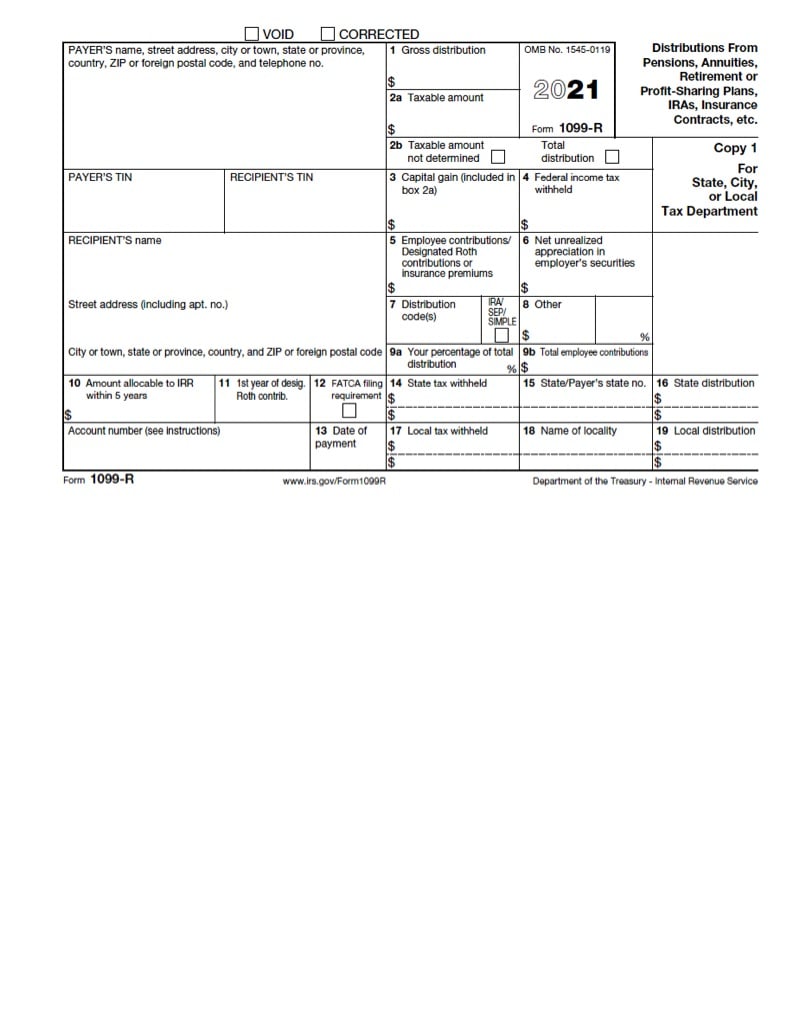

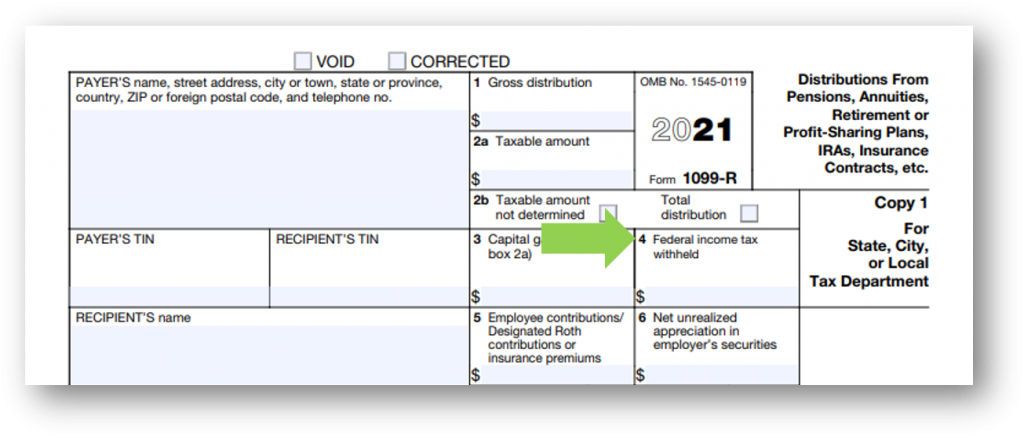

1099-r affect taxes. Box 1 - This shows the distribution amount you received during the tax year. Federal Taxes Wages Income. This income could have been from a pension an annuity a retirement or profit-sharing plan an IRA or an insurance contract.

The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue. Direct rollovers are not subject to federal income tax. The taxation of funds reported on your 1099-R depends upon the type of distribution youve received.

These distributions are deemed taxable income and may be subject to early distribution penalties. Youll generally receive one for distributions of 10 or more. This gross distribution is usually fully taxable to the beneficiarytaxpayer unless the deceased owner had made non-deductible contributions to the IRA.

Regular pension distributions and IRA plan payments are generally subject to federal income tax particularly if the original contributions to the plans were tax-deductible. Then when I put in my 1099-R I got from Vanguard my refund goes down by 70. The 1099-R tax form shows the gross amount of passive income paid to you during the previous calendar year as well as what portion of it is taxable.

Your retirement contributions are shown on the 1099-R tax form we send you each January for tax filing purposes. I use turbo tax and I have typed in all my 1099s. Use the IRS tax withholding estimator to figure out the tax-free portion of your annuity payment and your monthly federal income tax withholding.

No taxes are typically withheld from such a transfer and the taxable amount reported on Form 1099-R Box 2a should be 0 zero. Form 1099-R is generally used to report income that you received from a retirement account. Distributions From Pensions Annuities Retirement or Profit-Sharing Plans is an Internal Revenue System IRS tax form that is used for reporting distributions from annuities.

Form 1099-R is issued when a taxpayer does not make the required loan payments on time. You do not get money back for a 1099-R. But even though the form may indicate a taxable amount in box 2a that doesnt necessarily mean that.

Ill choose what I work on - if that screen comes up Retirement Plans Social Security IRA 401 k Pension Plan Withdrawals 1099-R. Enter a 1099-R here. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts.

General distributions from traditional 401 k plans including normal distributions hardship withdrawals and excess deferral returns are taxable. When this occurs the amount not repaid is considered a distribution and is usually reported on Form 1099-R with the distribution code L. Depending on the type of transaction a taxpayer may have to pay income tax on income from a Form 1099-R.

Box 1 of your 1099-R will show the total amount of your distribution and the taxable amount will normally. Federal withholding on the 1099R if nothing this will reduce your refund andor increase your tax Various credits could be affected some positively and others negatively - this depends on the total overall income. Federal Income Taxes With the exception of Roth IRAs withdrawals from IRAs are taxable.

One for the IRS. When a taxpayer receives a distribution from an inherited IRA they should receive from the financial instruction a 1099-R with a Distribution Code of 4 in Box 7. Form 1099-R indicates that the taxpayer received a distribution.

However distributions from Roth accounts generally are not. About Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. It also shows how much federal tax has already been withheld and what if anything you contributed toward a Roth individual retirement account or insurance premiums.

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. I thought Roth IRA is after tax contribution and hence should not affect my tax refund. If box 2a is zero you do not pay tax on it.

Profit-sharing or retirement plans. It must be included in the return regardless so you could enter everything else and write down the refund amount.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

How To Fill Out Form 1099 R Distributions From Pensions Annuities Retirement Etc Retirees Need To File Retirement Advice Retirement Fund Irs Tax Forms

How To Fill Out Form 1099 R Distributions From Pensions Annuities Retirement Etc Retirees Need To File Retirement Advice Retirement Fund Irs Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How Will The Tax Reform Affect W 2 And 1099 Tax Filings

What Is A 1099 Form And How Do I Fill It Out Bench Accounting 1099 Tax Form Tax Forms Irs Forms

What Is A 1099 Form And How Do I Fill It Out Bench Accounting 1099 Tax Form Tax Forms Irs Forms

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

How To Read Your Brokerage 1099 Tax Form Youtube

How To Read Your Brokerage 1099 Tax Form Youtube

Opers Tax Guide For Benefit Recipients

Opers Tax Guide For Benefit Recipients

Irs Form 1099 R Box 7 Distribution Codes Ascensus

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

What Is Distribution Code G In Box 7 On 1099 R Coding This Or That Questions Distribution

What Is Distribution Code G In Box 7 On 1099 R Coding This Or That Questions Distribution

Taxes 1099 R Public Employee Retirement System Of Idaho

Taxes 1099 R Public Employee Retirement System Of Idaho

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

How Will The Tax Reform Affect W 2 And 1099 Tax Filings

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company