Can Sole Proprietor Apply For Ppp Loan And Unemployment

If youre collecting Unemployment and get a PPP loan you should claim the entire loan in one week and forego one week of benefits. All applicants must have been in business on or before Feb.

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

What is the Pandemic Unemployment Assistance PUA program and am I eligible.

Can sole proprietor apply for ppp loan and unemployment. Eligibility for PUA Benefits as a Sole Proprietor Business Owner Freelancer Gig Worker or Independent Contractor. To help you decide heres what you want to think about. The changes allow for the PPP loan to be calculated based on gross income not on net profit of the proprietorship as has been the rule previously.

If you are approved for both programs however your PPP funds would be considered income and you would need to report that income to the state employment insurance department. This blog post is in response to several inquiries Ive had and comments Ive heard about the unavailability of PPP funds or unemployment for this group. Click on your application.

Once you do report your PPP loan as income your unemployment benefits may stop. Receiving a PPP loan by itself does not disqualify you for unemployment. You may be eligible if you are unemployed.

As a sole proprietor youre able to apply for either the PPP or unemployment but not both. As an independent contractor you can. You may very well run into legal issues if you receive a PPP loan based on payments to yourself from your own business and receive unemployment benefits for being out of work at the same time.

You were already in operation on February 15 2020. If you do not report your PPP funds to the state you could be liable for EI fraud. You have until June 30 to apply but act now.

Independent contractors sole proprietors or self-employed individuals including Realtors and gig workers are also eligible to apply for a PPP Loan beginning on April 10th. With independent contractors and self-employed individuals becoming eligible to apply for US. Sole proprietors self-employed and independent contractors qualify for the PPP.

With very few exceptions you cant have started a business this March or April and expect to get PPP funds Your primary place of residence is the United States. Small Business Administration Paycheck Protection Program PPP loans Friday April 10 2020 the SBA issued an interim final rule on how Schedule C sole proprietors and individual partners in a partnership should treat their self-employment income regarding the PPP loan process. And yes self-employed individuals independent contractors and sole proprietors can apply for PPP loans.

Click here for full details This situation has left many self-employed individuals wondering if it would make more sense for them to apply for a PPP loan or to file for unemployment. Get in line as soon as you can if. This blog post ONLY applies to self-employed independent contractors and sole proprietors.

If you meet the eligibility requirements for a PPP loan you should apply for PPP funds since the amount of money you receive on PPP can be significant up to 20833 per loan for a self-employed person far in excess of most unemployment. How much money will you receive. Both the PPP and unemployment offer substantial benefits for the next few months but which one will net you the most money.

As a sole proprietor or independent contractor you may be eligible for a PPP loan if all of the following are true. PUA is a part of the Federal CARES Act. If youre a sole proprietor you can claim all the money for payroll using form 3508S immediately after getting the loan funded.

Being on unemployment does not disqualify you from applying for a PPP loan. As mentioned above a PPP loan allows the employer to compensate employees and get them back on payroll. More specifically a business owner who offers employees to return to work using PPP loan funds will alter the employees qualification.

None of this happens nor does the application even get underway until the sole proprietor files their 2019 1040 Schedule C. Employees in most cases cannot receive unemployment benefits if their employer has a PPP loan. In other words the SBA is recognizing that sole proprietors and other Schedule C filers were being penalized as compared to entities that file a stand alone tax return and they are intending to.

Or you can accept PPP money and use it as a grant to pay your business expenses then pay it back and still collect Unemployment. Another approach might be to apply for a PPP loan first use the payroll benefits for the applicable 8 weeks to pay yourself and then apply for unemployment benefits once the PPP funds are exhausted. Apr 27 2020 The CARES Act provides many financial benefits to businesses and individuals though the PPP applications have been a bit of a nightmare but paycheck protection is not available to sole proprietors who have no official payroll and traditional unemployment benefits are not normally available to sole proprietors or freelancers.

Update The Sba Ppp And Sole Proprietors Independent Contractors Partners Apple Growth Partners

Update The Sba Ppp And Sole Proprietors Independent Contractors Partners Apple Growth Partners

Paycheck Protection Program Ppp Loan Forgiveness H R Block

Paycheck Protection Program Ppp Loan Forgiveness H R Block

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Ppp Round 2 Sole Proprietor Guide To Eligibility Application

Ppp Round 2 Sole Proprietor Guide To Eligibility Application

So You Received Your Ppp Loan Awesome Wow What Comes Next Do You Have A Clue What Happens Now With Apologies To Lin Manuel Miranda Forrest Firm

So You Received Your Ppp Loan Awesome Wow What Comes Next Do You Have A Clue What Happens Now With Apologies To Lin Manuel Miranda Forrest Firm

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Got Loans Treasury Will Make Some Ppp Borrower Names Public

Got Loans Treasury Will Make Some Ppp Borrower Names Public

Ppp Loan Increase For Self Employed Independent Contractors And Sole Proprietors Youtube

Ppp Loan Increase For Self Employed Independent Contractors And Sole Proprietors Youtube

Pin On Coronavirus Self Employed Unemployment Benefits

Pin On Coronavirus Self Employed Unemployment Benefits

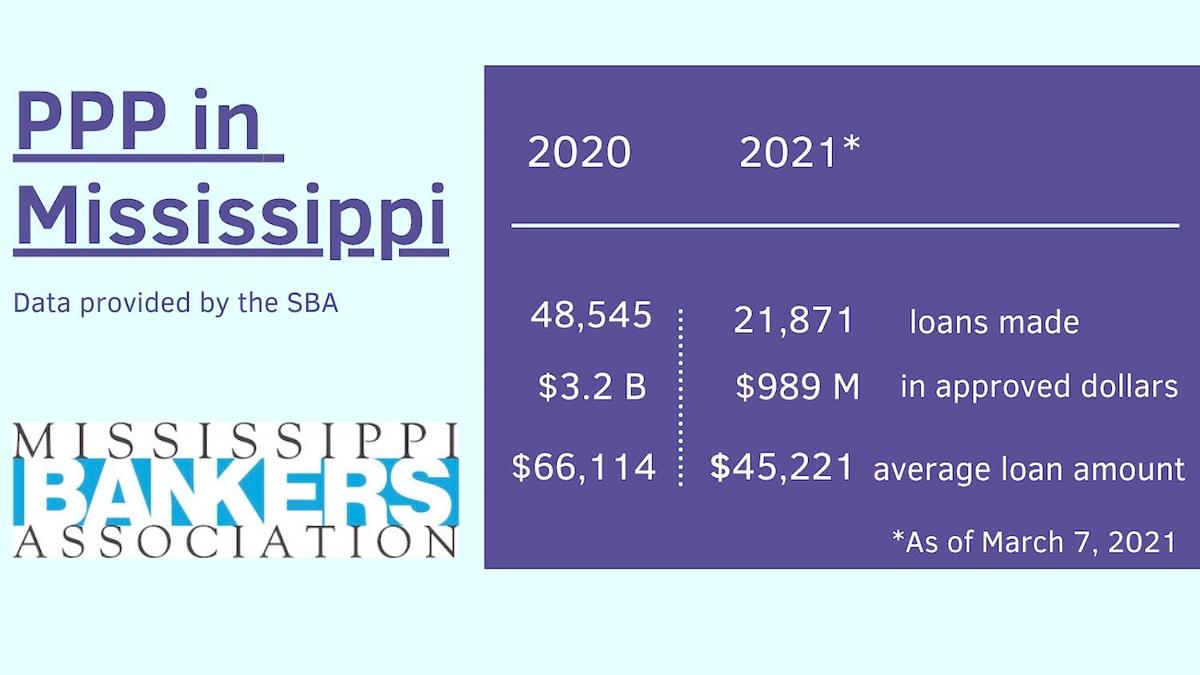

Ppp Changes Could Benefit Self Employed Mississippians Business Leader Call Com

Ppp Changes Could Benefit Self Employed Mississippians Business Leader Call Com

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

Ppp Forgiveness Apply Now Or Wait

Ppp Forgiveness Apply Now Or Wait

Can Independent Contractors Take Both Ppp And Unemployment Well Maybe Travel Agent Central

Can Independent Contractors Take Both Ppp And Unemployment Well Maybe Travel Agent Central